Proctor and Gamble 2001 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company maintains a share repurchase program, which

authorizes the purchase of shares annually on the open market to

mitigate the dilutive impact of employee compensation programs.

The Company also has a discretionary buy-back program under

which it may repurchase additional outstanding shares. Current year

purchases under the combined programs were $1.25 billion,

compared to $1.77 billion in 2000 and $2.53 billion in 1999. The

Company issued equity put options in 2001 for one million shares at

approximately $74 per share and for 12 million shares at prices

ranging from $60 to $71 per share in 2000, which reduce the

Company’s cash outlay for share repurchases.

Common share dividends grew 9% to $1.40 per share in 2001,

compared to $1.28 and $1.14 in 2000 and 1999, respectively. For

the coming year, the annual dividend rate will increase to $1.52 per

common share, marking the 46th consecutive year of increased

common share dividend payments. Total dividend payments, to

both common and preferred shareholders, were $1.94 billion,

$1.80 billion and $1.63 billion in 2001, 2000 and 1999,

respectively.

Total debt was fairly stable at $12.03 billion at June 30, 2001 and

$12.25 billion at June 30, 2000. A number of factors influenced the

various debt components, including issuance of long-term debt,

reductions in short-term debt, currency effects and mark-to-market

impacts of derivative financial instruments.

Long-term borrowing available under the Company’s shelf

registration statement filed in 1995, as amended in July 1997 and

FINANCIAL CONDITION

One of the Company’s focus areas is to improve its cash efficiency as

a key element of achieving superior shareholder return.

Cash

Operating cash flow provides the primary source of funds to finance

operating needs, capital expenditures and shareholder dividends.

This is supplemented by additional borrowings to provide funds to

finance the share repurchase program and acquisitions.

Cash flow from operations was $5.80 billion, $4.68 billion and

$5.54 billion in 2001, 2000 and 1999, respectively. Operating

cash flow trends were primarily impacted by working capital

changes, including the impact of restructuring program accruals.

Cash and cash equivalents increased $891 million in the current

year to $2.31 billion, reflecting reduced capital expenditures and

improved working capital. Cash and cash equivalents were $1.42

billion in 2000 and $2.29 billion in 1999. The decrease in 2000

reflected acquisition spending and lower net earnings, partially

offset by the issuance of debt.

Net cash used for acquisitions completed during 2001 totaled $138

million. This compares to acquisition spending of $2.97 billion in

2000 and $137 million in 1999. Spending in fiscal 2000 was

primarily related to the acquisitions of The Iams Company and

Affiliates, Recovery Engineering, Inc. and a joint venture ownership

increase in China. In May 2001, the Company announced its intent

to acquire the Clairol business, pending regulatory clearance. A

substantial portion of the $4.95 billion purchase price will be

financed with debt.

The Company continues its program to divest certain non-strategic

brands in order to focus resources on core businesses. The

proceeds from these and other asset sales generated $788 million

in cash flow in the current year, compared to $419 million and $434

million in 2000 and 1999, respectively.

The Procter & Gamble Company and Subsidiaries

12

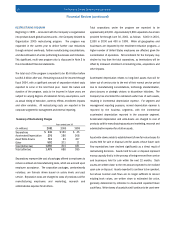

Financial Review (continued)

DIVIDENDS

($ per share)

1997

0

1998 1999 2000 2001

0.90 1.01 1.14 1.28

1.40

0.50

1.00

$1.50