Regions Bank 2010 Annual Report Download - page 171

Download and view the complete annual report

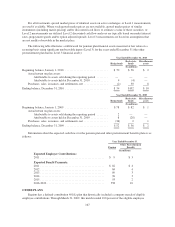

Please find page 171 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regions Bank may not, without approval of the Federal Reserve, declare or pay a dividend to Regions if the total of

all dividends declared in a calendar year exceeds the total of (a) Regions Bank’s net income for that year and (b) its

retained net income for the preceding two calendar years, less any required transfers to additional paid-in capital or

to a fund for the retirement of preferred stock. As a result of the losses incurred by Regions Bank in 2010, 2009, and

2008, Regions Bank cannot, without approval from the Federal Reserve, declare or pay a dividend to Regions until

such time as Regions Bank is able to satisfy the criteria discussed in the preceding sentence. Given the losses in

2010, 2009, and 2008, Regions Bank does not expect to be able to pay dividends to Regions in the near term

without obtaining regulatory approval. In addition to dividend restrictions, Federal statutes also prohibit unsecured

loans from banking subsidiaries to the parent company. Because of these limitations, substantially all of the net

assets of Regions’ subsidiaries are restricted.

In addition, Regions must adhere to various U.S. Department of Housing and Urban Development (“HUD”)

regulatory guidelines including required minimum capital to maintain their Federal Housing Administration

approved status. Failure to comply with the HUD guidelines could result in withdrawal of this certification. As of

December 31, 2010, Regions was in compliance with HUD guidelines. Regions is also subject to various capital

requirements by secondary market investors.

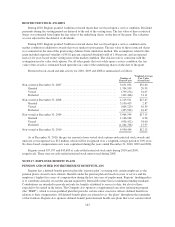

NOTE 14. STOCKHOLDERS’ EQUITY AND COMPREHENSIVE INCOME (LOSS)

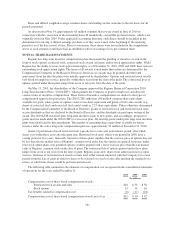

On November 14, 2008, Regions completed the sale of 3.5 million shares of its Fixed Rate Cumulative

Perpetual Preferred Stock, Series A, par value $1.00 and liquidation preference $1,000.00 per share (and $3.5

billion liquidation preference in the aggregate) to the U.S. Treasury as part of the Capital Purchase Program

(“CPP”). Regions will pay the U.S. Treasury on a quarterly basis a 5 percent dividend, or $175 million annually,

for each of the first five years of the investment, and 9 percent thereafter unless Regions redeems the shares.

Regions performed a discounted cash flow analysis to value the preferred stock at the date of issuance. For

purposes of this analysis, Regions assumed that the preferred stock would most likely be redeemed five years

from the valuation date based on optimal financial budgeting considerations. Regions used the Bloomberg USD

US Bank BBB index to derive the market yield curve as of the valuation date to discount future expected cash

flows to the valuation date. The discount rate used to value the preferred stock was 7.46 percent, based on this

yield curve at a 5-year maturity. Dividends were assumed to be accrued until redemption. While the discounting

was required based on a 5-year redemption, Regions did not have a 5-year security or similarly termed security

available. As a result, it was necessary to use a benchmark yield curve to calculate the 5-year value. To determine

the appropriate yield curve that was applicable to Regions, the yield to maturity on the outstanding debt

instrument with the longest dated maturity (8.875% junior subordinated notes due June 2048) was compared to

the longest point on the USD US Bank BBB index as of November 14, 2008. Regions concluded that the yield to

maturity as of the valuation date of the debt, which was 11.03 percent, was consistent with the indicative yield of

the curve noted above. The longest available point on this curve was 10.55 percent at 30 years.

As part of its purchase of the preferred securities, the U.S. Treasury also received a warrant to purchase

48.3 million shares of Regions’ common stock at an exercise price of $10.88 per share, subject to anti-dilution

and other adjustments. The warrant expires ten years from the issuance date. Regions used the Cox-Ross-

Rubinstein Binomial Option Pricing Model (“CRR Model”) to value the warrant at the date of issuance. The

CRR Model is a standard option pricing model which incorporates optimal early exercise in order to receive the

benefit of future dividend payments. Based on the transferability of the warrant, the CRR Model approach that

was applied assumes that the warrant holder will not sub-optimally exercise its warrant. The following

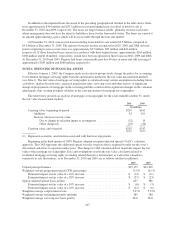

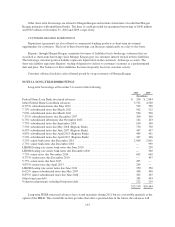

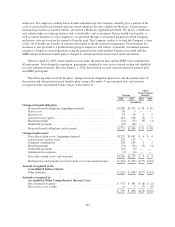

assumptions were used in the CRR Model:

157