Proctor and Gamble 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

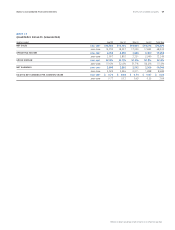

Millions of dollars except per share amounts or as otherwise specied.

Notes to Consolidated Financial Statements The Procter & Gamble Company 65

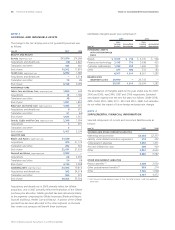

Total benet payments expected to be paid to participants, which

include payments funded from the Company’s assets, as discussed

above, as well as payments paid from the plans, are as follows:

Other

Years ended June 30 Pension Benets Retiree Benets

2008 $ 473 $ 199

2009 439 216

2010 454 233

2011 468 249

2012 474 263

2013 – 2017 2,654 1,523

We maintain the ESOP to provide funding for certain employee

benets discussed in the preceding paragraphs.

The ESOP borrowed $1.0 billion in 1989 and the proceeds were used

to purchase Series A ESOP Convertible Class A Preferred Stock to fund

a portion of the U.S. DC plan. Principal and interest requirements of

the borrowing were paid by the Trust from dividends on the preferred

shares and from advances from the Company. The original borrowing

of $1.0 billion has been repaid in full, and advances from the Company

of $216 remain outstanding at June 30, 2007. Each share is convertible

at the option of the holder into one share of the Company’s common

stock. The dividend for the current year was equal to the common stock

dividend of $1.28 per share. The liquidation value is $6.82 per share.

In 1991, the ESOP borrowed an additional $1.0 billion. The proceeds

were used to purchase Series B ESOP Convertible Class A Preferred

Stock to fund a portion of retiree health care benets. These shares,

net of the ESOP’s debt, are considered plan assets of the Other Retiree

Benets plan discussed above. Debt service requirements are funded

by preferred stock dividends, cash contributions and advances from

the Company, of which $123 is outstanding at June 30, 2007. Each

share is convertible at the option of the holder into one share of the

Company’s common stock. The dividend for the current year was

equal to the common stock dividend of $1.28 per share. The liquidation

value is $12.96 per share.

As permitted by SOP 93-6, “Employers Accounting for Employee Stock

Ownership Plans,” we have elected, where applicable, to continue

our practices, which are based on SOP 76-3, “Accounting Practices

for Certain Employee Stock Ownership Plans.” ESOP debt, which is

guaranteed by the Company, is recorded as debt (see Note 5). Preferred

shares issued to the ESOP are offset by the Reserve for ESOP Debt

Retirement in the Consolidated Balance Sheets and the Consolidated

Statements of Shareholders’ Equity. Advances to the ESOP are

recorded as an increase in the Reserve for ESOP Debt Retirement.

Interest incurred on the ESOP debt is recorded as interest expense.

Dividends on all preferred shares, net of related tax benets, are

charged to retained earnings.

The series A and B preferred shares of the ESOP are allocated to

employees based on debt service requirements, net of advances made

by the Company to the Trust. The number of preferred shares outstanding

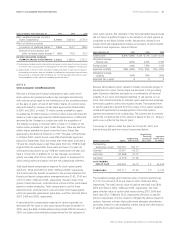

at June 30 was as follows:

Shares in thousands 2006 2005

Allocated 61,614 61,904

Unallocated 23,125 25,623

84,739 87,527

Allocated 21,733 21,989

Unallocated 45,594 46,338

67,327 68,327

For purposes of calculating diluted net earnings per common share,

the preferred shares held by the ESOP are considered converted from

inception.

In connection with the Gillette acquisition, we assumed the Gillette

ESOP, which was established to assist Gillette employees in nancing

retiree medical costs. These ESOP accounts are held by participants

and must be used to reduce the Company’s other retiree benet

obligations. Such accounts reduced our obligation by $245 at

June 30, 2007.

NOTE 10

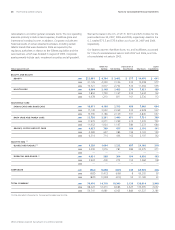

Under SFAS 109, “Accounting for Income Taxes,” income taxes are

recognized for the amount of taxes payable for the current year and

for the impact of deferred tax liabilities and assets, which represent

future tax consequences of events that have been recognized differently

in the nancial statements than for tax purposes. Deferred tax assets

and liabilities are established using the enacted statutory tax rates and

are adjusted for any changes in such rates in the period of change.

Management judgment is required in evaluating tax positions and

other items that factor into determining tax provisions. Management

believes its tax positions and related provisions reected in the

Consolidated Financial Statements are fully supportable. We establish

reserves for additional income taxes related to positions that may be

challenged by local authorities and may not be fully sustained, despite

our belief that the underlying tax positions are fully supportable. In

such cases, the reserves for additional taxes are based on management’s

best estimate of the ultimate outcome. These reserves are reviewed

on an ongoing basis and are adjusted in light of changing facts and

circumstances, including progress on tax audits, changes in interpretations

of tax laws, developments in case law and closing of statutes of

limitation. Our tax provision includes the impact of recording reserves

and any changes thereto. We have a number of tax audits in process

and have open tax years with various signicant taxing jurisdictions

that range primarily from 1997 to 2007. Based on currently available

information, we do not believe the ultimate outcome of these tax

audits and other tax positions related to open tax years, when nalized,

will have a material adverse effect on our nancial position, results of

operations or cash ows.