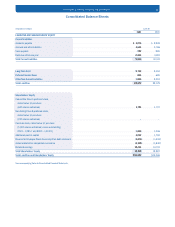

Proctor and Gamble 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FABRIC AND HOME CARE

Fabric and home care trends reflect the significant effort to restore

historical margins through innovation combined with necessary

pricing, disciplined cost focus and more efficient marketing. Net

sales were $11.66 billion, down 4% versus a strong year ago base

which included new brand introductions. Excluding a 3%

unfavorable foreign exchange impact, net sales decreased 1%. Unit

volume decreased 2% due to heavy competitive activity, primarily in

Western Europe.

Despite the volume decline, net earnings increased 13% to $1.64

billion. Net earnings growth was significant in light of product cost

increases and exchange impacts, which were offset by the benefits

of laundry pricing actions and lower taxes. Latin America delivered

particularly strong earnings progress, reflecting disciplined cost

management.

Fabric and home care is the Company’s most profitable segment,

accounting for nearly a third of net sales and an even greater

percentage of profits.

September 1999, was $489 million at June 30, 2001. Additionally,

the Company is able to issue commercial paper at favorable rates

and to access general bank financing.

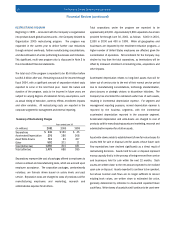

Capital Spending

Significant progress was made in 2001, as capital expenditures

decreased to $2.49 billion compared to $3.02 billion in 2000 and

$2.83 billion in 1999. Current year spending is 6.3% of net sales,

compared to 7.6% and 7.4% in 2000 and 1999. During 2001,

capital spending declined in most segments due to more choiceful

investments, increased efficiencies and favorable currency

impacts. The Company has revised its goal to reduce capital

spending to 6% of net sales by fiscal 2003, one year ahead of plan.

The following pages provide perspective on the Company’s

business segments. Product-based segment results exclude items

that are not included in measuring business performance for

management reporting purposes, most notably certain financing,

investing and employee benefit costs, goodwill amortization and

restructuring costs.

Sales in companies over which the Company exerts significant

influence, but does not control the financial and operating

decisions, are reported for segment purposes in a manner similar

to consolidated subsidiaries. Taxes are reflected in the business

segments at local statutory tax rates. The effects of these

conventions are eliminated in the corporate segment to adjust

management reporting conventions to accounting principles

generally accepted in the United States of America.

The Procter & Gamble Company and Subsidiaries 13

Financial Review (continued)

CAPITAL SPENDING

(in billions)

1997

Capital Spending

0

1

2

3

$4

0%

2%

4%

6%

8%

1998 1999 2000 2001

% of Sales

Fabric and Home Care

Beauty Care

Health Care

Food and Beverage

Paper

2001 NET SALES BY BUSINESS SEGMENT

11 %

30%

11 %

18%

30%

Fabric and Home Care

Beauty Care

Health Care

Food and Beverage

Paper

8%

37%

9%

22%

24%

2001 NET EARNINGS BY BUSINESS SEGMENT