Regions Bank 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

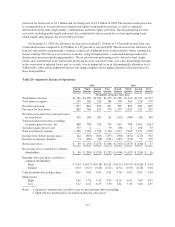

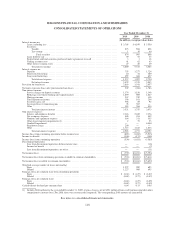

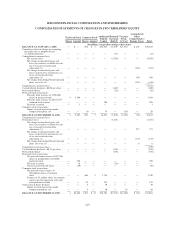

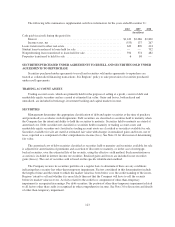

REGIONS FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

Preferred Stock Common Stock Additional

Paid-In

Capital

Retained

Earnings

(Deficit)

Treasury

Stock,

At Cost

Accumulated

Other

Comprehensive

Income (Loss) TotalShares Amount Shares Amount

(In millions, except share and per share data)

BALANCE AT JANUARY 1, 2008 ....... — $ — 694 $ 7 $16,545 $ 4,439 $(1,371) $ 203 $19,823

Cumulative effect of change in accounting

principles due to adoption of new

accounting literature .................. — — — — — (17) — — (17)

Comprehensive income (loss):

Net income (loss) .................. — — — — — (5,596) — — (5,596)

Net change in unrealized gains and

losses on securities available for sale,

net of tax and reclassification

adjustment (1) ................... — — — — — — — (101) (101)

Net change in unrealized gains and

losses on derivative instruments, net

of tax and reclassification

adjustment (1) ................... — — — — — — — 190 190

Net change from defined benefit pension

plans, net of tax (1) ............... — — — — — — — (314) (314)

Comprehensive income (loss) ............. (5,821)

Cash dividends declared—$0.96 per share . . . — — — — — (669) — — (669)

Preferred dividends ..................... — — — — — (26) — — (26)

Preferred stock transactions:

Proceeds from issuance of 3,500,000

shares of preferred stock ........... 4 3,304 — — — — — — 3,304

Proceeds from issuance of 48,253,677

common stock warrant ............ — — — — 196 — — — 196

Discount accretion .................. — 3 — — — — — — 3

Common stock transactions:

Impact of stock transactions under

compensation plans, net ........... — — (3) — 74 — (54) — 20

BALANCE AT DECEMBER 31, 2008 .... 4 3,307 691 7 16,815 (1,869) (1,425) (22) 16,813

Comprehensive income (loss):

Net income (loss) ...................... — — — — — (1,031) — — (1,031)

Net change in unrealized gains and

losses on securities available for sale,

net of tax and reclassification

adjustment (1) ................... — — — — — — — 277 277

Net change in unrealized gains and

losses on derivative instruments, net

of tax and reclassification

adjustment (1) ................... — — — — — — — (133) (133)

Net change from defined benefit pension

plans, net of tax (1) ............... — — — — — — — 8 8

Comprehensive income (loss) ............. (879)

Cash dividends declared—$0.13 per share . . . — — — — — (105) — — (105)

Preferred dividends ..................... — — — — — (194) — — (194)

Preferred stock transactions:

Net proceeds from issuance of 287,500

shares of mandatorily convertible

preferred stock ................... — 278 — — — — — — 278

Discount accretion .................. — 36 — — — (36) — — —

Conversion of Series B shares ........ — (19) — — — — — — (19)

Common stock transactions:

Net proceeds from issuance of

460 million shares of common

stock .......................... — — 460 5 1,764 — — — 1,769

Issuance of 33 million shares of common

stock issued in connection with early

extinguishment of debt ............ — — 33 — 135 — — — 135

Conversion of Series B shares — — 5 — 19 — — — 19

Impact of stock transactions under

compensation plans, net ........... — — 4 — 48 — 16 — 64

BALANCE AT DECEMBER 31, 2009 .... 4 $3,602 1,193 $ 12 $18,781 $(3,235) $(1,409) $ 130 $17,881

119