Regions Bank 2010 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

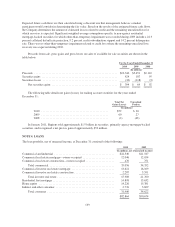

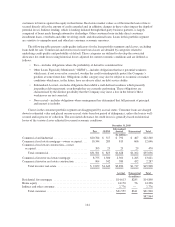

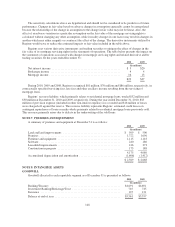

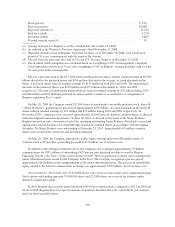

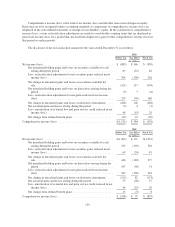

A summary of goodwill activity at December 31 is presented as follows:

2010 2009

(In millions)

Balance at beginning of year ......................................... $5,557 $5,548

Acquisitions of other businesses ...................................... 4 9

Impairment ....................................................... — —

Balance at end of year .............................................. $5,561 $5,557

As stated in Note 1, Regions evaluates each reporting unit’s goodwill for impairment on an annual basis in

the fourth quarter, or more often if events or circumstances indicate that there may be impairment. Regions tested

goodwill for impairment periodically during 2010, 2009 and 2008 and recorded a $6.0 billion impairment charge

within the Banking/Treasury unit during the fourth quarter of 2008. Due to the deteriorating economic

environment in 2010 and 2009, Regions performed interim impairment tests in each quarter of 2010 and during

the second and third quarters of 2009, in addition to the 2010 and 2009 annual tests which occur during the fourth

quarter. The results of these interim and annual tests indicated that goodwill was not impaired as of these test

dates.

In the fourth quarter of 2010, Regions performed the Step One analysis for all three reporting units as part of

its annual impairment test, which indicated potential impairment for the Banking/Treasury reporting unit. Based

on the results of the Step Two analysis performed, Regions concluded the Banking/Treasury reporting unit’s

goodwill was not impaired. The Step One analysis did not indicate that goodwill was impaired for the Investment

Banking/Brokerage/Trust and Insurance reporting units as of December 31, 2010.

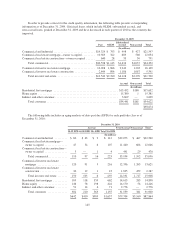

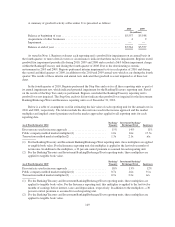

Below is a table of assumptions used in estimating the fair value of each reporting unit for the annual tests in

2010 and 2009, respectively. The tables include the discount rate used in the income approach and the market

multiplier and implied control premium used in the market approaches applied to all reporting units for each

reporting date.

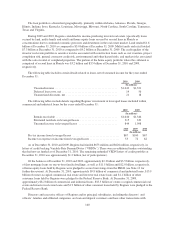

As of Fourth Quarter 2010

Banking/

Treasury

Investment Banking/

Brokerage/Trust Insurance

Discount rate used in income approach ........................... 15% 14% 11%

Public company method market multiplier(1) ..................... 1.0x 1.6x 17.3x

Transaction method market multiplier(2) ......................... 1.3x 2.1x n/a

(1) For the Banking/Treasury and Investment Banking/Brokerage/Trust reporting units, these multipliers are applied

to tangible book value. For the Insurance reporting unit, this multiplier is applied to the last twelve months of

net income. In addition to the multipliers, a 30 percent control premium is assumed for each reporting unit.

(2) For the Banking/Treasury and Investment Banking/Brokerage/Trust reporting units, these multipliers are

applied to tangible book value.

