Proctor and Gamble 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

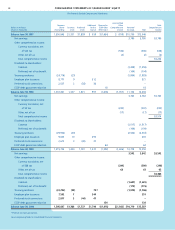

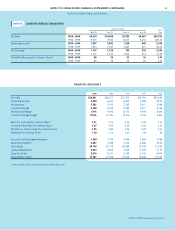

The Procter & Gamble Company and Subsidiaries

33

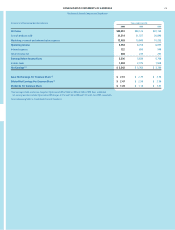

Millions of dollars except per share amounts

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Certain currency interest rate swaps are designated as hedges of

the Company’s foreign net investments. Currency effects of these

hedges are reflected in the accumulated other comprehensive

income section of shareholders’ equity, offsetting a portion of the

translation of the net assets.

The following table presents information for all interest rate instru-

ments. The notional amount does not necessarily represent

amounts exchanged by the parties and, therefore, is not a direct

measure of the Company’s exposure to credit risk. The fair value

approximates the cost to settle the outstanding contracts. The

carrying value includes the net amount due to counterparties

under swap contracts, currency translation associated with

currency interest rate swaps and any marked-to-market value

adjustments of instruments.

June 30

2000 1999

Notional amount $7,955 $1,614

Fair value $ 105 $7

Carrying value 149 15

Unrecognized loss (44) (8)

The increase in notional amount is due primarily to increased

emphasis on matching the currency component of assets and liabil-

ities on the Company’s consolidated balance sheet. This activity

hedges currency exposures in two ways. It hedges the Company’s net

investment position in major currencies and generates foreign cur-

rency interest payments which offset other transactional foreign

exchange exposures in these currencies.

Although derivatives are an important component of the Company’s

interest rate management program, their incremental effect on

interest expense for 2000, 1999 and 1998 was not material.

Currency Rate Management

The Company manufactures and sells its products in a number of

countries throughout the world and, as a result, is exposed to

movements in foreign currency exchange rates.

The Company’s major foreign currency exposures involve the

markets in Western and Eastern Europe, Asia and Mexico. The

primary purpose of the Company’s foreign currency hedging activ-

ities is to manage the volatility associated with foreign currency

purchases of materials and other assets and liabilities created in

the normal course of business. Corporate policy prescribes the

range of allowable hedging activity. The Company primarily utilizes

forward exchange contracts and purchased options with maturities

of less than eighteen months.

In addition, the Company enters into certain foreign currency swaps

to hedge intercompany financing transactions. The Company also

utilizes purchased foreign currency options with maturities of gener-

ally less than eighteen months and forward exchange contracts to

hedge against the effect of exchange rate fluctuations on royalties

and income from international operations.

Gains and losses related to qualifying hedges of foreign currency

firm commitments or anticipated transactions are deferred in

prepaid expense and are included in the basis of the underlying

transactions. To the extent that a qualifying hedge is terminated or

ceases to be effective as a hedge, any deferred gains and losses up

to that point continue to be deferred and are included in the basis

of the underlying transaction. All other foreign exchange contracts

are marked-to-market on a current basis, generally to marketing,

research and administrative expense. To the extent anticipated

transactions are no longer likely to occur, the related hedges are

closed with gains or losses charged to earnings on a current basis.

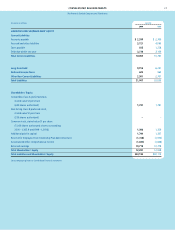

Currency instruments outstanding are as follows:

June 30

2000 1999

Notional amount

Forward contracts $1,822 $1,988

Purchased options 1,147 1,358

Currency swaps 033

Fair value

Forward contracts 4(6)

Purchased options 18 19

Currency swaps 05

The reduction in the notional amount of currency instruments

outstanding reflects the increased efficiencies of our centralized

global hedge program, including the foreign exchange exposure

offsets generated by foreign currency interest payments. The

deferred gains and losses on these currency instruments were

not material.

In addition, in order to hedge currency exposures related to the net

investments in foreign subsidiaries, the Company utilizes local

currency financing entered into by the subsidiaries, currency inter-

est rate swaps and other foreign currency denominated financing

instruments entered into by the parent. Gains and losses on instru-

ments designated as hedges of net investments are offset against

the translation effects reflected in shareholders’ equity.