Regions Bank 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regions elected to exit the FDIC's TAG program on July 1, 2010. The TAG program is a component of the

Temporary Liquidity Guarantee Program, whereby the FDIC guarantees all funds held at participating

institutions beyond the $250,000 deposit insurance limit in qualifying transaction accounts. The decision to exit

the program did not have a significant impact on liquidity. The Dodd-Frank Act permanently increased the FDIC

coverage limit to $250,000. As a result of the Dodd-Frank Act, effective December 31, 2010, unlimited coverage

for non-interest bearing demand transaction accounts will be provided through January 1, 2013. As of

December 31, 2010, Regions had $10.6 billion of FDIC uninsured deposits.

Due to the potential for uncertainty and inconsistency in the unsecured funding markets, Regions has been

maintaining higher levels of cash liquidity by depositing excess cash with the Federal Reserve Bank, which

primarily comprises the balance sheet line item, “interest-bearing deposits in other banks.” At the end of 2010,

Regions had over $4.8 billion in excess cash on deposit with the Federal Reserve. Regions' borrowing availability

with the Federal Reserve Bank as of December 31, 2010, based on assets available for collateral at that date, was

$16.6 billion.

Regions periodically accesses funding markets through sales of securities with agreements to repurchase.

Repurchase agreements are also offered through a commercial banking sweep product as a short-term investment

opportunity for customers. All such arrangements are considered typical of the banking and brokerage industries

and are accounted for as borrowings.

Regions’ financing arrangement with the FHLB adds additional flexibility in managing its liquidity position.

As of December 31, 2010, FHLB Atlanta advances totaled $4.2 billion. FHLB borrowing capacity is contingent

on the amount of collateral pledged to the FHLB. Regions has additional collateral available and, accordingly,

has additional capacity to borrow from the FHLB. Regions Bank and its subsidiaries have pledged certain

residential first mortgage loans on one-to-four family dwellings and home equity lines of credit as collateral for

the FHLB advances outstanding. Additionally, investment in FHLB stock is required in relation to the level of

outstanding borrowings. Regions held $419 million in FHLB stock at December 31, 2010. The FHLB has been

and is expected to continue to be a reliable and economical source of funding.

In February 2010, Regions filed a shelf registration statement with the U.S. Securities and Exchange

Commission. This shelf registration does not have a capacity limit and can be utilized by Regions to issue

various debt and equity securities. The registration statement will expire in February 2013. During the second

quarter of 2010, Regions issued from the shelf $250 million (par value) of 4.875% senior notes due April 2013

and $500 million (par value) of 5.75% senior notes due June 2015.

Regions’ Bank Note program allows Regions Bank to issue up to $20 billion aggregate principal amount of

bank notes outstanding at any one time. No issuances have been made under this program as of December 31,

2010. Notes issued under the program may be senior notes with maturities from 30 days to 15 years and

subordinated notes with maturities from 5 years to 30 years. These notes are not deposits and they are not insured

or guaranteed by the FDIC.

Regions may, from time to time, consider opportunistically retiring outstanding issued securities, including

subordinated debt, trust preferred securities and preferred shares in privately negotiated or open market

transactions for cash or common shares.

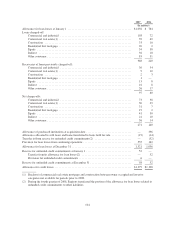

Morgan Keegan maintains certain lines of credit with unaffiliated banks to manage liquidity in the ordinary

course of business. See Note 11 “Short-Term Borrowings” to the consolidated financial statements for further

details.

See the “Stockholders’ Equity” section for discussion of the Federal Reserve’s Supervisory Capital

Assessment Program.

94