Proctor and Gamble 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We’re focused on these opportunities, realistic about challenges,

and condent P&G’s design for growth will enable us to keep

P&G growing. Over the next few years, our portfolio will continue

to shift toward faster-growing, higher-margin businesses.

We’ll extend the advantages we’ve created with our core

strengths. We’ll make the disciplined choices required to create

even more shareholder value. We’ll continue to develop the

industry’s strongest, broadest and deepest leadership bench.

And we’ll continue to focus on inspiring and enabling P&G

people to fulll our Company’s Purpose: improving consumers’

lives in small but always meaningful ways every day. This is critical.

Our design for growth reects the management choices we’ve

made to create the opportunities and capability for growth

—

but it’s P&G people who deliver it. Their performance in scal

2007 was outstanding once again, and their capability, creativity

and potential will ensure P&G out-performs the consumer

products industry year after year.

Opportunities for growth remain substantial in each of our

strategic focus areas.

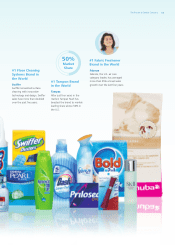

• P&G’s Core. We are widening P&G’s share advantages versus

competition. For example, in fabric care, we were the number

two player globally in the early 1990s. Today, P&G has a 34%

share of the global fabric care market, nearly double the next

competitor, and we’ve grown share for six consecutive years.

We have a lot of opportunity to keep growing all of P&G’s

billion-dollar brands. We’re proving in category after category

that a leading share, even a relatively high share, is not a

barrier to growth. We will continue to leverage our brand

lineup and category-leading innovation to keep core

businesses healthy and growing.

• Faster-Growing, Higher-Margin Businesses. We have even

greater upside in businesses such as beauty and health care.

The beauty and health categories in which P&G competes are

a combined $360 billion market today, and are projected to

grow 3% to 4% a year for the balance of the decade. P&G

has nearly doubled its share of beauty and health over the

past decade, and yet P&G’s share of this combined market

is only about 10% globally.

• Developing Markets and Lower-Income Consumers.

We can still grow substantially in developing markets by

increasing household penetration and consumer usage

frequency, and by entering categories where we’re not yet

competing. For example, the average U.S. household buys

ve to ten times as much P&G product per year as the

average household in developing markets. In addition, there

is a large number of households in developing regions that

do not yet purchase any P&G product. Closing this gap,

which we’re condent we can do over time, will continue

to drive strong growth for years to come.

There are signicant bottom-line growth opportunities, as well.

We’ll continue to leverage P&G’s scale. We’ll reduce overhead

costs by simplifying the way we work and eliminating duplication

between global business units and market development

organizations. We’ll be more effective and efcient in how

we manage our smaller country organizations and brands.

And we’ll continue to increase productivity in every one of

our businesses.

We’ll also continue to improve gross margins. The Company’s

current gross margin is about 52%. We can earn a higher total-

company margin by achieving best-in-class margins in more

categories and business units. Based on industry benchmarking,

we believe that only about half of P&G businesses have gross

margins better than their competitive peer set. As we get more

of our businesses to best-in-class levels, we’ll increase our total-

company margin.

Chairman of the Board and Chief Executive Ofcer

August 14, 2007

The Procter & Gamble Company 7