Proctor and Gamble 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 39Management’s Discussion and Analysis

Fabric Care and Home Care net sales in 2006 increased 9% to

$17.1 billion driven by an 8% increase in unit volume. Volume growth

was broad-based, with high-single digit growth in fabric care and

mid-single digit growth in home care. Volume growth was driven by

approximately 1 point of market share expansion on both fabric care

and home care behind product innovations such as Tide with Febreze,

Gain Joyful Expressions, Bounce with Febreze, Bold Liquid Tabs, Dawn

Direct Foam and Febreze Noticeables. Every region delivered mid-

single digit or higher volume growth, led by double-digit growth in

developing regions. Price increases, primarily in Latin America fabric

care and North America dish care to offset rising commodity costs,

added 2% to sales growth. Foreign exchange reduced sales by 1%.

Net earnings increased 11% to $2.4 billion in 2006. Earnings margin

improved by 35-basis points as volume scale leverage, price increases

and cost savings initiatives more than offset commodity cost increases.

Overhead and marketing spending increased year-on-year on an

absolute basis, but were down slightly as a percentage of net sales.

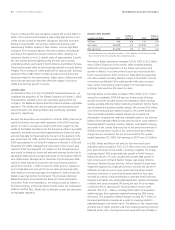

Change vs. Change vs.

(in millions of dollars) Prior Year 2006 Prior Year

Volume +5% n/a +3%

Net sales +6% $11,972 +3%

Net earnings +11% $ 1,299 +9%

Baby Care and Family Care net sales increased 6% in 2007 to $12.7 billion

behind 5% unit volume growth. Baby care volume grew mid-single

digits with developing regions up double-digits. In developed regions,

baby care volume was up low-single digits as growth on Pampers

Baby Stages of Development and Baby Dry Caterpillar Flex more than

offset softness on Pampers in Western Europe and Luvs in North

America from lower competitor pricing of both branded and private

label products. Family care volume increased mid-single digits behind

product performance upgrades on Bounty and continued growth on

Bounty and Charmin Basic products. Disproportionate growth on

baby care in developing regions and on the Basic tier products, which

have a lower average selling price, led to a negative 1% mix impact.

Favorable foreign exchange contributed 2% to sales growth.

Net earnings in Baby Care and Family Care increased 11% to $1.4 billion

behind sales growth and a 50-basis point improvement in net earnings

margin. Earnings margin increased as lower SG&A as a percentage of

net sales more than offset a reduction in gross margin. Gross margin

was down slightly as manufacturing cost savings and volume scale

leverage were more than offset by the impact of higher pulp costs

and a less protable product mix. SG&A improved as a percentage of

net sales due to lower overhead expenses from volume scale leverage

and a reduction in marketing expenses as a percentage of net sales.

We have reached an agreement to sell our Western European family

care business, which comprises approximately $650 million in segment

net sales. The sale is subject to regulatory approval and is expected to

close in the rst half of scal 2008.

Baby Care and Family Care net sales were up 3% to $12.0 billion in

2006. Unit volume increased 3%, with organic volume up 4%. Baby

care volume increased mid-single digits led by double-digit increases in

developing regions. In developed regions, baby care volume declined

slightly as growth on Pampers Baby Stages of Development and

Kandoo was more than offset by softness on Baby Dry as well as on

Luvs in North America, primarily due to pricing pressure from private

label competitors. Family care organic volume grew mid-single digits,

largely behind growth on the Bounty and Charmin Basic initiative.

Price increases in North America baby care, coupled with a mid-year

increase in North America family care, added 2% to sales growth.

Disproportionate growth in mid-tier products and in developing regions,

where average unit selling price is below the segment average, resulted

in a negative 1% mix impact on segment sales. Foreign exchange also

had a negative 1% impact on sales. Baby Care and Family Care net

earnings increased 9% in 2006 to $1.3 billion behind sales growth

and a 60-basis point earnings margin improvement. Scale benets of

volume growth and price increases more than offset the increase in

commodity and energy costs. In addition, SG&A was down as a

percentage of net sales due to reductions in both overhead and

marketing spending as a percentage of net sales.

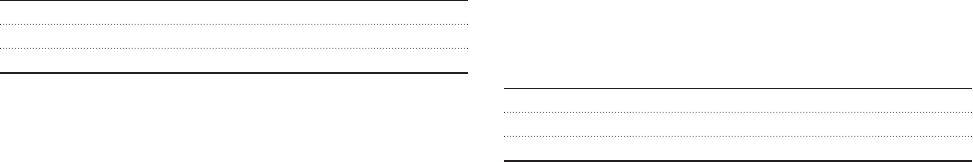

Change vs. Change vs.

(in millions of dollars) Prior Year 2006 Prior Year

Volume +0% n/a +0%

Net sales +4% $4,383 +2%

Net earnings +24% $ 385 -13%

Snacks, Coffee and Pet Care net sales increased 4% in 2007 to

$4.5 billion. Unit volume was in line with the prior year as growth in

coffee was offset by a decline in pet care. Snacks volume was in line

with the prior year. Coffee volume was up high-single digits primarily

due to a low base period that included a reduction in the coffee

business from Hurricane Katrina and current period volume from the

launches of Folgers Simply Smooth and Gourmet Selections. Pet care

volume was down mid-single digits versus the year-ago period due

to strong competitive activity and the impacts of a voluntary recall.

In March 2007, we voluntarily recalled certain Iams and Eukanuba wet

pet foods to help ensure maximum pet safety following the discovery

of contaminated materials at a pet food supplier. Price increases in

coffee and favorable product mix from disproportionate coffee growth

each had a positive 1% impact on sales. Foreign exchange had a

positive 2% impact on sales.

Net earnings increased 24% to $477 million. Earnings increased behind

sales growth and base period costs related to Hurricane Katrina,

which more than offset a decline in the current year gross margin

from the impacts of higher commodity costs and expenses associated

with the pet food recall.