Regions Bank 2010 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In December 2009 and in November 2010, Regions and certain current and former directors and officers

were named in a consolidated shareholder derivative action and in a separate derivative action, both of which

were filed in Jefferson County, Alabama. The complaints allege mismanagement, waste of corporate assets,

breach of fiduciary duty and unjust enrichment relating to bonuses and other benefits received by executive

management. Plaintiffs in these cases have requested equitable relief and unspecified monetary damages.

Although it is not possible to predict the ultimate resolution or financial liability with respect to these matters,

management is currently of the opinion that the outcome of these matters will not have a material effect on

Regions’ business, consolidated financial position, results of operations or cash flows.

In September 2009, Regions was named as a defendant in a purported class-action lawsuit filed by

customers of Regions Bank in the U.S. District Court for the Northern District of Georgia challenging the manner

in which non-sufficient funds (“NSF”) and overdraft fees were charged and the policies related to posting order.

The case was transferred to multidistrict litigation in the U.S. District Court for the Southern District of Florida,

and in May 2010 an order to compel arbitration was denied. In July 2010, a separate class-action was filed in the

Circuit Court of Greene County Missouri, making a claim under Missouri’s consumer protection statute. The

case has been removed to the U.S. District Court for the Western District of Missouri. Plaintiffs in these cases

have requested equitable relief and unspecified monetary damages. These class-action lawsuits are still early in

their development and no classes have been certified. Unless and until a class is certified, the scope of the class

and claims remains unknown. There are numerous factors that result in a greater degree of complexity in class-

action lawsuits as compared to other types of litigation. Due to the many intricacies involved in class-action

lawsuits at the early stages of these matters, obtaining clarity on a reasonable estimate is difficult which may call

into question its reliability. At this stage of the lawsuits, and in view of the inherent inability to predict the

outcome of litigation, particularly where there are many claimants, Regions cannot determine the probability of a

material adverse result or reasonably estimate a range of potential exposures, if any. However, in light of the

inherent uncertainties involved in these matters, it is reasonably possible that an adverse outcome in any of these

matters could be material to Regions’ business, consolidated financial position, results of operations, or cash

flows for any particular reporting period.

GUARANTEES

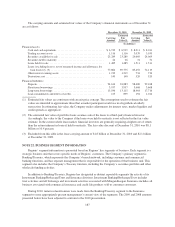

As a member of the Visa USA network, Regions, along with other members, indemnified Visa USA against

litigation. On October 3, 2007, Visa USA was restructured and acquired several Visa affiliates. In conjunction

with this restructuring, Regions’ indemnification of Visa USA was modified to cover specific litigation

(“covered litigation”). Regions’ liability recognized under this indemnification was approximately $24 million

and $27 million at December 31, 2010 and 2009, respectively.

On March 25, 2008, Visa executed an initial public offering (“IPO”) of common stock and, in connection

with the IPO, Regions’ ownership interest in Visa was converted into Class B common stock of approximately

3.8 million shares. In the first quarter of 2008, Visa redeemed approximately 1.5 million shares of the Class B

common stock from Regions for proceeds of approximately $63 million, all of which was recorded as “Other

Income” in the consolidated statements of operations. In the second quarter of 2009, Regions sold the remaining

Class B common stock to a third party. The sale resulted in a pre-tax gain of $80 million.

A portion of Visa’s proceeds from the IPO was escrowed to fund the covered litigation. To the extent that

the amount available under the escrow arrangement is insufficient to fully resolve the covered litigation, Visa

will enforce the indemnification obligations of Visa USA’s members for any excess amount.

192