Proctor and Gamble 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Core net earnings, which exclude restructuring program costs,

increased to $4.40 billion in 2001 from $4.23 billion in 2000 and

$4.15 billion in 1999. Core net earnings per share were $3.12,

compared to $2.95 per share in 2000 and $2.85 per share in 1999.

Core net earnings per share increased 6% in 2001, compared to 4%

in 2000. Core net earnings progress was significant in light of

product cost increases and exchange impacts, which were offset by

pricing benefits, lower taxes and gains from the divestiture of non-

strategic brands. Growth in the prior year was affected by significant

investments in new initiatives.

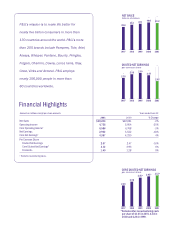

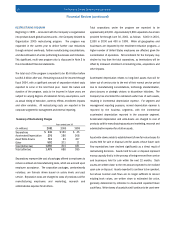

Net Sales

Reported net sales were $39.24 billion, compared to $39.95 billion

in 2000 and $38.13 billion in 1999. Excluding an unfavorable

exchange rate impact of over 3% in the current year, net sales grew

2%, reflecting improved pricing in beauty care, fabric and home care

and paper, primarily family care. Unit volume was flat in 2001, as

exceptionally strong performance by new businesses in health care

was offset by softness in food and beverage. Unit volume grew 4%

in 2000, while net sales excluding a 2% unfavorable exchange

impact increased 7%. This growth reflected strong product initiative

activity, the acquisition of the Iams pet health and nutrition business

and progress on flagship brands, largely in fabric and home care.

RESULTS OF OPERATIONS

Fiscal 2001 was a year of progress – in making choices, establishing

realistic goals and delivering on commitments. The Company also

made considerable progress on strengthening its cost structure and

improving cash efficiency. This was despite a tough year that

included weakening economies in some major geographies,

significant currency impacts, rising commodity prices and an

increasingly competitive environment.

To accelerate long-term growth, the Company has made and will

continue to make tough, clear choices about where to play and how

to win. The Company is focused on building superior shareholder

return – by creating and building big brands with top-line results,

sales margins and cash flow at the best competitive benchmarks.

During the past year, the Company refocused on its core categories

to develop high-margin growth businesses with global leadership

potential. The Company also expanded its restructuring program,

initiated in June 1999, in conjunction with Organization 2005, to

drive further enrollment reductions and address under-performing

businesses. These actions are critical to delivering on the

Company’s long-term goals to consistently grow earnings and

earnings per share at double-digit rates.

Net Earnings

Reported net earnings were $2.92 billion or $2.07 per share in

2001. This compared to $3.54 billion or $2.47 per share in 2000,

and $3.76 billion or $2.59 per share in 1999. Current year results

include charges of $1.48 billion after tax for restructuring program

costs. These costs were $688 million and $385 million in 2000 and

1999, respectively. This program covers a significant reduction in

enrollment, manufacturing consolidations and portfolio choices to

scale back or discontinue under-performing businesses and

initiatives.

The Procter & Gamble Company and Subsidiaries

10

Financial Review

NET SALES AND EXCHANGE IMPACTS

(in billions)

1997

Foreign Exchange Impacts

32

34

36

38

40

$42

1998 1999 2000 2001

Net Sales

*Excludes restructuring program costs.

NET EARNINGS PER SHARE

(on a diluted basis)

1999

Net Earnings Per Share

0

2

$4

2000 2001

Core Net Earnings Per Share*