Proctor and Gamble 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Millions of dollars except per share amounts or as otherwise specied.

Notes to Consolidated Financial Statements

The Procter & Gamble Company

58

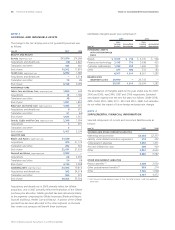

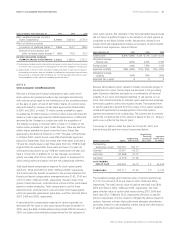

NOTE 3

The change in the net carrying amount of goodwill by business was

as follows:

June 30 2006

Beauty, beginning of year $14,580

Acquisitions and divestitures 2,807

Translation and other 483

End of year 17,870

Health Care, beginning of year 1,683

Acquisitions and divestitures

4,318

Translation and other 89

End of year 6,090

Fabric Care and Home Care, beginning of year 644

Acquisitions 1,180

Translation and other 26

End of year 1,850

Baby Care and Family Care, beginning of year 955

Acquisitions and divestitures 672

Translation and other (64)

End of year 1,563

Snacks, Coffee and Pet Care, beginning of year 1,954

Acquisitions 437

Translation and other 5

End of year 2,396

Blades and Razors, beginning of year

—

Acquisitions 21,174

Translation and other 365

End of year 21,539

Duracell and Braun, beginning of year

—

Acquisitions 3,930

Translation and other 68

End of year 3,998

, beginning of year 19,816

Acquisitions and divestitures 34,518

Translation and other 972

End of year 55,306

Acquisitions and divestitures in 2006 primarily reect the Gillette

acquisition, and in 2007 primarily reect the nalization of the Gillette

purchase price allocation. Gillette goodwill has been allocated primarily

to the segments comprising the Gillette businesses (Blades and Razors,

Duracell and Braun, Health Care and Beauty). A portion of the Gillette

goodwill has also been allocated to the other segments on the basis

that certain cost synergies will benet these businesses.

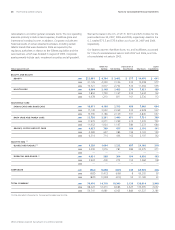

Identiable intangible assets were comprised of:

2006

Gross Gross

Carrying Accumulated Carrying Accumulated

June 30 Amount Amortization Amount Amortization

Brands $ 3,135 $ 540

Patents and technology 3,098 425

Customer relationships 1,695 135

Other 333 183

8,261 1,283

26,743

—

35,004 1,283

The amortization of intangible assets for the years ended June 30, 2007,

2006 and 2005, was $640, $587 and $198, respectively. Estimated

amortization expense over the next ve years is as follows: 2008 – $618;

2009 – $594; 2010 – $556; 2011 – $513 and 2012 – $480. Such estimates

do not reect the impact of future foreign exchange rate changes.

NOTE 4

Selected components of current and noncurrent liabilities were as

follows:

June 30 2006

Marketing and promotion $2,357

Liability under Wella Domination Agreement 207

Compensation expenses 1,471

Accrued Gillette exit costs 929

Other 4,623

9,587

Pension benefits (1) 2,550

Other postretirement benefits (1) 374

Other 1,548

4,472

(1) 2007 amounts include adoption impact of SFAS 158. Refer to Notes 1 and 9 for additional

information.