Proctor and Gamble 2007 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Diluted net earnings per share increased 15%, to $3.04.

Free cash ow from operating activities was $10.5 billion,

or 101% of net earnings.

The growth was broad-based.

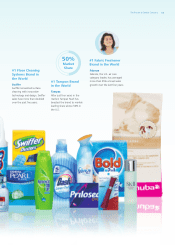

Fabric and Home Care grew organic sales 8%, with double-digit

growth in developing markets and mid-single-digit growth in

developed regions. Key growth drivers included Tide Simple

Pleasures, Gain Joyful Expressions, and Febreze Noticeables.

Blades and Razors organic sales increased 8%, behind the

continued expansion of the Fusion razor system and growth

on Mach3 in countries where Fusion has not launched.

Beauty organic sales increased 5%, led by strong growth in

feminine care, prestige fragrances and hair care. Billion-dollar

brands Always, Olay, and Head & Shoulders each grew sales

double-digits for the year.

Health Care organic sales increased 6%, driven by very

strong growth in oral care. In the U.S., Crest extended its

category market leadership to 38% behind the success of

the Pro-Health line.

Baby and Family Care organic sales increased 4%. This growth

was driven by continuing expansion into developing markets

and strong results on Pampers Baby Stages of Development and

Baby Dry Caterpillar Flex products in North America.

Growth was also broad-based across geographic regions, led by

mid-single-digit organic volume growth in North America and

double-digit organic growth in developing markets.

In addition to solid business growth, we made excellent progress

on the integration of Gillette. This was the largest acquisition and

the most complex integration in the consumer products industry

and in P&G history

—

and we’re about a year ahead of schedule.

We measure integration success by tracking progress in four areas:

business momentum, integration nancials, project management,

and elding the best team from both Gillette and P&G.

• Business Momentum. Our scal 2007 results demonstrate

that we were not distracted by the integration. We delivered

sales growth in line with our growth targets behind continuing

product innovation and expansion into new markets.

• Integration Financials. The dilution impact on earnings per

share was $0.10 to $0.12 per share. This is better than the low

end of our guidance range, which was $0.12 to $0.18 per

share. The acquisition remains on track and is expected to be

neutral to earnings per share in scal 2008. We expect cost

synergies to be at the top end of the $1 billion to $1.2 billion

target range and revenue synergies to be on target at about

$750 million next scal year.

(1) Organic sales exclude the impacts of acquisitions, divestitures and foreign

exchange, which where were 6%, on average, in 2001-2007.

(2) 2001 EPS excludes a negative $0.61 per share impact from Organization 2005

restructuring program charges and amortization of goodwill and intangible assets.

(3) Free cash ow productivity is the ratio of free cash ow to net earnings.

(4) Excludes the impact of adding newly acquired billion-dollar brands to the portfolio.

(5) Excludes impact of adding Gillette.

&

&

Average annual 2007 2001–2007

Organic Sales Growth (1) 5% 6%

Earnings-per-Share Growth 15% 12%(2)

Free Cash Flow Productivity (3) 101% 120%

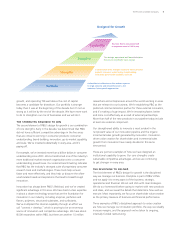

Grow from the core:

Leading Brands, Big Markets, Top Customers

Volume up 7%,

on average, for

P&G’s 23 billion-

dollar brands (4)

Volume up 8%,

on average,

for P&G’s top

16 countries (5)

Volume up 8%,

on average,

for P&G’s top 10

retail customers (5)

Beauty sales

doubled to

$23 billion;

prot more than

doubled to

$3.5 billion

Health Care

sales more than

doubled to

$9 billion; prot

increased 6-fold

to $1.5 billion

Home Care sales

up nearly 85%;

prot more than

tripled

Develop faster-growing, higher-margin, more asset-

efcient businesses

Accelerate growth in developing markets and among

low-income consumers

Developing

market sales up

18% per year

Over one-third

of total-company

sales growth

from developing

markets

Developing

market prot

margins

comparable

to developed-

market margins

The Procter & Gamble Company 3