Proctor and Gamble 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2001 Annual Report

MAKING LIFE

BETTER

Table of contents

-

Page 1

MAKING LIFE BETTER 2001 Annual Report -

Page 2

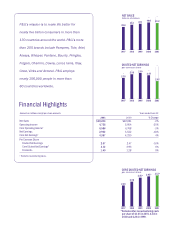

... P&G's more than 250 brands include Pampers, Tide, Ariel, billions of dollars 38.1 37.2 35.8 40.0 39.2 1997 1998 1999 2000 2001 Always, Whisper, Pantene, Bounty, Pringles, Folgers, Charmin, Downy, Lenor, Iams, Olay, Crest, Vicks and Actonel. P&G employs nearly 106,000 people in more than 80... -

Page 3

... In Latin America, 3% volume growth drove earnings to record levels. • Profits rebounded in China during the year and market shares are now growing broadly. • Elsewhere in Asia, we grew volume in virtually every country; in the Philippines, for example, our Fabric and Home Care business turned... -

Page 4

... Baby Care, Fabric Care, Feminine Protection and Hair Care are our top-priority core businesses. These are categories in which P&G is #1 in global sales and market share, and where the Company believes it can consistently grow earnings at double-digit rates. Together, these four businesses represent... -

Page 5

... quality of life for consumers around the world. In fact, we want to come through for people when they need help caring for themselves, their families and their homes. In the pages that follow, we feature three P&G employees - a scientist from Iams, a Consumer Relations agent from Olay, a marketer... -

Page 6

FOUR -

Page 7

... line of diets created to manage health conditions, such as kidney failure or joint problems, through nutrition. Iams is the world leader in premium dog and cat nutritional healthcare. For over 50 years the company has been making an everwidening range of pet food products to meet the needs of... -

Page 8

SIX -

Page 9

...first lathering cloths to offer multiple skincare benefits. One easy-to-use product takes care of cleansing, make-up removal, gentle exfoliation and conditioning. Total Effects is a complete skin care system for the entire body, with moisturizers and cleansers working together in an integrated fight... -

Page 10

EIGHT -

Page 11

...and a professional version is available from dentists. There are plans to make the product global. Users who wear the strips for 30 minutes twice a day can look forward to a whiter smile in just 14 days. Crest Whitestrips whiten 10 times better than the leading whitening toothpaste, a level of teeth... -

Page 12

... Organization 2005, to drive further enrollment reductions and address under-performing businesses. These actions are critical to delivering on the Company's long-term goals to consistently grow earnings and earnings per share at double-digit rates. Net9Sales Reported net sales were $39.24 billion... -

Page 13

... benefit of the implementation of the Company's new global business unit structure. Non-Operating9Items Interest expense was $794 million in 2001, compared to $722 million in 2000 and $650 million in 1999. The interest expense trend reflects higher average debt levels, primarily due to share... -

Page 14

... return. The Company maintains a share repurchase program, which authorizes the purchase of shares annually on the open market to mitigate the dilutive impact of employee compensation programs. The Company also has a discretionary buy-back program under which it may repurchase additional outstanding... -

Page 15

...were offset by the benefits of laundry pricing actions and lower taxes. Latin America delivered particularly strong earnings progress, reflecting disciplined cost management. Fabric and home care is the Company's most profitable segment, accounting for nearly a third of net sales and an even greater... -

Page 16

... growth in hair care and skin care was offset by competitive activity in deodorants and bar soaps. Net earnings were $972 million, a 9% improvement behind the successful expansion of high-performance, premiumpriced products. Looking forward, initiative programs are currently underway to drive future... -

Page 17

... new whitening and cleaning products. Crest Whitestrips and Crest Spinbrush are driving the trends toward at-home whitening and powered brushing, respectively. Health care net sales in North America grew behind volume progress on the strength of new businesses. The Iams Company and Affiliates again... -

Page 18

... increase in a decade. Corporate results reflect one-time gains from the Company's nonIn snacks and juice, North America results are showing signs of stabilizing as merchandising returned to competitive levels. Lower net earnings in Western Europe were primarily due to investments in Sunny Delight... -

Page 19

... correlation and diversification from holding multiple currency and interest rate instruments and assumes that financial returns are normally distributed. Estimates of volatility and correlations of market factors are drawn from the RiskMetricsâ„¢ dataset as of June 30, 2001. In cases where data is... -

Page 20

... The Procter & Gamble Company and Subsidiaries Financial Review (continued) RESTRUCTURING9PROGRAM9 Beginning in 1999 - concurrent with the Company's reorganization into product-based global business units - the Company initiated its Organization 2005 restructuring program. The program was expanded... -

Page 21

... ability to maintain key customer relationships; (4) the achievement of growth in significant developing markets such as China, Korea, Mexico, the Southern Cone of Latin America and the countries of Central and Eastern Europe; (5) the ability to successfully manage regulatory, tax and legal matters... -

