Regions Bank 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Salaries and Employee Benefits

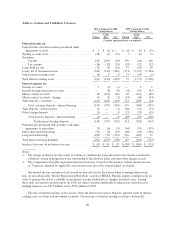

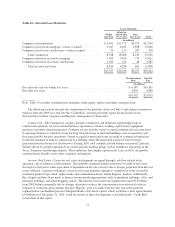

Total salaries and employee benefits increased $49 million, or 2 percent, in 2010. The year-over-year

increase in salaries and employee benefits cost is due to higher pension and 401(k) expense as explained below.

Although salaries and benefits expense increased, headcount was reduced approximately 2 percent in 2010. At

December 31, 2010, Regions had 27,829 employees compared to 28,509 at December 31, 2009.

Regions provides employees who meet established employment requirements with a benefits package that

includes 401(k), pension, and medical, life and disability insurance plans. New enrollment in the Regions pension

plan ended effective December 31, 2000. New enrollment in the legacy AmSouth pension plan ended effective

with the merger date, November 4, 2006. Former AmSouth employees enrolled as of November 4, 2006 continue

to be active in the plan, but no additional participants will be added. Effective September 30, 2007, the two

pension plans merged into one plan. Regions’ 401(k) plan includes a company match of eligible employee

contributions. The Company temporarily suspended the pension service credit and the company match for

eligible employee contributions in early 2009; however, the Company restored these benefits in January 2010.

The temporary suspensions contributed to the increase in salaries and employee benefits in 2010 as compared to

2009. See Note 17 “Pension and Other Employee Benefit Plans” to the consolidated financial statements for

further details.

There are various incentive plans in place in many of Regions’ lines of business that are tied to the

performance levels of employees. At Morgan Keegan, commissions and incentives are a key component of

compensation, which is typical in the brokerage and investment banking industry. In general, incentives are used

to reward employees for selling products and services, for productivity improvements and for achievement of

corporate financial goals. These achievements are determined through a review of profitability and risk

management. Regions’ long-term incentive plan provides for the granting of stock options, restricted stock,

restricted stock units and performance shares. See Note 16 “Share-Based Payments” to the consolidated financial

statements for further information.

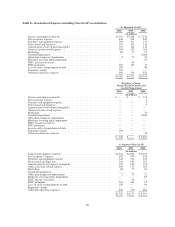

Net Occupancy Expense

Net occupancy expense includes rents, depreciation and amortization, utilities, maintenance, insurance,

taxes, and other expenses of premises occupied by Regions and its affiliates. Occupancy expense decreased $6

million, or 1 percent, in 2010 primarily due to charges incurred in 2009 associated with the decision to

consolidate 121 branches.

Furniture and Equipment Expense

Furniture and equipment expense decreased $7 million to $304 million in 2010. This decrease is primarily

due to branch consolidation charges of $7 million incurred in 2009.

Professional and Legal Fees

Professional and legal fees are comprised of amounts related to legal, consulting and other professional fees.

These fees decreased $6 million to $303 million in 2010, reflecting a reduction in the level of legal expenses

incurred at Morgan Keegan and credit-related legal costs in 2010. Legal expenses, however, remained elevated in

2010. Refer to Note 23 “Commitments, Contingencies and Guarantees” to the consolidated financial statements

for additional information.

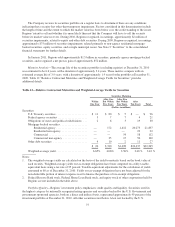

Amortization of Core Deposit Intangibles

The premium paid for core deposits in an acquisition is considered to be an intangible asset that is amortized

on an accelerated basis over its useful life. As a result, amortization of core deposit intangibles decreased 11

percent to $107 million in 2010 compared to $120 million in 2009.

67