Proctor and Gamble 2000 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

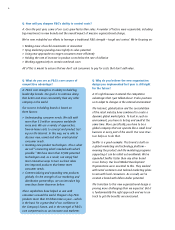

Q: Why should I invest in P&G when companies

in other sectors, like technology, are growing at

a faster rate?

A: Investment decisions require an assessment of

risk. Many high-growth, high-return stocks come

with a relatively high risk. Investors willing to

absorb that risk will pay a share price premium.

P&G, on the other hand, delivers real profits and

significant cash flow today with an expectation of

steady growth in the years ahead – a combination

we have proven can result in meaningful share

price appreciation.

We’re not trying to be a high-risk, high-growth com-

pany. We’re committed to delivering the same kind

of reliable shareholder returns that we’ve delivered

historically – and that is precisely the reason many

people will continue to invest in us. In fact, it may

be the reason why we’ve added more than 200,000

new shareholders in the past year alone.

Q: What criteria guide your acquisition plans?

A: We look for acquisitions that will provide a good

financial return for our shareholders, while consider-

ing key strategic issues:

>We want brands that can help expand our leader-

ship in existing categories. Tampax, for example,

strengthened our feminine care business by get-

ting us into the tampon segment.

>We also look for opportunities that help us enter

entirely new businesses, such as Iams, which took

us into premium pet health and nutrition.

In addition to these basic criteria, we look for acqui-

sitions with which we can leverage our considerable

strengths in marketing, distribution scale and cus-

tomer relationships. Iams is actually a great example

of all of this: It brings us product technology that

leverages our own competencies in health and

nutrition, and a brand that we can expand world-

wide with our superior marketing and distribution

know-how.

Historically, we’ve focused on small-to-medium size

acquisitions. Of course, if much larger opportunities

emerge, we’ll look at them, but they’re not essential

to our growth goals.