Proctor and Gamble 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

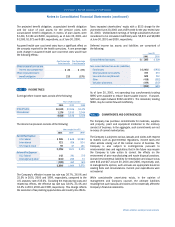

SFAS No. 142 eliminates the amortization of goodwill and

indefinite-lived intangible assets and initiates an annual review for

impairment. Identifiable intangible assets with a determinable

useful life will continue to be amortized. The amortization provisions

apply to goodwill and other intangible assets acquired after June

30, 2001. Goodwill and other intangible assets acquired prior to

June 30, 2001 will be affected upon adoption. The Company will

adopt SFAS No. 142 effective July 1, 2001, which will require the

Company to cease amortization of its remaining net goodwill

balance and to perform an impairment test of its existing goodwill

based on a fair value concept. Although the Company is still

reviewing the provisions of these Statements, it is management’s

preliminary assessment that goodwill impairment will not result

upon adoption. As of June 30, 2001, the Company has net

unamortized goodwill of $7,429 and amortization expense of $224,

$214 and $180 for the years ended June 30, 2001, 2000 and

1999, respectively.

Revenue Recognition: Sales are recognized when revenue is

realized or realizable and has been earned. In general, revenue is

recognized when risk and title to the product transfers to the

customer, which usually occurs at the time shipment is made.

Currency Translation: Financial statements of subsidiaries outside

the U.S. generally are measured using the local currency as the

functional currency. Adjustments to translate those statements into

U.S. dollars are recorded in other comprehensive income. For

subsidiaries operating in highly inflationary economies, the U.S.

dollar is the functional currency. Remeasurement adjustments for

highly inflationary economies and other transactional exchange

gains and losses are reflected in earnings.

Cash Equivalents: Highly liquid investments with maturities of three

months or less when purchased are considered cash equivalents.

Inventory Valuation: Inventories are valued at cost, which is not in

excess of current market price. Cost is primarily determined by

either the average cost or the first-in, first-out method. The

replacement cost of last-in, first-out inventories exceeded carrying

value by approximately $55 and $83 at June 30, 2001 and 2000,

respectively.

Goodwill and Other Intangible Assets: Under current accounting

guidance, the cost of intangible assets is amortized, principally on a

straight-line basis, over the estimated periods benefited, generally

forty years for goodwill and periods ranging from three to forty years

for other intangible assets. The realizability of goodwill and other

intangibles is evaluated periodically when events or circumstances

indicate a possible inability to recover the carrying amount. Such

evaluation is based on various analyses, including cash flow and

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation: The consolidated financial statements

include The Procter & Gamble Company and its controlled

subsidiaries (the Company). Investments in companies over which

the Company exerts significant influence, but does not control the

financial and operating decisions, are accounted for using the

equity method. These investments are managed as integral parts of

the Company’s business units, and segment reporting reflects such

investments as consolidated subsidiaries.

Use of Estimates: Preparation of financial statements in conformity

with accounting principles generally accepted in the United States

of America requires management to make estimates and

assumptions that affect the amounts reported in the consolidated

financial statements and accompanying disclosures. These

estimates are based on management’s best knowledge of current

events and actions the Company may undertake in the future.

Actual results may ultimately differ from estimates.

New Pronouncements: The Financial Accounting Standards Board

(FASB) issued SFAS No. 133, “Accounting for Derivative Instruments

and Hedging Activities” which was adopted by the Company

effective July 1, 2000. See further discussion in Note 6.

The Securities and Exchange Commission issued Staff Accounting

Bulletin 101, “Revenue Recognition in Financial Statements,” which

became effective in the fourth quarter.

During 2000 and 2001, the Emerging Issues Task Force issued: EITF

No. 00-10, “Accounting for Shipping and Handling Fees and Costs”

addressing the statement of earnings classification of shipping and

handling costs billed to customers; EITF No. 00-14, “Accounting for

Certain Sales Incentives” addressing the recognition, measurement

and statement of earnings classification of certain sales incentives;

and EITF No. 00-25, “Vendor Income Statement Characterization of

Consideration Paid to a Reseller of the Vendor’s Products”

addressing the statement of earnings classification of consideration

from a vendor to an entity that purchases the vendor’s products for

resale.

There is no material impact on the Company’s financial statements

resulting from application of the above new pronouncements.

In June 2001, the FASB approved two new pronouncements: SFAS

No. 141, “Business Combinations,” and SFAS No. 142, “Goodwill

and Other Intangible Assets.” SFAS No. 141 applies to all business

combinations with a closing date after June 30, 2001. This

Statement eliminates the pooling-of-interests method of accounting

and further clarifies the criteria for recognition of intangible assets

separately from goodwill.

26

Notes to Consolidated Financial Statements

The Procter & Gamble Company and Subsidiaries

Millions of dollars except per share amounts