Proctor and Gamble 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Project Management. We completed the integration of

our sales force, distribution networks, and billing systems.

Since integration work began, we’ve added more than 50,000

new product codes and 100,000 new shipping points to P&G

systems. This enables us to go to market as one company and

to fully leverage P&G’s scale.

• Fielding the Best Team. Our management and employee team

is comprised of the best of both companies. Several of our key

management positions have been lled by Gillette employees,

and retention is ahead of the target we established at close.

Importantly, our employee survey results indicate that Gillette

employees are positive about their integration with P&G.

&

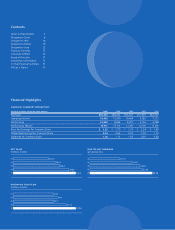

Our performance in scal 2007 meets or exceeds the Company’s

growth goals, which are:

Organic sales growth of 4% to 6%

Diluted net earnings per share growth of 10% or better

Free cash ow productivity of 90% or greater

These growth goals are realistic yet demanding. The categories in

which we compete grow about 3% a year. If we maintain market

shares

—

which is always a challenge in our highly competitive

industry

—

we grow along with the categories. But we need

another 1% to 3% growth to meet our goals. The only way to

achieve this growth is to increase market shares, expand into

new geographic markets, and create new brands and categories.

And then, of course, we have to turn sales growth into double-

digit earnings-per-share growth, which requires consistent

margin expansion of 50 to 75 basis points per year.

In addition to the ongoing challenges of sustaining growth,

there are specic challenges in the year ahead. We expect raw

material and energy costs to increase again in scal 2008, roughly

in line with the impact we saw in scal 2007. We’ll need to offset

these increased costs with a combination of pricing and cost-

savings projects. Competitive pressure will also remain a challenge.

We compete against some of the best companies in the world.

Many have restructured and are spending restructuring savings to

regain lost market share, which makes it even more important for

us to deliver industry-leading innovation and superior consumer

value in every category where we compete.

Sustaining growth despite these challenges is not easy, but we

believe the growth we’re targeting is achievable on a consistent,

sustainable basis because we have designed P&G to grow reliably

and consistently, year after year.

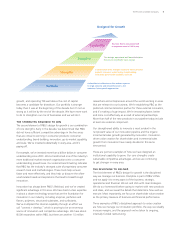

The rst element of P&G’s design is a portfolio that balances

growth and consistency.

In the 1990s, two businesses accounted for 85% of all the value

created by P&G through the decade. Today, we have a much

stronger and more robust portfolio of businesses. We’re competing

in 22 categories that include a balanced mix of faster-growing,

higher-margin, asset-efcient businesses, such as beauty or home

care, and large, foundation categories, such as laundry or baby care.

We also have an attractive geographic mix, with about half

of the Company’s sales coming from North America and half

coming from the rest of the world. We’re focusing on achieving

disproportionate growth in fast-growing developing markets.

These markets have contributed more than a third of the

Company’s top-line growth over the past ve years, and their

contribution has been accelerating. Nearly 40% of P&G’s sales

growth came from developing markets this past scal year, and

we expect the contribution to be even greater in the year ahead.

P&G’s diversied portfolio reduces exposure to single economic

and competitive events, and maximizes future growth opportunities.

Traditional businesses, like fabric care and baby care, are strong

and growing in their own right, and they create scale that

makes our beauty and health care businesses more competitive.

Geographically, our North America home base is rock solid, with

dependable growth that allows us to invest in developing markets.

In addition, the breadth and diversity of P&G’s businesses and

the breadth and diversity of the technological expertise that

supports these businesses enable us to transfer technologies

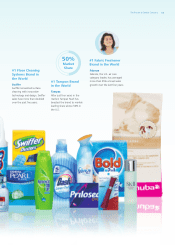

from one business to another. For example, Crest Whitestrips

was created by combining bleach stabilization technology from

laundry care with lm technology from corporate R&D to provide

in-home teeth whitening. The Swiffer Wet Jet pad combines

absorbent cores from feminine care with exible surface layers

from baby care. Olay Daily Facials combines structured paper

from family care with skin conditioning and mild cleansing from

beauty to provide a mini-facial in the home. Our ability to

combine technologies from so many diverse businesses is

unrivaled in the industry because no other consumer products

company has the scope of science and technology found at P&G.

Our business portfolio is not static. We use operating total

shareholder return (TSR) delivered by each business to

continuously ensure our portfolio is maximizing shareholder

value. TSR is a cash ow return on investment (CFROI) model

that measures sales growth, earnings growth and cash ow to

determine the rate of return that each business earns. Any

business that cannot deliver sales growth at least at the low end

of our target range, upper-single-digit or better operating prot

The Procter & Gamble Company

4