Proctor and Gamble 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

Millions of dollars except per share amounts

offsets. For the residual portion, the Company enters into various

derivative transactions pursuant to the Company’s policies in areas

such as counterparty exposure and hedging practices. Designation

is performed on a specific exposure basis to support hedge

accounting. The changes in fair value of these hedging instruments

are offset in part or in whole by corresponding changes in the fair

value or cash flows of the underlying exposures being hedged. The

Company does not hold or issue derivative financial instruments for

trading purposes.

Interest Rate Hedging

The Company’s policy is to manage interest cost using a mix of fixed-

and variable-rate debt. To manage this mix in a cost efficient

manner, the Company enters into interest rate swaps in which the

Company agrees to exchange, at specified intervals, the difference

between fixed and variable interest amounts calculated by reference

to an agreed-upon notional principal amount.

At June 30, 2001, the Company had swaps with a fair value of $125

designated as fair value hedges of underlying fixed-rate debt

obligations and recorded as long-term assets. The mark-to-market

values of both the fair value hedging instruments and the underlying

debt obligations are recorded as equal and offsetting gains and

losses in the interest expense component of the income statement.

All existing fair value hedges are 100% effective. As a result, there is

no impact to earnings due to hedge ineffectiveness.

Non-qualifying instruments are also recorded on the balance sheet at

fair value, but the impact was not material to the income statement.

Currency Rate Hedging

The Company manufactures and sells its products in a number of

countries throughout the world and, as a result, is exposed to

movements in foreign currency exchange rates. The Company’s

major foreign currency exposures involve the markets in Western and

Eastern Europe, Asia, Mexico and Canada. The primary purpose of

the Company’s foreign currency hedging activities is to manage the

volatility associated with foreign currency purchases of materials and

other assets and liabilities created in the normal course of business.

The Company primarily utilizes forward exchange contracts and

purchased options with maturities of less than 18 months and

currency swaps with maturities up to five years.

The Company enters into certain foreign currency derivative

instruments that do not meet hedge accounting criteria. These

primarily are intended to protect against exposure related to

intercompany financing transactions and income from international

operations. The fair values of these instruments at June 30, 2001

were recorded as $136 in assets and $16 in liabilities. The net

impact on marketing, research and administrative expense was a

$24 after-tax gain.

In addition, the Company utilizes purchased foreign currency

options, forward exchange contracts and cross currency swaps which

qualify as cash flow hedges. These are intended to offset the effect

of exchange rate fluctuations on forecasted sales, inventory

purchases, intercompany royalties and intercompany loans

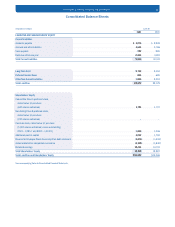

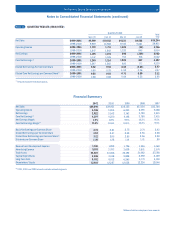

NOTE 5 SHORT-TERM AND LONG-TERM DEBT

The weighted average short-term interest rates were 5.3% and 4.8%

as of June 30, 2001 and 2000, respectively.

Long-term weighted average interest rates were 5.0% and 6.1% as

of June 30, 2001 and 2000, respectively, and include the effects of

related interest rate swaps discussed in Note 6.

The fair value of the long-term debt was $10,164 and $9,024 at

June 30, 2001 and 2000, respectively. Long-term debt maturities

during the next five years are as follows: 2002--$622; 2003--

$1,117; 2004--$1,040; 2005--$1,912 and 2006 -- $32.

NOTE 6 RISK MANAGEMENT ACTIVITIES

Effective July 1, 2000, the Company adopted SFAS No. 133,

“Accounting for Derivative Instruments and Hedging Activities,” as

amended, which requires that all derivative instruments be reported

on the balance sheet at fair value and establishes criteria for

designation and effectiveness of hedging relationships. The

cumulative effect of adopting SFAS No. 133 as of July 1, 2000 was

not material.

The Company is exposed to market risks, such as changes in interest

rates, currency exchange rates and commodity pricing. To manage

the volatility relating to these exposures, the Company nets the

exposures on a consolidated basis to take advantage of natural

Notes to Consolidated Financial Statements (continued)

The Procter & Gamble Company and Subsidiaries

June 30

2001 2000

Long-Term Debt

5.25% USD note due 2003

6.00% USD note due 2003

6.60% USD note due 2004

8.33% ESOP debentures due 2003, 2004

1.50% JPY note due 2005

5.75% EUR note due 2005

6.13% USD note due 2008

6.88% USD note due 2009

2.00% JPY note due 2010

9.36% ESOP debentures due 2007-2021

6.45% USD note due 2026

6.25% GBP note due 2030

All other long-term debt

Current portion of long-term debt

$ 750

500

1,000

392

518

–

500

1,000

471

1,000

300

757

2,107

283

9,012

$ 750

500

1,000

306

441

1,270

500

1,000

401

1,000

300

705

2,033

414

9,792

$ 2,188

–

283

770

3,241

$ 675

559

414

585

2,233

June 30

2001 2000

Short-Term Debt

USD commercial paper

Non USD commercial paper

Current portion of long-term debt

Other

( )

( )