Proctor and Gamble 2001 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Feminine care volume declined 3% due to a challenging competitive

environment in North America and Northeast Asia, partially offset

by growth in developing markets. Net sales were comparable to the

prior year – excluding a 5% negative exchange impact.

In 2000, paper segment net sales were $12.04 billion, down 1%

from the prior year on flat unit volume. Excluding the impact of

exchange rates, primarily the euro, net sales were up 1%. Excluding

the impact of the Attends divestiture in 1999, unit volume increased

2%. Net earnings were $1.07 billion, down 16%, reflecting family

care expansion in Western Europe, investments in new product

initiatives on Charmin, a tough competitive environment in baby

care and feminine care businesses, increased capacity and

unfavorable raw and packing material cost trends.

Looking forward, initiative programs are currently underway to drive

future growth. Though challenges remain, a continued focus on

innovation and cost reductions should lead to stronger

performance.

BEAUTY CARE

Beauty care increased profitability behind innovative, high-margin,

global brands. Net sales were $7.26 billion, down 2% versus $7.39

billion in 2000. Excluding a 4% impact of unfavorable exchange

rates, primarily in Western Europe and Asia, net sales increased 2%.

Unit volume was down 1% versus the prior year. Excluding the

impact of divestitures, volume was flat. Volume growth in hair care

and skin care was offset by competitive activity in deodorants and

bar soaps. Net earnings were $972 million, a 9% improvement

behind the successful expansion of high-performance, premium-

priced products.

Positive results in hair care were primarily driven by the global

restage of Pantene and Head & Shoulders. Latin America, in

particular, posted record results on double-digit top-line growth.

The Company is committed to strengthening the business in

Western Europe. Strategic plans are in place to improve the

business through a differentiated portfolio of brands that provide

superior value, meet a variety of consumer needs and build to a

total leadership position.

In 2000, net sales for fabric and home care were $12.16 billion, an

increase of 7% over 1999. Excluding unfavorable foreign exchange

impacts, primarily in Western Europe, net sales grew 9% on 5% unit

volume growth. Top-line growth was spurred by the introduction of

new brands and solid base business performance. Net earnings for

the segment were $1.45 billion, down 3% versus the prior year,

primarily due to investments in product initiatives.

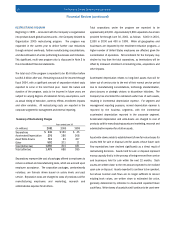

PAPER

The paper segment, which includes baby, feminine and family care,

reflected mixed results. Net sales were $11.99 billion, compared to

$12.04 billion in 2000. Excluding a 4% negative impact of

exchange rates, primarily the euro, net sales increased 4%. Unit

volume grew 2%, driven by family care and baby care. Commodity-

related cost increases and weaker foreign currencies resulted in net

earnings decreasing 2% to $1.04 billion, despite progress in family

care and feminine care. These were partially offset by pricing

actions and lower overhead and marketing spending.

Family care volume grew 3% due to new product introductions and

base business growth in North America. Net sales increased 10%,

excluding a 2% unfavorable impact of exchange, resulting from

commodity-driven global pricing actions on Charmin and Bounty.

Baby care volume increased 3% driven by Latin America and Central

and Eastern Europe. Excluding a 5% negative exchange impact, net

sales increased 1%.

The Procter & Gamble Company and Subsidiaries

14

Financial Review (continued)