Proctor and Gamble 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

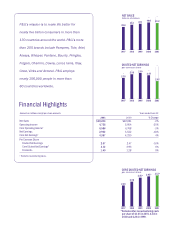

multi-billion-dollar

businesses -- are

not performing

satisfactorily.

Western Europe –

our second

largest market –

also lags

expectations. We have improvements planned for

each of these businesses.

Getting Competitive

Cost competitiveness improved.

• We reduced P&G’s overhead costs in 2000/2001

for the first time in five years.

• We reduced marketing spending in 2000/2001 –

for the first time in five years.

• We reduced capital spending from 7.6% of

sales last fiscal year to 6.3% this year, and

revised our goal to 6% of sales by 2002/2003,

one year ahead of plan.

We also announced plans to broaden our Organization

2005 restructuring program to drive costs to best-in-

class levels, rationalize our manufacturing capacity

and address under-performing businesses. This

includes a reduction in force of 9,600 jobs, in addition

to 7,800 remaining from our original Organization 2005

program. We are on track to achieve the nearly $2

billion in savings expected from this program by fiscal

year 2004.

Strategic Choices

Last year, we identified the need to make clearer,

tougher choices. Again, we’ve made progress.

Here’s where P&G will focus:

1. Build existing core businesses into

stronger global leaders. Baby Care,

Fabric Care, Feminine Protection and

Hair Care are our top-priority core

businesses. These are categories in

which P&G is #1 in global sales and

market share, and where the Company

believes it can consistently grow earnings

at double-digit rates. Together, these four

businesses represent about two-thirds

of P&G sales and an even greater

percentage of profit.

2. Grow big brands, big countries, leading

customers. With this focus, we intend to

grow sales, market shares and profits

at rates that exceed Company averages.

We’ll concentrate on our billion-dollar and

soon-to-be billion-dollar brands, and on

our top customers in our top 10 countries.

3. Develop faster-growing, higher-margin,

more asset-efficient businesses with

global leadership potential. These are

businesses – such as Personal Health

Care and Beauty Care – that are high

Total Shareholder Return performers.

We’ll develop them through internal

innovation, as we’re doing with Crest

Whitestrips, and through acquisitions

and alliances that are in or adjacent to

core P&G categories, such as Clairol,

which we announced our intention to

acquire in May.

4. Regain growth momentum and

leadership in Western Europe. We’ll

restore P&G leadership in Western

Europe by focusing on core categories

and on our biggest brands, leading

customers, biggest countries.

5. Drive growth in key developing markets.

We expect growth in the coming decade

to come from a balanced mix of developed

and developing markets. We’ll win in our

high-priority developing markets by

tailoring low-income offerings in core

P&G categories.

In all these areas, innovation will continue to be the

primary driver of P&G growth. We intend to be the

innovation leader in new and established businesses

alike, and in both developed and developing markets.

In 2000, for example, P&G had five of the top new U.S.

consumer products, as reported in the Information

Resources, Inc. (IRI) annual study. Over the past eight

years, we have averaged three to four of the top 10

new items each year. In fact, over the last four years,

P&G has launched 13 new products in the U.S., each

of which has exceeded $100 million in sales – nearly

a third of all new consumer products during that time

that beat the $100 million mark.

TWO