Regions Bank 2010 Annual Report Download - page 142

Download and view the complete annual report

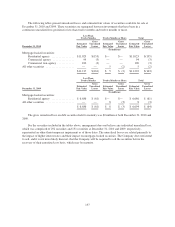

Please find page 142 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.From time to time, assets classified as premises and equipment are transferred to held for sale for various

reasons. These assets are carried in other assets at the lower of the recorded investment in the asset or fair value

less estimated cost to sell based upon the property’s appraised value at the date of transfer. Any write-downs of

property held for sale are recorded as other non-interest expense. At December 31, 2010 and 2009, the carrying

values of premises and equipment held for sale were approximately $28 million and $56 million, respectively.

DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING ACTIVITIES

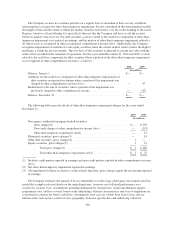

The Company enters into derivative financial instruments to manage interest rate risk, facilitate asset/

liability management strategies and manage other exposures. These instruments primarily include interest rate

swaps, options on interest rate swaps, interest rate caps and floors, Eurodollar futures, and forward sale

commitments. All derivative financial instruments are recognized on the consolidated balance sheets as other

assets or other liabilities, as applicable, at estimated fair value. Regions enters into master netting agreements

with counterparties and/or requires collateral based on counterparty credit ratings to cover exposures.

Interest rate swaps are agreements to exchange interest payments based upon notional amounts. Interest rate

swaps subject Regions to market risk associated with changes in interest rates, as well as the credit risk that the

counterparty will fail to perform. Option contracts involve rights to buy or sell financial instruments on a

specified date or over a period at a specified price. These rights do not have to be exercised. Some option

contracts such as interest rate floors, involve the exchange of cash based on changes in specified indices. Interest

rate floors are contracts to hedge interest rate declines based on a notional amount. Interest rate floors subject

Regions to market risk associated with changes in interest rates, as well as the credit risk that the counterparty

will fail to perform. Forward rate contracts are commitments to buy or sell financial instruments at a future date

at a specified price or yield. Regions primarily enters into forward rate contracts on marketable instruments,

which expose Regions to market risk associated with changes in the value of the underlying financial instrument,

as well as the credit risk that the counterparty will fail to perform. Eurodollar futures are futures contracts on

Eurodollar deposits. Eurodollar futures subject Regions to market risk associated with changes in interest rates.

Because futures contracts are cash settled daily, there is minimal credit risk associated with Eurodollar futures.

Qualifying derivative financial instruments are designated, based on the exposure being hedged, as either

fair value or cash flow hedges. For derivative financial instruments not designated as fair value or cash flow

hedges, gains and losses related to the change in fair value are recognized in earnings during the period of change

in fair value as brokerage, investment banking and capital markets income.

Fair value hedge relationships mitigate exposure to the change in fair value of an asset, liability or firm

commitment. Under the fair value hedging model, gains or losses attributable to the change in fair value of the

derivative instrument, as well as the gains and losses attributable to the change in fair value of the hedged item,

are recognized in earnings in the period in which the change in fair value occurs. Hedge ineffectiveness is

recognized to the extent the changes in fair value of the derivative do not offset the changes in fair value of the

hedged item as other non-interest expense. The corresponding adjustment to the hedged asset or liability is

included in the basis of the hedged item, while the corresponding change in the fair value of the derivative

instrument is recorded as an adjustment to other assets or other liabilities, as applicable.

Cash flow hedge relationships mitigate exposure to the variability of future cash flows or other forecasted

transactions. For cash flow hedge relationships, the effective portion of the gain or loss related to the derivative

instrument is recognized as a component of other comprehensive income. The ineffective portion of the gain or

loss related to the derivative instrument, if any, is recognized in earnings as other non-interest expense during the

period of change. Amounts recorded in other comprehensive income are recognized in earnings in the period or

periods during which the hedged item impacts earnings.

The Company formally documents all hedging relationships between hedging instruments and the hedged

items, as well as its risk management objective and strategy for entering into various hedge transactions. The

128