Proctor and Gamble 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

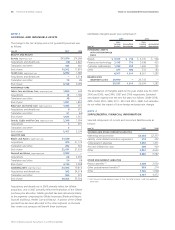

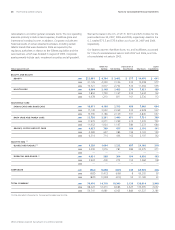

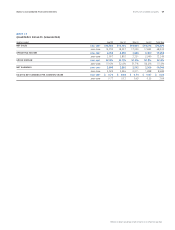

Millions of dollars except per share amounts or as otherwise specied.

Notes to Consolidated Financial Statements

The Procter & Gamble Company

68

rationalization, and other general corporate items. The non-operating

elements primarily include interest expense, divestiture gains and

interest and investing income. In addition, Corporate includes the

historical results of certain divested businesses, including certain

Gillette brands that were divested in 2006 as required by the

regulatory authorities in relation to the Gillette acquisition and the

Juice business, which was divested in August of 2004. Corporate

assets primarily include cash, investment securities and all goodwill.

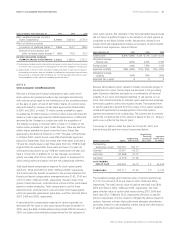

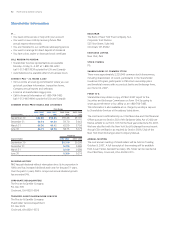

Before-Tax Depreciation & Capital

Global Segment Results Net Sales Earnings Net Earnings Amortization Total Assets Expenditures

2006 21,126 4,359 3,106 535 13,498 577

2005 19,721 3,977 2,752 535 11,494 535

2006 7,852 1,740 1,167 234 7,644 162

2005 6,078 1,210 811 161 2,536 112

2006 17,149 3,553 2,369 435 6,928 567

2005 15,796 3,186 2,129 391 6,845 647

2006 11,972 2,071 1,299 612 7,339 739

2005 11,652 1,924 1,197 580 7,272 684

2006 4,383 627 385 159 2,122 150

2005 4,314 714 444 162 2,197 142

(1)

(1)

2006 3,499 1,076 781 489 24,575 271

2005

—

—

—

—

—

—

(1)

2006 2,924 400 273 155 7,384 108

2005

—

—

—

—

—

—

2006 (683) (1,413) (696) 8 66,205 93

2005 (820) (1,030) (410) 55 31,183 61

2006 68,222 12,413 8,684 2,627 135,695 2,667

2005 56,741 9,981 6,923 1,884 61,527 2,181

(1) 2006 data reects information for the nine months ended June 30, 2006.

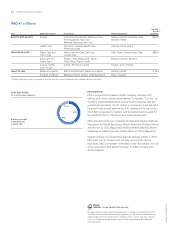

We had net sales in the U.S. of $31.9, $29.5 and $25.3 billion for the

years ended June 30, 2007, 2006 and 2005, respectively. Assets in the

U.S. totaled $73.5 and $75.4 billion as of June 30, 2007 and 2006,

respectively.

Our largest customer, Wal-Mart Stores, Inc. and its afliates, accounted

for 15% of consolidated net sales in both 2007 and 2006, and 16%

of consolidated net sales in 2005.