Page 22

... Daley Jr. Chief Financial Officer and Comptroller Independent Auditors' Report 250 East Fifth Street Cincinnati, Ohio 45202 To the Board of Directors and Shareholders of The Procter & Gamble Company: We have audited the accompanying consolidated balance sheets of The Procter & Gamble Company and... -

Page 23

...Gamble Company and Subsidiaries 21 Consolidated Statements of Earnings Amounts in millions except per share amounts 2001 Years ended June 30 2000 1999 Net9Sales Cost of products sold Marketing...2001,... net earnings per share include restructuring charges of $1.14 and $1.05 in 2001, $.52 and ... -

Page 24

...Gamble Company and Subsidiaries Consolidated Balance Sheets Amounts in millions June 30 92001999999999999999999999999999999992000 ASSETS Current9Assets Cash and cash equivalents Investment securities Accounts receivable Inventories Materials and supplies Work... Consolidated Financial Statements. ... -

Page 25

... Class B preferred stock, stated value $1 per share (200 shares authorized) Common stock, stated value $1 per share (5,000 shares authorized; shares outstanding: 2001 - 1,295.7 and 2000 - 1,305.9) Additional paid-in capital Reserve for Employee Stock Ownership Plan debt retirement Accumulated other... -

Page 26

... Procter & Gamble Company and Subsidiaries Consolidated Statements of Shareholders' Equity Common Shares Common Outstanding Stock Additional Paid-In Capital Reserve for ESOP Debt Retirement Accumulated Other Comprehensive Income Total Comprehensive Income Dollars in millions/ Shares in thousands... -

Page 27

... Capital expenditures Proceeds from asset sales Acquisitions Change in investment securities Total9Investing9Activities Financing9Activities Dividends to shareholders Change in short-term debt Additions to long-term debt Reductions of long-term debt Proceeds from stock options Treasury purchases... -

Page 28

... the financial and operating decisions, are accounted for using the equity method. These investments are managed as integral parts of the Company's business units, and segment reporting reflects such investments as consolidated subsidiaries. Use9of9Estimates:9 Preparation of financial statements in... -

Page 29

..., short- and long-term investments and short-term debt approximate cost. The estimated fair values of other financial instruments, including debt, equity and risk management instruments, have been determined using available market information and valuation methodologies, primarily discounted... -

Page 30

... Marketing expenses Compensation expenses Organization 2005 restructuring reserves Other $1,271 576 999460 2,324 999994,631 9 $ 9534 9925 999386 999991,845 $1,142 462 88 2,074 3,766 Equity9Put9Options During 2001 and 2000, the Company entered into equity put options on its common stock... -

Page 31

... or issue derivative financial instruments for trading purposes. Interest9Rate9Hedging The Company's policy is to manage interest cost using a mix of fixedand variable-rate debt. To manage this mix in a cost efficient manner, the Company enters into interest rate swaps in which the Company agrees to... -

Page 32

... not expect to incur material credit losses on its risk management or other financial instruments. NOTE 7 9STOCK9OPTIONS The Company has stock-based compensation plans under which stock options are granted annually to key managers and directors at the market price on the date of grant. Grants after... -

Page 33

... at the option of the holder into one share of the Company's common stock. Annual credits to participants' accounts are based on individual base salaries and years of service, and do not exceed 15% of total participants' annual salaries and wages. The liquidation value is equal to the issue price of... -

Page 34

32 The Procter & Gamble Company and Subsidiaries Notes to Consolidated Financial Statements (continued) from retirees and pay a stated percentage of expenses, reduced by deductibles and other coverages. Retiree contributions change annually in line with health care cost trends. These benefits are ... -

Page 35

...for the health care plans. A one percentage point change in assumed health care cost trend rates would have the following effects: One Percentage One Percentage Point Increase Point Decrease Taxes impacted shareholders' equity with a $155 charge for the year ended June 30, 2001 and a $59 credit for... -

Page 36

... tax rates. Corporate assets primarily include cash, investment securities and goodwill. Fabric and Home Care Paper Beauty Care Health Care Food and Beverage Corporate Total Net9Sales Net9Earnings Before-Tax9Earnings Depreciation9and9Amortization Total9Assets Capital9Expenditures 2001... -

Page 37

... Basic Net Earnings per Common Share Diluted Net Earnings per Common Share Diluted Core Net Earnings per Common Share(2) Dividends per Common Share Research and Development Expense Advertising Expense Total Assets Capital Expenditures Long-Term Debt Shareholders' Equity (2) 2001 9$39,244 99994,736... -

Page 38

... President - Global Home Care Jorge9P.9Montoya President - Global Food & Beverage & Latin America Tom9A.9Muccio9 President - Global Customer Teams Martin9J.9Nuechtern President - Global Hair Care Dimitri9Panayotopoulos President - Central & Eastern Europe, Middle East and Africa Laurent9L.9Philippe... -

Page 39

... of the Company's 2001 report to the Securities and Exchange Commission on Form 10-K by going to P&G's investor Web site at www.pg.com/investor or by calling us at 1-800-764-7483. This information is also available at no charge by sending a request to Shareholder Services at the address listed above... -

Page 40

© 2001 Procter & Gamble 0038-7115