Proctor and Gamble 2000 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

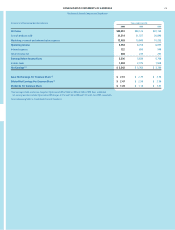

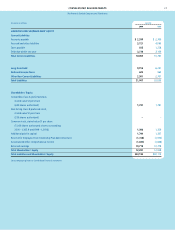

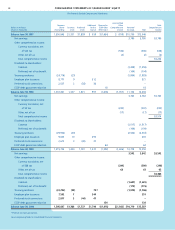

FINANCIAL REVIEW (CONTINUED)

The Procter & Gamble Company and Subsidiaries

19

Actonel (risedronate sodium tablets) 5 mg., the Company’s

first major prescription drug, was launched in the fourth

quarter. Actonel is a bisphosphonate for the prevention

and treatment of osteoporosis and is the only therapy

proven to significantly reduce spinal fractures in one year.

A milestone payment received upon FDA approval

of Actonel was essentially offset by launch costs in

the current year. The launch is off to a good start in the

United States, United Kingdom and Germany, with

launches planned shortly in four more countries.

Western Europe depressed sales, primarily due to the

weak euro and lower volume. The Actonel launch is

expected to impact Western Europe results more signif-

icantly next fiscal year.

In 1999, net sales were flat versus the prior year at

$2.88 billion on a 3% unit volume reduction. Net earn-

ings were $242 million, a 4% increase over 1998.

Earnings progress reflected a shift toward higher-margin

pharmaceutical sales and pricing, mitigated by invest-

ments in product launches.

FOOD AND BEVERAGE

Food and beverage net sales were flat versus last year at

$4.63 billion, including a 1% negative exchange impact.

Unit volume also was flat. Excluding the prior year divesti-

ture of Hawaiian Punch, unit volume increased 5% behind

strong growth in Western Europe and Northeast Asia,

partially due to the expansion of Pringles. Net earnings

increased to $364 million, up 11% versus last year, pri-

marily due to gross margin improvement.

Results in North America reflected significant competitive

activity, particularly in coffee and snacks. Initiative

launches helped drive volume, partially offsetting the

impact of the Hawaiian Punch divestiture. Despite product

cost savings, earnings were impacted by marketing costs

and other spending increases.

Unit volume in Western Europe achieved double-digit

growth with the successful expansion of Pringles. Juice

volume suffered due to a temporary public relations

setback with Sunny Delight in the United Kingdom that

has now been addressed. Recent launches in France and

Spain are expected to improve volume progress, along

with additional launches in Western Europe.

Northeast Asia posted double-digit progress on volume

and sales driven by renewed strength in the snacks busi-

ness, as well as strengthening of the Japanese yen.

In 1999, net sales increased 1% to $4.66 billion, on a 4%

volume increase. Net earnings were $328 million, a 12%

increase versus $294 million in 1998, which included

significant initiative related spending.

CORPORATE

The Corporate segment includes both operating and

non-operating elements, such as: financing and invest-

ing activities, goodwill amortization, employee benefit

costs, charges related to restructuring (including the

Organization 2005 program), segment eliminations and

other general corporate items.

Corporate sales reflected adjustments to reconcile

management reporting conventions to accounting prin-

ciples generally accepted in the United States of America.

Corporate results reflected increased charges from

Organization 2005 and goodwill amortization, partially

offset by lower corporate costs, including reduced

employee benefit costs and the proceeds of a patent

litigation settlement with Paragon Trade Brands, Inc.