Proctor and Gamble 2000 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

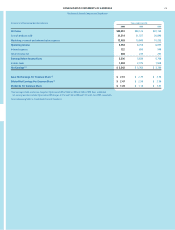

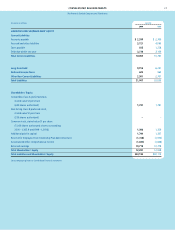

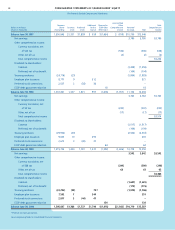

FINANCIAL REVIEW (CONTINUED)

The Procter & Gamble Company and Subsidiaries

23

Charges for accelerated depreciation were $386 mil-

lion ($335 million after tax) in 2000 and $208 million

($206 million after tax) in 1999. The charges for accel-

erated depreciation related to long-lived assets that will

be taken out of service prior to the end of their normal

service period due to manufacturing consolidations,

technology standardization and plant closures. The

Company has shortened the estimated useful lives of

such assets, resulting in an acceleration of deprecia-

tion. The underlying plant closures and consolidations

will impact substantially all businesses. Accelerated

depreciation charges are expected to be approximately

$250 million in 2001. Both asset write-downs and accel-

erated depreciation are charged to cost of products sold.

Other costs were $211 million ($208 million after tax)

and $11 million ($8 million after tax) in 2000 and 1999,

respectively. These costs were incurred as a direct result

of Organization 2005 and were expensed as incurred.

The nature of the costs included training, relocation,

tax and other incremental costs relating to establish-

ment of Global Business Services and the new legal and

organizational structure of Organization 2005. Such

before-tax costs were primarily charged to marketing,

research and administrative expense and were included

in the Corporate segment. Charges for other costs are

expected to be approximately $225 million in 2001.

Most charges under Organization 2005 are paid shortly

after accrual or charged directly to the related assets.

The reserve balances at June 30, 2000 and 1999 were

$88 million and $44 million, respectively.

FORWARD-LOOKING STATEMENT

The Company has made and will make certain forward-

looking statements in the Annual Report and in other

contexts relating to volume growth, increases in market

shares, Organization 2005, financial goals and cost

reduction, among others.

These forward-looking statements are based on assump-

tions and estimates regarding competitive activity,

pricing, product introductions, economic conditions, tech-

nological innovation, currency movements, governmental

action and the development of certain markets. Among

the key factors necessary to achieve the Company’s goals

are: (1) the successful implementation of Organization

2005, including achievement of expected cost and tax

savings and successful management of organizational

and work process restructuring; (2) the ability to achieve

business plans, including volume growth and pricing plans,

despite high levels of competitive activity; (3) the ability

to maintain key customer relationships; (4) the achieve-

ment of growth in significant developing markets such as

China, Mexico, the Southern Cone of Latin America and

the countries of Central and Eastern Europe; (5) the abil-

ity to successfully manage regulatory, tax and legal

matters, including resolution of pending matters within

current estimates; (6) the successful execution of planned

minor brand divestitures; (7) the ability to successfully

implement cost improvement plans in manufacturing and

overhead areas; and (8) the ability to successfully manage

currency, interest rate and certain commodity cost expo-

sures. If the Company’s assumptions and estimates are

incorrect or do not come to fruition, or if the Company

does not achieve all of these key factors, then the

Company’s actual performance could vary materially from

the forward-looking statements made herein.