Proctor and Gamble 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Total separations under the program are expected to be

approximately 24,600. Approximately 9,200 separations have been

provided for through June 30, 2001, as follows: 6,000 in 2001,

2,800 in 2000 and 400 in 1999. While all geographies and

businesses are impacted by the enrollment reduction programs, a

higher number of United States employees are affected, given the

concentration of operations. Net enrollment for the Company may

decline by less than the total separations, as terminations will be

offset by increased enrollment at remaining sites, acquisitions and

other impacts.

Accelerated depreciation relates to long-lived assets that will be

taken out of service prior to the end of their normal service period

due to manufacturing consolidations, technology standardization,

plant closures or strategic choices to discontinue initiatives. The

Company has shortened the estimated useful lives of such assets,

resulting in incremental depreciation expense. For segment and

management reporting purposes, normal depreciation expense is

reported by the business segments, with the incremental

accelerated depreciation reported in the corporate segment.

Accelerated depreciation and write-downs are charged to cost of

products sold for manufacturing assets and marketing, research and

administrative expense for all other assets.

Asset write-downs relate to establishment of new fair-value bases for

assets held for sale or disposal and for assets whose future cash

flow expectations have declined significantly as a direct result of

restructuring decisions. Assets held for sale or disposal represent

excess capacity that is in the process of being removed from service

and businesses held for sale within the next 12 months. Such

assets are written down to the net amount expected to be realized

upon sale or disposal. Assets expected to continue to be operated,

but whose nominal cash flows are no longer sufficient to recover

existing book values, are written down to estimated fair value,

generally determined by reference to discounted expected future

cash flows. Write-downs of assets that will continue to be used were

RESTRUCTURING PROGRAM

Beginning in 1999 – concurrent with the Company’s reorganization

into product-based global business units – the Company initiated its

Organization 2005 restructuring program. The program was

expanded in the current year to deliver further cost reductions

through reduced overheads, further manufacturing consolidations,

and discontinuation of under-performing businesses and initiatives.

This significant, multi-year program also is discussed in Note 2 to

the consolidated financial statements.

The total cost of the program is expected to be $5.6 billion before

tax ($4.4 billion after tax). Remaining costs will be incurred through

fiscal 2004, with a significant amount of separation related costs

expected to occur in the next fiscal year. Given the nature and

duration of the program, costs to be incurred in future years are

subject to varying degrees of estimation for key assumptions, such

as actual timing of execution, currency effects, enrollment impacts

and other variables. All restructuring costs are reported in the

corporate segment for management and external reporting.

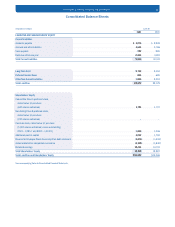

Summary of Restructuring Charges

(in millions) 2001 2000 1999

Separations

Accelerated Depreciation

Asset Write-Downs

Other

Total (before tax)

Total (after tax)

Separations represent the cost of packages offered to employees to

reduce overhead and manufacturing costs, which are accrued upon

employee acceptance. The separation packages, predominantly

voluntary, are formula driven based on salary levels and past

service. Separation costs are charged to costs of products sold for

manufacturing employees and marketing, research and

administrative expense for all others.

The Procter & Gamble Company and Subsidiaries

18

Financial Review (continued)

$ 45

208

217

11

481

385

$ 153

386

64

211

814

688

$ 341

276

731

502

1,850

1,475

Years ended June 30