Proctor and Gamble 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company

38 Management’s Discussion and Analysis

Beauty net sales in 2006 increased 7% to $21.1 billion. Sales grew

behind 8% unit volume growth, including a positive 2% impact from

nine months of Gillette personal care results. Volume growth was

driven by initiative activity and expansion of our brands in developing

regions, where volume increased double-digits during the year. Skin

care volume increased double-digits behind continued growth and

initiative activity on the Olay brand. Hair care volume increased high-

single digits behind growth on Pantene, Head & Shoulders and

Rejoice. Feminine care volume grew high-single digits behind new

product innovations on Always/Whisper and continued growth on

Naturella. Cosmetics volume declined due to reduced Max Factor

distribution and a base period on Cover Girl with signicant initiative

pipeline shipments. Foreign exchange had a negative 1% impact on

sales growth. Net earnings increased 13% in 2006 to $3.1 billion

behind sales growth and a 75-basis point net earnings margin

expansion primarily driven by lower overhead expenses as a percentage

of net sales. Margin improvements from scale benets of volume

growth and manufacturing cost savings initiatives offset higher

commodity costs.

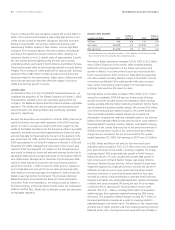

Change vs. Change vs.

(in millions of dollars) Prior Year* 2006* Prior Year*

Volume +9% n/a +26%

Net sales +14% $7,852 +29%

Net earnings +25% $1,167 +44%

* Fiscal 2006 gures include results of Gillette oral care for the nine months ended June 30, 2006.

Health Care net sales increased 14% in 2007 to $9.0 billion behind a

9% increase in unit volume. Sales and volume were up as a result of

three additional months of Gillette oral care results in the current

scal year and growth on the base P&G business. Health Care organic

sales increased 6% on 4% organic volume growth. Oral care organic

volume grew mid-single digits behind double-digit growth in

developing regions, high-single digit growth on Oral-B and the launch

of Crest Pro-Health toothpaste in North America. Pharmaceuticals

and personal health volume increased low-single digits behind growth

on Prilosec OTC, partially offset by lower volume on Actonel due to

strong competitive activity in the osteoporosis market. Our U.S. market

share on Prilosec OTC increased about 1 point during the year. Pricing,

primarily in pharmaceuticals and personal health, contributed 2%

to segment sales growth. A more premium product mix added an

additional 1% to sales as disproportionate growth on Crest Pro-Health

in North America more than offset the negative impact from higher

relative growth in developing regions. Foreign exchange had a positive

2% impact on sales.

Net earnings grew 25% to $1.5 billion in 2007 behind organic sales

growth, the additional three months of Gillette oral care results and

earnings margin expansion. Earnings margin increased 135-basis points

as lower product costs on our base business and lower SG&A as a

percentage of net sales more than offset the negative mix impact

from the additional three months of the Gillette oral care business in

the current year. SG&A improved primarily due to lower overhead

expenses as a percentage of net sales resulting from volume scale

leverage, Gillette synergy savings and lower research and development

costs in our pharmaceuticals business driven by further leveraging

external R&D networks and higher clinical milestone payments in the

base period.

Health Care net sales in 2006 increased 29% to $7.9 billion. Sales

were up behind 26% unit volume growth, including nine months of

Gillette oral care results. Organic sales grew 9% on 7% organic

volume growth. Pharmaceuticals and personal health organic volume

increased high-single digits behind double-digit growth on Prilosec

OTC and Actonel. Prilosec OTC volume increased as a result of market

share growth and a suppressed base period which included several

months of shipment allocations. Oral care organic volume grew mid-

single digits as a result of market share increases across the globe,

especially in the U.S. and in Central and Eastern Europe. Price

increases, primarily on Actonel and Prilosec OTC, added 2% to sales

growth. Favorable product mix, driven largely by the addition of the

Gillette oral care business, contributed 2% to sales growth. Foreign

exchange had a negative 1% impact on sales growth. Net earnings

increased 44% to $1.2 billion in 2006 behind sales growth and a

150-basis point earnings margin expansion. Net earnings margin

expanded primarily due to lower overhead and marketing spending

as a percentage of net sales.

Change vs. Change vs.

(in millions of dollars) Prior Year 2006 Prior Year

Volume +8% n/a +8%

Net sales +11% $17,149 +9%

Net earnings +18% $ 2,369 +11%

Fabric Care and Home Care net sales increased 11% in 2007 to

$19.0 billion behind 8% unit volume growth. Volume growth was

broad-based across regions with mid-single digit or higher increases

in every region, led by double-digit growth in developing regions.

Volume was up high-single digits in both fabric care and home care

behind product initiatives such as Tide Simple Pleasures, Gain Joyful

Expressions, Febreze Noticeables, upgrades on Swiffer and the launch

of Fairy auto-dishwashing in Western Europe. Our market share in

both fabric care and home care increased by about 1 point globally

during the year. Favorable foreign exchange had a positive 3% impact

on sales.

Net earnings were up 18% to $2.8 billion behind sales growth and a

90-basis point improvement in net earnings margin. Earnings margin

improved behind higher gross margin and lower SG&A as a percentage

of net sales. The gross margin improvement was driven by scale

benets of volume growth and cost savings projects that more than

offset higher commodity costs. SG&A improved behind lower overhead

expenses as a percentage of net sales resulting from volume scale

leverage and Gillette synergy savings.