Proctor and Gamble 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

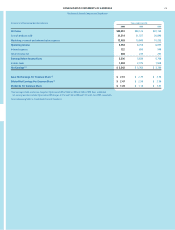

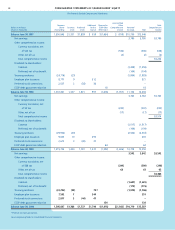

FINANCIAL REVIEW (CONTINUED)

The Procter & Gamble Company and Subsidiaries

18

BEAUTY CARE

Net sales in beauty care were $7.39 billion, comparable to

the prior year, but up 1% excluding the impact of unfavor-

able exchange rates, primarily in Western Europe. Unit

volume declined 2%, impacted by a difficult competitive

environment in key European markets and significant

contraction of the market in China. Net earnings were

$894 million, a 3% decrease from the prior year.

Sales in the current year were slightly ahead of volume

due to the focus on high-performance, premium-priced

initiatives, including the launch of the Physique styling-

led line, cosmetics and skin care product initiatives and

the expansion of Secret Platinum.

Earnings for the current year reflected the weakness in

China and Western Europe and higher marketing costs

associated with the introduction of new products and

initiatives on established brands, which more than offset

gains from minor brand divestitures.

Western Europe was negatively impacted by competitive

factors and the euro devaluation. Plans to restore

growth include improved focus on cost control, as well

as the expansion of premium-priced initiatives such as

the VS Sassoon and Head and Shoulders restages and

expansion of Olay Total Effects.

China, especially hair care, was challenged by a wors-

ening economic situation, which fueled the growth of

low cost local brands and a higher incidence of branded

product counterfeiting. Going forward, the business

will continue to focus on strengthening brand equities

through several upgrades on large brands.

North America increased volume behind premium product

introductions. Physique, positioned as a salon-quality

brand, was launched in the last half of the year and

achieved solid share results. The introduction of Old Spice

Red Zone and expansion of Secret Platinum also provided

good share results.

In 1999, net sales declined 1% to $7.38 billion on a 5%

unit volume drop. Sales were negatively affected by the

financial crisis in Eastern Europe, as well as competitive

activity and the impact of divestitures of non-strategic

brands in Western Europe. Net earnings were $917 mil-

lion, a 9% increase from 1998, reflecting favorable pricing

and steady progress on cost control.

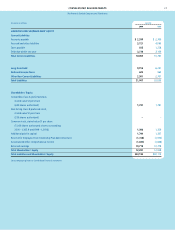

HEALTH CARE

Health care net sales were $3.91 billion, with growth

primarily coming from acquisitions. Volume and sales

increased 34% and 36%, respectively, versus the prior

year. Unfavorable exchange rates impacted sales by

2%. Net earnings were $335 million, a 38% increase over

1999. Excluding the impact of acquisitions, health care

delivered sales growth of 4% despite a 2% volume

decline, while earnings increased 17%.

The Iams Company posted record results, doubling

distribution with the expansion into new retail chan-

nels. Beyond the channel expansion, Iams introduced

several successful product initiatives.

Health care sales in North America grew behind strong

consumption, favorable pricing and volume progress in

pharmaceuticals. Oral care volume gains were driven by

the launches of Crest MultiCare Advanced Cleaning and

other premium dentifrice products.