Proctor and Gamble 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

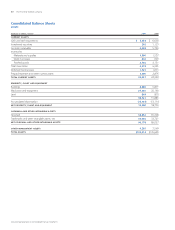

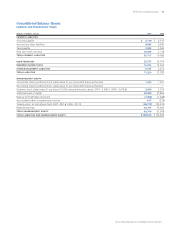

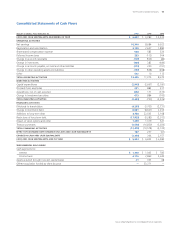

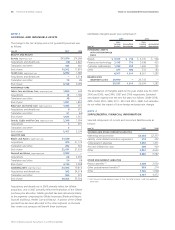

Millions of dollars except per share amounts or as otherwise specied.

Notes to Consolidated Financial Statements

The Procter & Gamble Company

60

on earnings from hedge ineffectiveness. For cash ow hedges, the

effective portion of the changes in fair value of the hedging instrument is

reported in other comprehensive income (OCI) and reclassied into

interest expense over the life of the underlying debt. The ineffective

portion, which is not material for any year presented, is immediately

recognized in earnings. The fair value of these cash ow hedging

instruments was an asset of $53 and $225 at June 30, 2007 and

2006, respectively. During the next 12 months, $33 of the June 30,

2007 OCI balance will be reclassied to earnings consistent with the

timing of the underlying hedged transactions.

We manufacture and sell our products in a number of countries

throughout the world and, as a result, are exposed to movements in

foreign currency exchange rates. The purpose of our foreign currency

hedging program is to reduce the risk caused by short-term changes

in exchange rates.

To manage this exchange rate risk, we primarily utilize forward contracts

and options with maturities of less than 18 months and currency swaps

with maturities up to ve years. These instruments are intended to

offset the effect of exchange rate uctuations on forecasted sales,

inventory purchases, intercompany royalties and intercompany loans

denominated in foreign currencies and are therefore accounted for as

cash ow hedges. The fair value of these instruments at June 30, 2007

and 2006, was $34 and $25 in assets and $2 and $58 in liabilities,

respectively. The effective portion of the changes in fair value of these

instruments is reported in OCI and reclassied into earnings in the

same nancial statement line item and in the same period or periods

during which the related hedged transactions affect earnings.

The ineffective portion, which is not material for any year presented,

is immediately recognized in earnings.

Certain instruments used to manage foreign exchange exposure of

intercompany nancing transactions, income from international

operations and other balance sheet items subject to revaluation do

not meet the requirements for hedge accounting treatment. In these

cases, the change in value of the instruments is designed to offset the

foreign currency impact of the related exposure. The fair value of these

instruments at June 30, 2007 and 2006, was $110 and $17 in assets

and $78 and $19 in liabilities, respectively. The change in value of

these instruments is immediately recognized in earnings. The net impact

of such instruments, included in selling, general and administrative

expense, was $56, $87 and $18 of gains in 2007, 2006 and 2005,

respectively, which substantially offset foreign currency transaction

and translation losses of the exposures being hedged.

We hedge certain net investment positions in major foreign subsidiaries.

To accomplish this, we either borrow directly in foreign currency and

designate all or a portion of foreign currency debt as a hedge of the

applicable net investment position or enter into foreign currency swaps

that are designated as hedges of our related foreign net investments.

Under SFAS 133, changes in the fair value of these instruments are

immediately recognized in OCI to offset the change in the value of

the net investment being hedged. Currency effects of these hedges

reected in OCI were after-tax losses of $835 and $786 in 2007 and

2006, respectively, and a $135 after-tax gain in 2005. Accumulated

net balances were $2,072 and $1,237 after-tax losses as of June 30,

2007 and 2006, respectively.

Certain raw materials utilized in our products or production processes

are subject to price volatility caused by weather, supply conditions,

political and economic variables and other unpredictable factors.

To manage the volatility related to anticipated purchases of certain of

these materials, we use futures and options with maturities generally

less than one year and swap contracts with maturities up to ve years.

These market instruments generally are designated as cash ow hedges

under SFAS 133. The effective portion of the changes in fair value for

these instruments is reported in OCI and reclassied into earnings in the

same nancial statement line item and in the same period or periods

during which the hedged transactions affect earnings. The ineffective

portion, which is not material for any year presented, is immediately

recognized in earnings. The fair value of these cash ow hedging

instruments was an asset of $70 and $32 at June 30, 2007 and 2006,

respectively. During the next 12 months, $14 of the June 30, 2007

OCI balance will be reclassied to earnings consistent with the timing

of the underlying hedged transactions.

The Company purchases limited discretionary insurance to cover

catastrophic property damage, business interruption, and liability risk

of loss exposures. Deductibles and loss sharing will likely increase over

time, recognizing the Company’s ability to cost-effectively fund losses

from internal cash ow generation and access to capital markets.

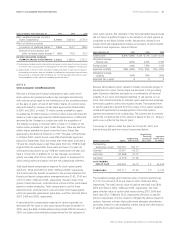

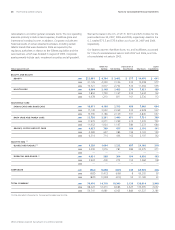

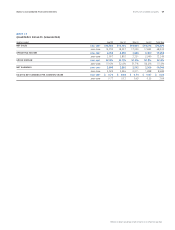

NOTE 7

Net earnings less preferred dividends (net of related tax benets) are

divided by the weighted average number of common shares outstanding

during the year to calculate basic net earnings per common share.

Diluted net earnings per common share are calculated to give effect to

stock options and other stock-based awards (see Note 8) and assume

conversion of preferred stock (see Note 9).

Net earnings and common shares used to calculate basic and diluted

net earnings per share were as follows:

Years ended June 30 2006 2005

$8,684 $6,923

Preferred dividends,

net of tax benefit (148) (136)

8,536 6,787

Preferred dividends,

net of tax benefit 148 136

Preferred dividend impact on

funding of ESOP

—

(1)

8,684 6,922