Proctor and Gamble 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

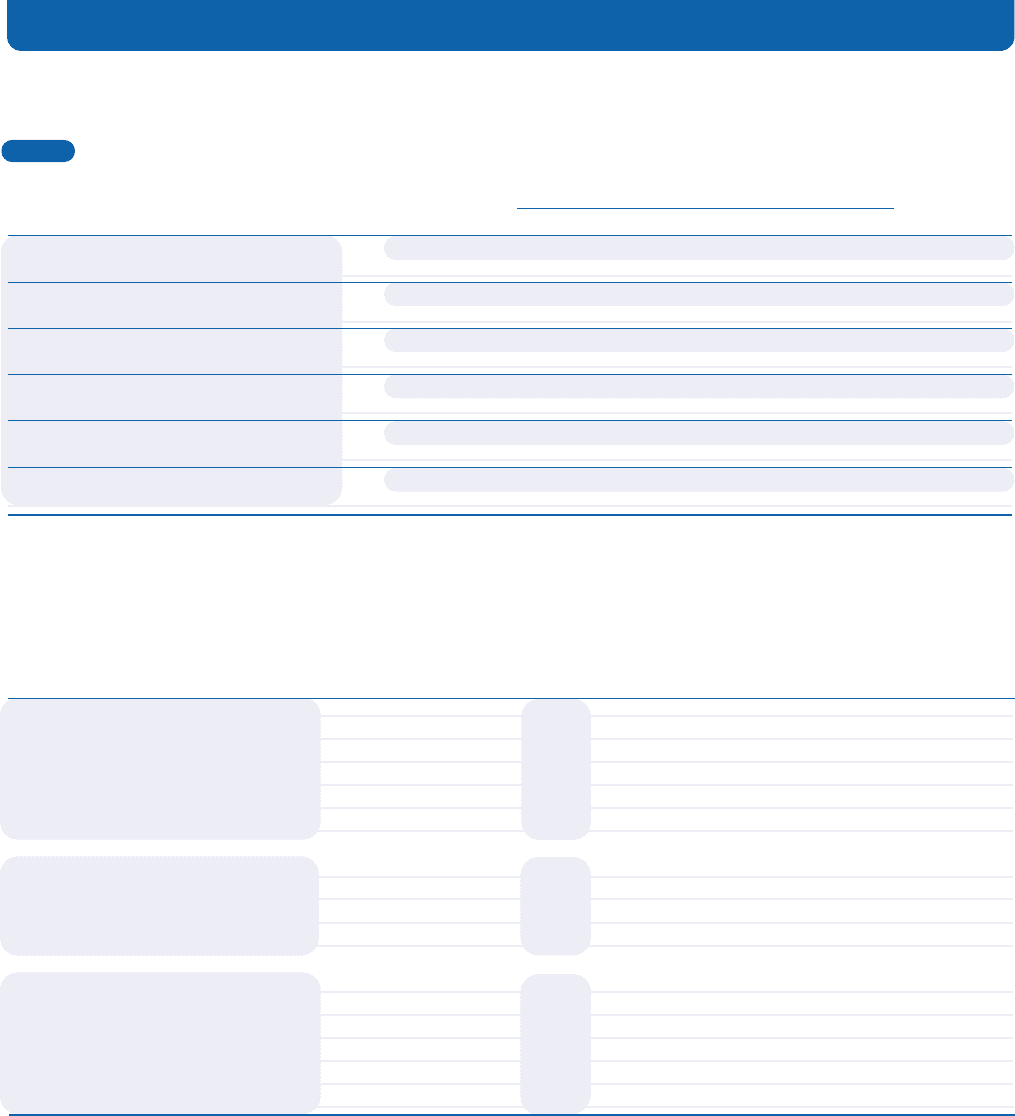

The Procter & Gamble Company and Subsidiaries 35

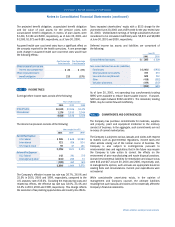

Notes to Consolidated Financial Statements (continued)

Millions of dollars except per share amounts

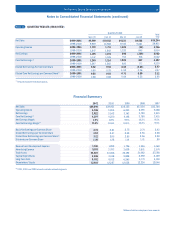

NOTE 13 QUARTERLY RESULTS (UNAUDITED)

Financial Summary

$39,244

39,951

4,736

5,954

2,922

3,542

4,397

4,230

2.07

2.47

3.12

2.95

Net Sales

Operating Income

Net Earnings

Core Net Earnings(1)

Diluted Net Earnings Per Common Share

Diluted Core Net Earnings per Common Share(1)

2000–2001

1999–2000

2000–2001

1999–2000

2000–2001

1999–2000

2000–2001

1999–2000

2000–2001

1999–2000

2000–2001

1999–2000

$9,969

9,919

1,779

1,847

1,155

1,147

1,240

1,267

0.82

0.80

0.88

0.88

$10,182

10,588

1,711

1,842

1,194

1,126

1,314

1,263

0.84

0.78

0.93

0.88

$9,511

9,783

1,302

1,320

893

753

1,006

923

0.63

0 .52

0.71

0.64

$9,582

9,661

56

945

320

516

837

777

0.23

0.36

0.60

0.55

( )

( )

( )

Quarters Ended

Sept. 30 Dec. 31 Mar. 31 June 30

(1)Amounts exclude restructuring costs.

Total

Year

$39,244

4,736

2,922

4,397

7.4%

11.2%

2.15

2.07

3.12

1.40

1,769

3,193

34,387

2,486

9,792

12,010

Net Sales

Operating Income

Net Earnings

Core Net Earnings(2)

Net Earnings Margin

Core Net Earnings Margin(2)

Basic Net Earnings per Common Share

Diluted Net Earnings per Common Share

Diluted Core Net Earnings per Common Share(2)

Dividends per Common Share

Research and Development Expense

Advertising Expense

Total Assets

Capital Expenditures

Long-Term Debt

Shareholders’ Equity

(2) 2001, 2000 and 1999 amounts exclude restructuring costs.

$39,951

5,954

3,542

4,230

8.9%

10.6%

2.61

2.47

2.95

1.28

1,899

3,793

34,366

3,018

9,012

12,287

$38,125

6,253

3,763

4,148

9.9%

10.9%

2.75

2.59

2.85

1.14

1,726

3,639

32,192

2,828

6,265

12,058

$37,154

6,055

3,780

3,780

10.2%

10.2%

2.74

2.56

2.56

1.01

1,546

3,801

31,042

2,559

5,774

12,236

$35,764

5,488

3,415

3,415

9.5%

9.5%

2.43

2.28

2.28

.90

1,469

3,574

27,598

2,129

4,159

12,046

2001 2000 1999 1998 1997