Proctor and Gamble 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

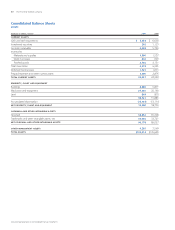

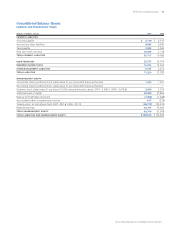

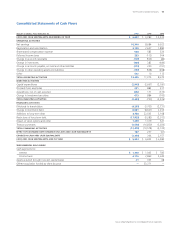

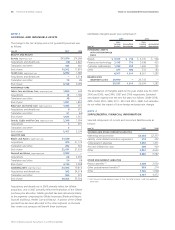

Millions of dollars except per share amounts or as otherwise specied.

Notes to Consolidated Financial Statements

The Procter & Gamble Company

56

SFAS 158 had no impact on our measurement date, which continues

to be as of our scal year end. Refer to Note 9 for additional

information regarding our pension and postretirement plans.

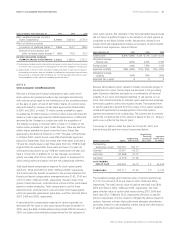

The following table reects the effect of the adoption of SFAS 158 on

our Consolidated Balance Sheets:

Before After

Application SFAS 158 Application

of SFAS 158 Adjustments of SFAS 158

Other noncurrent assets

Deferred income taxes

Other noncurrent liabilities

Accumulated other

comprehensive income

In July 2006, the FASB issued FASB Interpretation (FIN) 48, “Accounting

for Uncertainty in Income Taxes.” FIN 48 addresses the accounting

and disclosure of uncertain tax positions. FIN 48 prescribes a recognition

threshold and measurement attribute for the nancial statement

recognition and measurement of a tax position taken or expected

to be taken in a tax return. We will adopt FIN 48 on July 1, 2007.

We estimate that the adoption of FIN 48 will result in a net decrease

to beginning retained earnings of approximately $200 – $250,

primarily related to the accrual of additional interest and penalties on

unrecognized tax benets.

NOTE 2

On October 1, 2005, we completed our acquisition of The Gillette

Company. Pursuant to the acquisition agreement, which provided for

the exchange of 0.975 shares of The Procter & Gamble Company

common stock, on a tax-free basis, for each share of The Gillette

Company, we issued 962 million shares of The Procter & Gamble

Company common stock. The value of these shares was determined

using the average Company stock prices beginning two days before

and ending two days after January 28, 2005, the date the acquisition

was announced. We also issued 79 million stock options in exchange

for Gillette’s outstanding stock options. Under the purchase method

of accounting, the total consideration was approximately $53.4 billion

including common stock, the fair value of vested stock options and

acquisition costs. This acquisition resulted in two new reportable

segments: Blades and Razors, and Duracell and Braun. The Gillette

oral care and personal care businesses were subsumed within the

Health Care and Beauty reportable segments, respectively. The operating

results of the Gillette businesses are reported in our nancial statements

beginning October 1, 2005.

The Gillette Company is a market leader in several global product

categories including blades and razors, oral care and batteries. Total

sales for Gillette during its most recent pre-acquisition year ended

December 31, 2004, were $10.5 billion.

In order to obtain regulatory approval of the transaction, we were

required to divest certain overlapping businesses. We completed the

divestiture of the Spinbrush toothbrush business, Rembrandt (a Gillette

oral care product line), Right Guard and other Gillette deodorant brands

during the scal year ended June 30, 2006.

In connection with this acquisition, we also announced a share buyback

plan under which we planned to acquire up to $22.0 billion of

Company common shares through the open market or from private

transactions. We completed this share buyback plan in July 2006 with

cumulative purchases of $20.1 billion. The repurchases were nanced by

borrowings under a $24.0 billion three-year credit facility with a

syndicate of banks (see Note 5).

The following table provides pro forma results of operations for the

years ended June 30, 2006 and 2005, as if Gillette had been acquired

as of the beginning of each scal year presented. The pro forma results

include certain purchase accounting adjustments such as the changes

in depreciation and amortization expense on acquired tangible and

intangible assets. However, pro forma results do not include any

anticipated cost savings or other effects of the integration activities of

Gillette. Accordingly, such amounts are not necessarily indicative of

the results if the acquisition had occurred on the date indicated or

that may result in the future.