Regions Bank 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

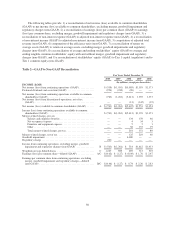

Specific factors as of the date of filing the financial statements that could negatively impact the assumptions

used in assessing goodwill for impairment include: disparities in the level of fair value changes in net assets

compared to equity; adverse business trends resulting from litigation and/or regulatory actions; increasing FDIC

premiums; higher loan losses; lengthened forecasts of unemployment in excess of 10 percent beyond 2012;

future increased minimum regulatory capital requirements above current thresholds (refer to Note 14 “Regulatory

Capital Requirements and Restrictions” to the consolidated financial statements for a discussion of current

minimum regulatory requirements); future federal rules and regulations resulting from the Dodd-Frank Act; and/

or a protraction in the current low level of interest rates beyond 2012.

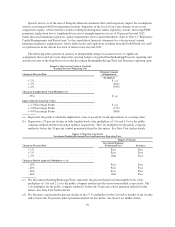

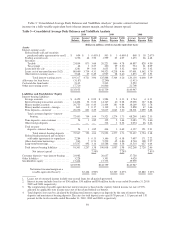

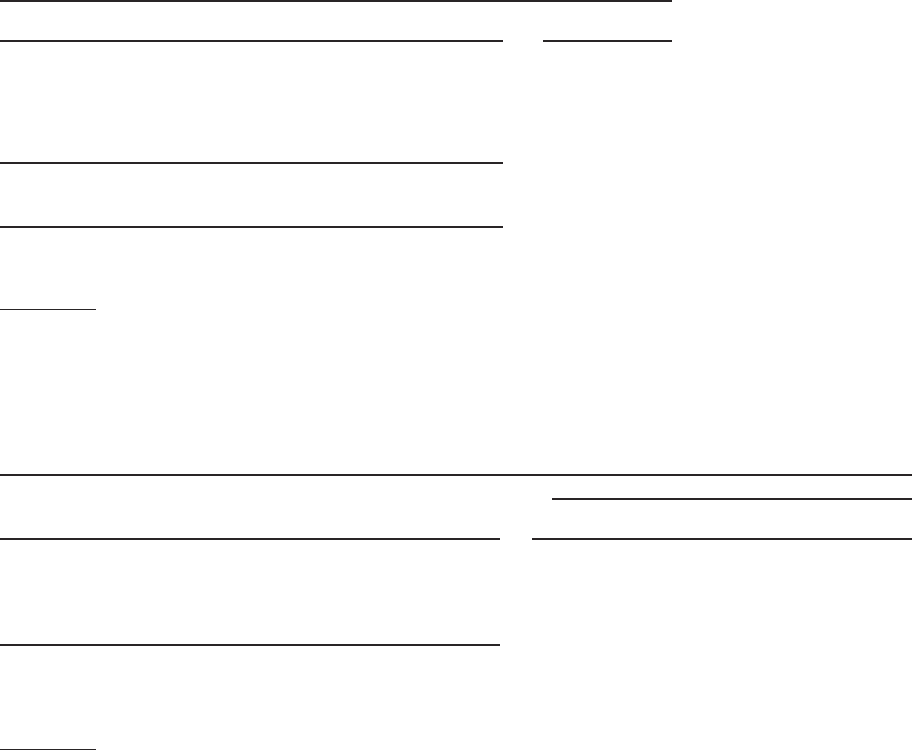

The following tables present an analysis of independent changes in market factors or significant

assumptions that could adversely impact the carrying balance of goodwill in the Banking/Treasury reporting unit

and the outcome of the Step One tests for the Investment Banking/Brokerage/Trust and Insurance reporting units:

Impact to the Carrying Value of Goodwill

Banking/Treasury Reporting Unit

Change in Discount Rate

Estimated Amount

of Impairment

(In millions)

+2%.......................................... $ (a)

+3%.......................................... (464)

+4%.......................................... (939)

Change in Tangible Book Value Multipliers (b)

-53% ......................................... $ (a)

Improvement in Loan Fair Values

+ 2.7 Percentage Points ........................... $ (a)

+ 3.0 Percentage Points ........................... (172)

+ 4.0 Percentage Points ........................... (680)

(a) Represents the point at which the implied fair value of goodwill would approximate its carrying value.

(b) Represents a 53 percent decline in both tangible book value multipliers of 1.0x and 1.3x for the public

company method and the transaction method, respectively. The 1.0x multiplier for the public company

method is before the 30 percent control premium utilized for this metric. See Note 8 for further details.

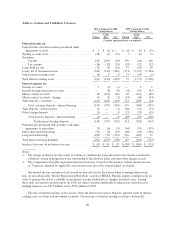

Impact to Step One Conclusion

Investment Banking/Brokerage/Trust and Insurance Reporting Units

Impact of Change

Change in Discount Rate

Investment Banking/

Brokerage/Trust Insurance

+1% ......................................... Pass Pass

+2% ......................................... Pass Pass

+3% ......................................... Fail Pass

Change in Market Approach Multipliers (c) (d)

-10%......................................... Pass Pass

-20%......................................... Pass Pass

-30%......................................... Pass Pass

-40%......................................... Fail Pass

(c) For Investment Banking/Brokerage/Trust, represents the percent decline in both tangible book value

multipliers of 1.6x and 2.1x for the public company method and the transaction method, respectively. The

1.6x multiplier for the public company method is before the 30 percent control premium utilized for this

metric. See Note 8 for further details.

(d) For Insurance, represents the percent decline in the 17.3x multiplier for the last twelve months of net income

and is before the 30 percent control premium utilized for this metric. See Note 8 for further details.

56