Proctor and Gamble 2000 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

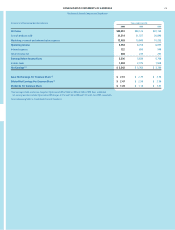

FINANCIAL REVIEW (CONTINUED)

The Procter & Gamble Company and Subsidiaries

22

The Company recorded Organization 2005 charges of

$814 million ($688 million after tax) and $481 million

($385 million after tax) in 2000 and 1999, respectively.

These charges were recorded in the Corporate segment

for management and external reporting purposes, although

they affected substantially all business units. Savings for

the current year were approximately $65 million after tax,

with no individual business unit significantly impacted.

Estimated costs for fiscal 2001 are $750 million ($550 mil-

lion after tax). The balance of the charges are not expected

to materially affect any single year, and savings are

expected to offset the charges.

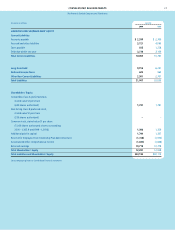

Costs under Organization 2005 were related primarily to

separation and relocation of employees as well as stream-

lining manufacturing facilities, including consolidations,

closures and standardization projects. Certain other costs

directly related to Organization 2005 also were included.

The non-cash costs of the program primarily were related

to manufacturing consolidations and asset write-downs.

These accounted for 62% and 88% of charges in 2000

and 1999, respectively. Approximately 30% of future

charges are expected to be non-cash. Cash requirements of

the program, including capital spending requirements,

will be met through normal operating cash flow.

Approximately 45% of the plant and production module

closings have occurred to date, with the majority of the

remainder expected to be completed in fiscal 2001.

Employee separation charges were $153 million ($102 mil-

lion after tax) and $45 million ($29 million after tax) in

2000 and1999, respectively. These costs related to sever-

ance packages for approximately 2,800 people in 2000

and 400 people in 1999, with all geographies and busi-

nesses impacted. The predominantly voluntary packages

were formula driven, based on salary levels and past

service. Severance costs related to voluntary separations

were charged to earnings when the employee accepted

the offer and were reflected in cost of products sold for

manufacturing employees and in marketing, research and

administrative expense for all other employees.

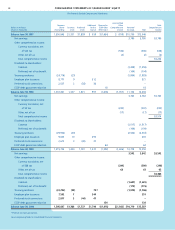

The streamlined work processes and manufacturing

consolidations under Organization 2005 are expected

to affect approximately 15,000 jobs over six years (fiscal

1999 through 2004). The majority of the remaining

separation costs are expected to occur by 2002, although

additional costs will continue throughout the program.

Net enrollment is expected to decline by less than the

total separations, as terminations will be partially offset

through increased enrollment at remaining sites and

acquisition impacts.

Asset write-downs were $64 million ($43 million after

tax) in 2000 and $217 million ($142 million after tax) in

1999. The 2000 charges related to assets held for sale or

disposal and represented excess capacity that is in the

process of being removed from service. Such assets were

written down to the lower of their current carrying basis

or net amounts expected to be realized upon disposal. In

the prior year, the charges primarily related to manu-

facturing assets that were expected to operate at levels

significantly below their capacity because of a shift in

global strategy enabled by Organization 2005, as well as

demand trends below expectations. Because the expected

cash flows of those assets were estimated to be less

than their carrying values, the assets were written down

to estimated fair value as determined using discounted

cash flows. The remainder of the 1999 charges related to

assets held for sale. Asset write-downs will not have a

significant impact on future depreciation charges.