Proctor and Gamble 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

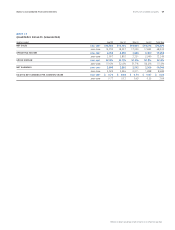

Millions of dollars except per share amounts or as otherwise specied.

Notes to Consolidated Financial Statements The Procter & Gamble Company 63

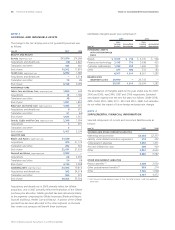

Pension Benets Other Retiree Benets

Years ended June 30 2006 2006

Funded status at end of year $(3,041) $(195)

Unrecognized net

actuarial loss 672 275

Unrecognized transition

amount 7

—

Unrecognized prior

service cost 146 (220)

(2,216) (140)

Noncurrent assets

—

prepaid benefit cost 386 255

Current liability

—

accrued benefit cost (216) (21)

Noncurrent liability

—

accrued benefit cost (2,550) (374)

Intangible asset 74

—

Accumulated other

comprehensive income

—

minimum pension liability 90

—

(2,216) (140)

Net actuarial loss

—

—

Prior service cost (credit)

—

—

Minimum pension liability 90

—

90

—

The underfunding of pension benets is primarily a function of the

different funding incentives that exist outside of the U.S. In certain

countries where we have major operations, there are no legal

requirements or nancial incentives provided to companies to pre-

fund pension obligations. In these instances, benet payments are

typically paid directly from the Company’s cash as they become due.

The accumulated benet obligation for all dened benet retirement

pension plans was $8,611 and $8,013 at June 30, 2007, and June 30,

2006, respectively. Pension plans with accumulated benet obligations

in excess of plan assets and plans with projected benet obligations

in excess of plan assets consist of the following:

Accumulated Benet Projected Benet

Obligation Exceeds the Obligation Exceeds the

Fair Value of Plan Assets

Fair Value of Plan Assets

Years ended June 30 2006 2006

Projected benefit obligation $5,597 $7,695

Accumulated benefit

obligation 4,912 6,544

Fair value of plan assets 2,684 4,498

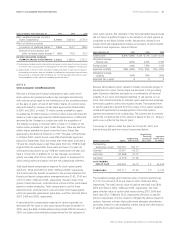

Net Periodic Benet Cost. Components of the net periodic benet

cost were as follows:

Pension Benets Other Retiree Benets

Years ended June 30 2006 2005 2006 2005

Service cost $ 265 $ 162 $ 97 $ 67

Interest cost 383 241 179 146

Expected return

on plan assets (353) (185) (372) (333)

Amortization of

deferred amounts 7 6 (22) (22)

Curtailment and

settlement

(gain) loss (4) 13

—

—

Recognized net

actuarial loss 76 31 6 1

374 268 (112) (141)

Dividends on ESOP

preferred stock

—

—

(78) (73)

374 268 (190) (214)

Pursuant to plan revisions adopted during 2007, Gillette’s U.S.

dened benet retirement pension plans will be frozen effective

January 1, 2008, at which time Gillette employees in the U.S. will

move into the P&G dened contribution Prot Sharing Trust and

Employee Stock Ownership Plan. This revision resulted in a $154

curtailment gain for the year ended June 30, 2007.

Amounts expected to be amortized from accumulated other

comprehensive income into net period benet cost during the year

ending June 30, 2008, are as follows:

Other

Pension Retiree

Benets Benets

Net actuarial loss $25 $ 6

Prior service cost (credit) 14 (21)