Proctor and Gamble 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

The Procter & Gamble Company and Subsidiaries

Millions of dollars except per share amounts

of creditworthy counterparties. Therefore, the Company does not

expect to incur material credit losses on its risk management or

other financial instruments.

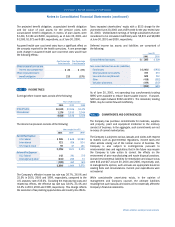

NOTE 7 STOCK OPTIONS

The Company has stock-based compensation plans under which

stock options are granted annually to key managers and directors

at the market price on the date of grant. Grants after 1998 are fully

exercisable after three years and have a fifteen-year life, while prior

years’ grants are fully exercisable after one year and have a ten-

year life. The Company issues stock appreciation rights in countries

where stock options are not permitted by local governments.

Pursuant to SFAS No. 123, “Accounting for Stock-Based

Compensation,” the Company has elected to account for its

employee stock option plans under APB Opinion No. 25,

“Accounting for Stock Issued to Employees.” Because stock

options have been issued with exercise prices equal to grant date

fair value, compensation cost has not been recognized. Had

compensation cost for the plans been determined based on the fair

value at the grant date consistent with SFAS No. 123, the

Company’s net earnings and earnings per share would have been

as follows:

The fair value of each option grant is estimated on the date of grant

using a binomial option-pricing model with the following

assumptions:

denominated in foreign currency. The fair values of these instruments

at June 30, 2001 were recorded as $94 in assets and $101 in

liabilities. Gains and losses on these instruments are deferred in

other comprehensive income (OCI) until the underlying transaction is

recognized in earnings. The earnings impact is reported in either net

sales, cost of products sold, or marketing research and

administrative expenses, to match the underlying transaction being

hedged. Qualifying cash flow hedges currently deferred in OCI are

not material. These amounts will be reclassified into earnings as the

underlying transactions are recognized. During the year the Company

charged to earnings a $15 after-tax loss due to the change in the

time value of options excluded from the hedge effectiveness test.

This was prior to the change in SFAS No. 133 interpretation that

allows change in time value to be included in effectiveness testing.

No currency cash flow hedges were discontinued during the year due

to changes in expectations on the original forecasted transactions.

Net Investment Hedging

The Company hedges its net investment position in major currencies

and generates foreign currency interest payments that offset other

transactional exposures in these currencies. To accomplish this, the

Company borrows directly in foreign currency and designates a

portion of foreign currency debt as a hedge of net investments. In

addition, certain foreign currency interest rate swaps are designated

as hedges of the Company’s related foreign net investments.

Currency effects of these hedges reflected in OCI produced a $460

after-tax gain during the year, leaving an accumulated net balance

of $577.

Commodity Price Management

Raw materials used by the Company are subject to price volatility

caused by weather, supply conditions, political and economic

variables and other unpredictable factors. To manage the volatility

related to anticipated inventory purchases, the Company uses

futures and options with maturities generally less than one year and

swap contracts with maturities up to five years. These market

instruments are designated as cash flow hedges. The mark-to-

market gain or loss on qualifying hedges is included in other

comprehensive income to the extent effective, and reclassified into

cost of products sold in the period during which the hedged

transaction affects earnings. Qualifying cash flow hedges currently

deferred in OCI are not material. These amounts will be reclassified

into earnings as the underlying transactions are recognized. The

mark-to-market gains or losses on non-qualifying, excluded and

ineffective portions of hedges are recognized in cost of products sold

immediately. No cash flow hedges were discontinued during the year

ended June 30, 2001. Commodity hedging activity is not material to

the Company’s financial statements.

Credit Risk

Credit risk arising from the inability of a counterparty to meet the

terms of the Company’s financial instrument contracts is generally

limited to the amounts, if any, by which the counterparty’s

obligations exceed the obligations of the Company. It is the

Company’s policy to enter into financial instruments with a diversity

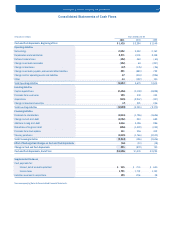

$3,763

3,683

$2.75

2.69

2.59

2.53

Years ended June 30

2001 2000 1999

Net earnings

As reported

Pro forma

Net earnings per common share

Basic

As reported

Pro forma

Diluted

As reported

Pro forma

$3,542

3,363

$2.61

2.47

2.47

2.34

$2,922

2,612

$2.15

1.92

2.07

1.85

30

5.4%

1.5%

26%

7

Options Granted in

Years ended June 30

2001 2000 1999

6.0%

1.5%

28%

9

5.8%

2.0%

26%

9

Interest rate

Dividend yield

Expected volatility

Expected life in years