Proctor and Gamble 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

researchers and entrepreneurs around the world working in areas

that are relevant to our business. We’re establishing P&G as the

preferred commercialization partner for these external innovators,

and it’s making a huge impact. We’re innovating faster, better

and more cost effectively as a result of external partnerships.

More than half of the new products in our pipeline today include

at least one external component.

Our strengthened ability to innovate is most evident in the

net present value of our innovation pipeline and the organic

incremental sales growth generated by innovation. Innovation-

driven value creation for shareholders and incremental sales

growth from innovation have nearly doubled in this same

time period.

These are just two examples of how we have designed an

institutional capability to grow. Our core strengths create

sustainable competitive advantages, and we are continuing

to get stronger in every area.

The third element of P&G’s design for growth is the disciplined

way we manage our business. Discipline is part of P&G’s DNA

and we apply it to every aspect of the business: strategic,

operational and nancial. We set and stick with clear strategies.

We do our homework before going to market with new products

and ideas, and we sweat the details that determine how well we

execute. Most importantly, we focus on shareholder value creation

as the primary measure of business and nancial performance.

Three examples of P&G’s disciplined approach to value creation

are how we manage our innovation portfolio, the way we reliably

increase margins, and the approach we’ve taken to ongoing,

internally funded restructuring.

growth, and operating TSR well above the cost of capital

becomes a candidate for divestiture. Our portfolio is stronger

today than it was at the beginning of the decade but it’s not as

strong as it will be by the end of the decade. We have more work

to do to strengthen our mix of businesses and we will do it.

The second element of P&G’s design for growth is our combination

of core strengths. Early in the decade, we determined that P&G

did not have sufcient competitive advantage in the ve areas

that are critical to winning in consumer products: consumer

understanding, brand-building, innovation, go-to-market capability,

and scale. We’ve invested substantially in every area, and it’s

paying off.

For example, we’ve invested more than a billion dollars in consumer

understanding since 2001. We’ve transformed one of the industry’s

more traditional market research organizations into a consumer

understanding powerhouse. Our external benchmarking indicates

that P&G has the industry’s strongest suite of proprietary consumer

research tools and methodologies. These tools help us learn

faster and more effectively, and they help us discover the often-

unarticulated needs and aspirations that lead to breakthrough

innovation.

Innovation has always been P&G’s lifeblood, and we’ve created

signicant advantage in this area. We have best-in-class expertise

in about a dozen technology areas that are the foundation for

innovation in our industry, including enzymes, perfumes and

avors, polymers, structured substrates, and surfactants.

We’ve multiplied this internal capability through an effort we

call “connect + develop,” which is proving to be an enormous

source of innovation and competitive advantage. We have about

8,500 researchers within P&G, but there are another 1.5 million

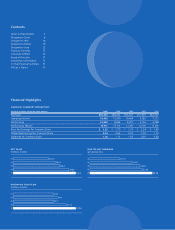

The strategic, operational and nancial discipline

that ensures shareholder value creation

The most diverse and experienced

management team in P&G history

A combination of the strengths required to win in consumer

products: consumer understanding, brand-building,

innovation, go-to-market capability, and scale

A diversied mix of businesses that reduces exposure

to single economic and competitive events, and

maximizes future growth opportunities

The Procter & Gamble Company 5