Proctor and Gamble 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

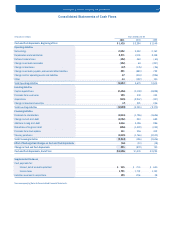

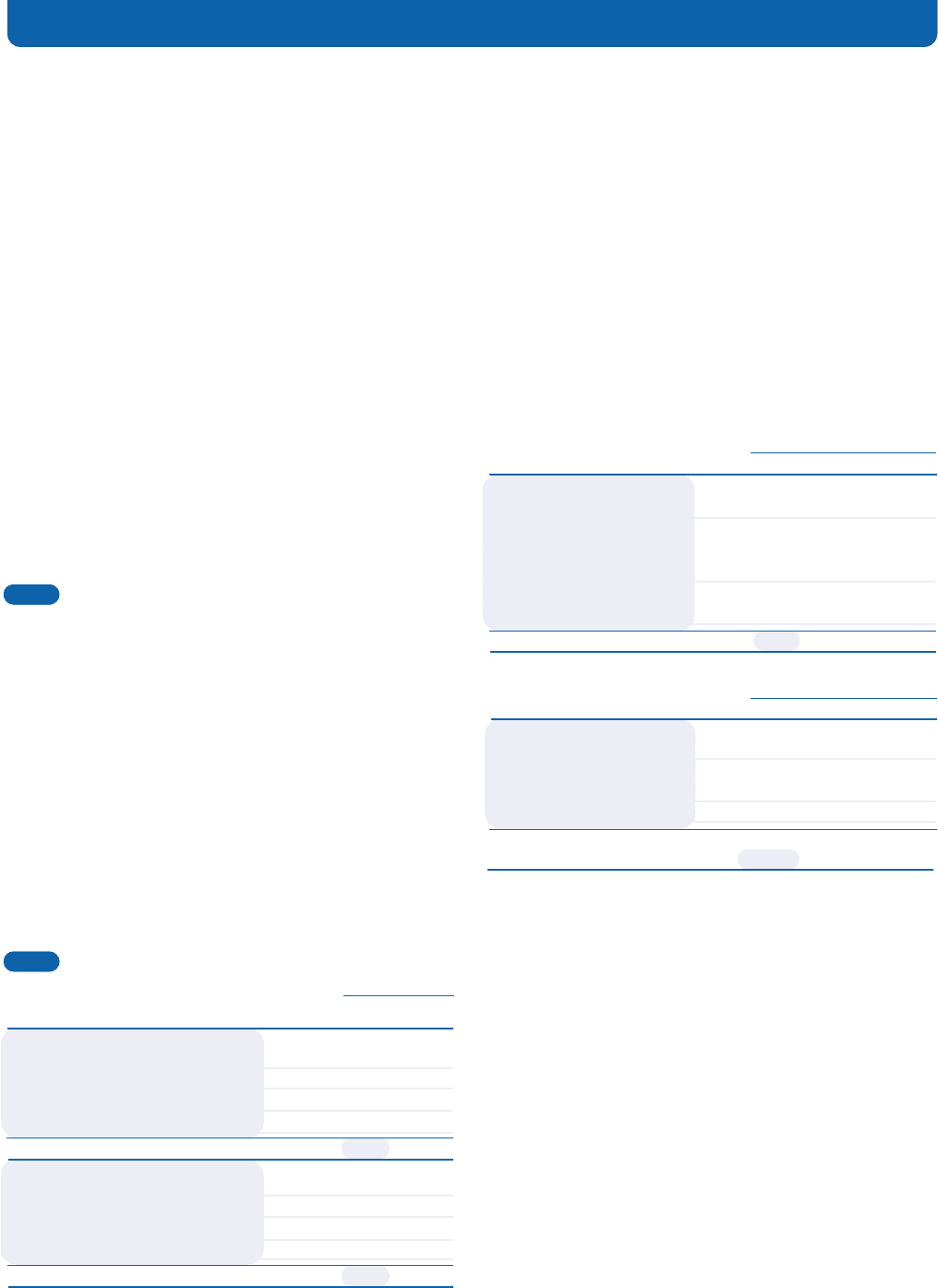

Millions of dollars except per share amounts

Selected Operating Expenses

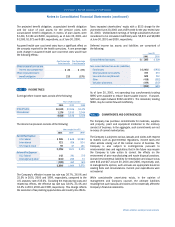

Research and development costs are charged to earnings as

incurred and were $1,769 in 2001, $1,899 in 2000 and $1,726 in

1999. Advertising costs are charged to earnings as incurred and

were $3,193 in 2001, $3,793 in 2000 and $3,639 in 1999.

