Proctor and Gamble 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

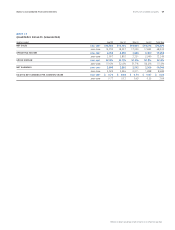

Millions of dollars except per share amounts or as otherwise specied.

Notes to Consolidated Financial Statements

The Procter & Gamble Company

62

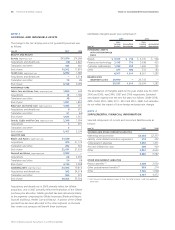

At June 30, 2007, there was $622 of compensation cost that has not

yet been recognized related to nonvested stock-based awards. That

cost is expected to be recognized over a remaining weighted average

period of 1.9 years.

Cash received from options exercised was $1,422, $1,229 and $455

in 2007, 2006 and 2005, respectively. The actual tax benet realized

for the tax deductions from option exercises totaled $265, $242 and

$149 in 2007, 2006 and 2005, respectively.

NOTE 9

We offer various postretirement benets to our employees.

We have dened contribution plans which cover the majority of our

U.S. employees, as well as employees in certain other countries. These

plans are fully funded. We generally make contributions to participants’

accounts based on individual base salaries and years of service. The

primary U.S. dened contribution plan (the U.S. DC plan) comprises

the majority of the balances and expense for the Company’s dened

contribution plans. For the U.S. DC plan, the contribution rate is set

annually. Total contributions for this plan approximated 15% of total

participants’ annual wages and salaries in 2007, 2006 and 2005.

We maintain The Procter & Gamble Prot Sharing Trust (Trust) and

Employee Stock Ownership Plan (ESOP) to provide a portion of the

funding for the U.S. DC plan, as well as other retiree benets. Operating

details of the ESOP are provided at the end of this Note. The fair

value of the ESOP Series A shares allocated to participants reduces

our cash contribution required to fund the U.S. DC plan. Total dened

contribution expense was $273, $249 and $215 in 2007, 2006 and

2005, respectively.

We offer dened benet retirement pension plans to certain employees.

These benets relate primarily to local plans outside the U.S., and to a

lesser extent, plans assumed in the Gillette acquisition covering U.S.

employees. These acquired Gillette plans will be frozen effective

January 1, 2008.

We also provide certain other retiree benets, primarily health care and

life insurance, for the majority of our U.S. employees who become

eligible for these benets when they meet minimum age and service

requirements. Generally, the health care plans require cost sharing

with retirees and pay a stated percentage of expenses, reduced by

deductibles and other coverages. These benets are primarily funded

by ESOP Series B shares, as well as certain other assets contributed by

the Company.

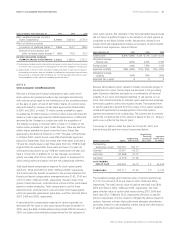

As discussed in Note 1, we adopted SFAS 158 on June 30, 2007, on

the required prospective basis. Our June 30, 2007 disclosure is in

accordance with the new requirements.

Obligation and Funded Status. We use a June 30 measurement date

for our dened benet retirement plans and other retiree benet plans.

The following provides a reconciliation of benet obligations, plan

assets and funded status of these plans:

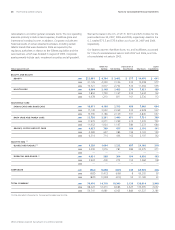

Pension Benets

(1) Other Retiree Benets

(2)

Years ended June 30 2006 2006

Benefit obligation at

beginning of year (3) $ 5,626 $3,079

Service cost 265 97

Interest cost 383 179

Participants’ contributions 19 35

Amendments 65

—

Actuarial (gain) loss (754) (466)

Acquisitions (divestitures) 3,744

506

Curtailments and settlements (9)

—

Special termination benefits

—

1

Currency translation

and other 247 22

Benefit payments (342) (167)

(3) 9,244 3,286

Fair value of plan assets

at beginning of year 2,572 2,700

Actual return on

plan assets 481 234

Acquisitions (divestitures) 2,889

288

Employer contributions 427 21

Participants’ contributions 19 35

Currency translation

and other 157 (1)

ESOP debt impacts (4)

—

(19)

Benefit payments (342) (167)

6,203 3,091

(3,041) (195)

(1) Primarily non-U.S.-based dened benet retirement plans.

(2) Primarily U.S.-based other postretirement benet plans.

(3) For the pension benet plans, the benet obligation is the projected benet obligation.

For other retiree benet plans, the benet obligation is the accumulated postretirement

benet obligation.

(4) Represents increases in the ESOP’s debt, which is netted against plan assets for Other

Retiree Benets.