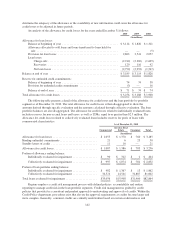

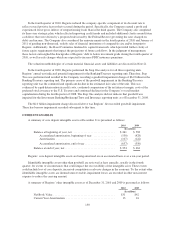

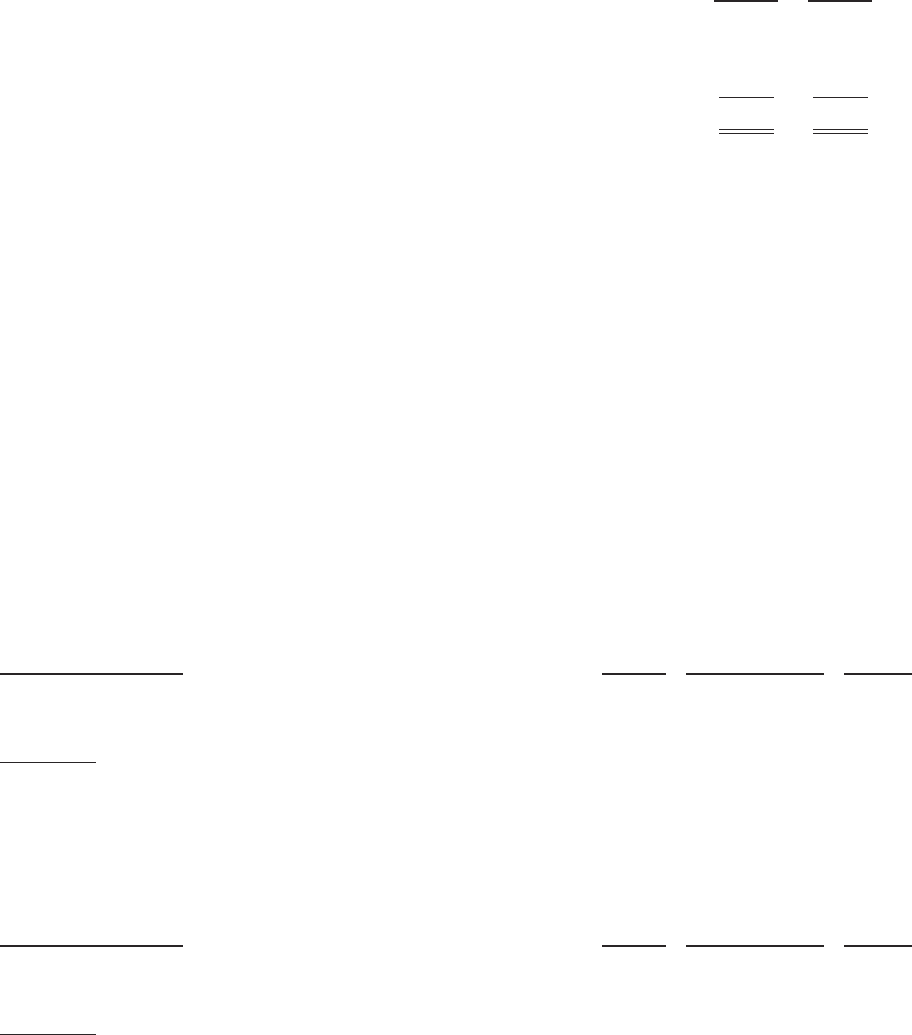

As of Fourth Quarter 2009

Banking/

Treasury

Investment Banking/

Brokerage/Trust Insurance

Discount rate used in income approach ........................... 18% 13% 12%

Public company method market multiplier(1) ..................... 0.7x 1.6x 9.1x

Transaction method market multiplier(2) ......................... 0.9x 2.2x n/a

(1) For the Banking/Treasury and Investment Banking/Brokerage/Trust reporting units, these multipliers are

applied to tangible book value. For the Insurance reporting unit, this multiplier is applied to the last twelve

months of earnings before interest, taxes and depreciation, respectively. In addition to the multipliers, a 30

percent control premium is assumed for each reporting unit.

(2) For the Banking/Treasury and Investment Banking/Brokerage/Trust reporting units, these multipliers are

applied to tangible book value.

149