Net Earnings Per Common Share

Net earnings less preferred dividends (net of related tax benefits)

are divided by the weighted average number of common shares

outstanding during the year to calculate basic net earnings

per common share. Diluted net earnings per common share

are calculated to give effect to stock options and convertible

preferred stock.

Basic and diluted net earnings per share are reconciled as follows:

Equity Put Options

During 2001 and 2000, the Company entered into equity put

options on its common stock. These agreements can be settled on

a physical or net-share basis at the Company’s option. The premium

received from the sale of the instruments is credited to equity and

reduces the Company’s cash outlay for share repurchases.

The 2001 options are equivalent to one million common shares, at

approximately $74 per share. They expire in the first quarter of

2002. The options entered into in 2000 were equivalent to 12

million common shares, at prices ranging from $60 to $71 per

share. They expired mostly unexercised in the second quarter

of 2001.

from such assets over their remaining useful lives were no longer

estimated to be greater than their current carrying values; therefore,

they were written down to estimated fair value, generally determined

by reference to discounted expected future cash flows. Such

charges represented approximately $160 before tax in 2001, $0 in

2000 and $160 in 1999.

Charges for accelerated depreciation are related to long-lived assets

that will be taken out of service prior to the end of their normal

service period due to manufacturing consolidations, technology

standardization, plant closures or strategic choices to discontinue

initiatives. The Company has shortened the estimated useful lives of

such assets, resulting in incremental depreciation expense.

Other Restructuring Charges

Other costs incurred as a direct result of the program included

relocation, training, establishment of global business services and

the new legal and organization structure of Organization 2005, and

discontinuation of initiatives.

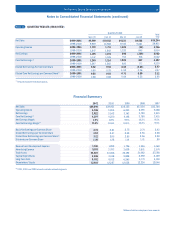

NOTE 3 ACQUISITIONS

In 2001, acquisitions were accounted for using the purchase

method and totaled $246. These acquisitions resulted in goodwill

and other intangibles of $208. In 2000, the Company acquired The

Iams Company and Affiliates for approximately $2,222 in cash.

Other acquisitions in 2000 totaled $745 and consisted primarily of

Recovery Engineering, Inc. and a joint venture ownership increase in

China. The 2000 acquisitions were accounted for using the

purchase method and resulted in goodwill and other intangibles of

$2,508. Purchase acquisitions in 1999 totaled $137.

In May 2001, the Company announced its intent to purchase the

Clairol business from Bristol-Myers Squibb Company for $4,950.

The acquisition is subject to regulatory approvals.

NOTE 4 SUPPLEMENTAL FINANCIAL INFORMATION

Notes to Consolidated Financial Statements (continued)

The Procter & Gamble Company and Subsidiaries

28

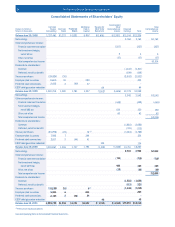

Years ended June 30

2001 2000 1999

Net earnings available to

common shareholders

Effect of dilutive securities

Preferred dividends, net

of tax benefit

Preferred dividend impact on

funding of ESOP

Diluted net earnings

$3,654

109

22

3,741

$3,427

115

18

3,524

$2,801

121

15

2,907

( )

( ) ( )

2001 2000 1999

Shares in millions

1,328.1

97.2

21.5

1,446.8

Basic weighted average common

shares outstanding

Effect of dilutive securities

Conversion of preferred shares

Exercise of stock options (1)

Diluted weighted average common

shares outstanding

1,313.2

94.3

19.7

1,427.2

1,300.3

91.9

13.4

1,405.6

Years ended June 30

(1)Approximately one-third of the Company’s outstanding stock options were not

included in the diluted net earnings per share calculation for 2001 because to do

so would have been antidilutive.

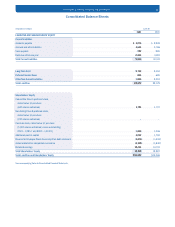

Accrued and Other Liabilities

Marketing expenses

Compensation expenses

Organization 2005 restructuring reserves

Other

Other Non-Current Liabilities

Other postretirement benefits

Pension benefits

Other

$1,142

462

88

2,074

3,766

$ 824

975

502

2,301

$1,271

576

460

2,324

4,631

$ 534

925

386

1,845

June 30

2001 2000