Proctor and Gamble 2001 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

When we began the 2000/2001 fiscal year, Job One was getting

P&G’s business back on track and growing again.

We have refocused on our biggest, and fastest growing brands, in

our biggest markets, with our leading customers. We’ve strengthened

the value of our brands for consumers. We’ve made strategic choices

about which businesses P&G should be in, and which it should not.

And we’ve improved P&G’s competitiveness by controlling costs and

managing cash more effectively. We believe these are the choices that

will deliver superior Total Shareholder Return, which is the key measure

of our progress and our underlying commitment to P&G shareholders.

Making Progress

We’ve made progress, although there’s more to do.

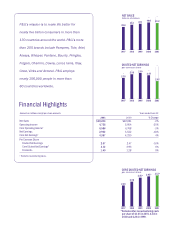

• Sales were $39.2 billion, down slightly from last year but

up 2% excluding the effects of unfavorable exchange rates.

• Net earnings were $2.9 billion. Core net earnings, which exclude

restructuring charges, were $4.4 billion – up 4% -- while earnings

per share were $3.12, up 6%.

• Business trends improved during the year. Fourth quarter unit

volumes grew 3% and we made significant progress on costs,

delivering core operating income growth of 12%.

• Operating cash flow increased over $1 billion.

Progress in the U.S. – our largest market – is particularly encouraging.

A year ago, only three of our top 10 U.S. brands were growing

share; at the end of the 2000/2001 fiscal year, eight of 10 were

growing share.

This progress isn’t limited to the U.S.

• In Latin America, 3% volume growth drove earnings

to record levels.

• Profits rebounded in China during the year and market

shares are now growing broadly.

• Elsewhere in Asia, we grew volume in virtually every country; in

the Philippines, for example, our Fabric and Home Care business

turned in an exceptional year with record volume and profits

while regaining volume-share leadership for the past six months.

• In Central and Eastern Europe, Russia

bounced back from the 1998 economic and

currency crises: volume, sales and market

shares are all rebounding with solid profits.

While we are pleased with this progress, we know

we still have a lot of hard work ahead of us. Diapers

and Feminine Protection – both of which are core,

To Our Shareholders:

A. G. Lafley and John E. Pepper

P&G’s Billion Dollar Brands

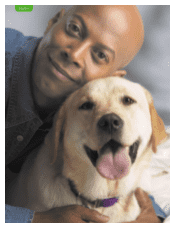

In 2000/2001, Iams joined P&G’s

“Billion Dollar Club.” The Company

now has 11 brands with more than

a billion dollars in sales.