Proctor and Gamble 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

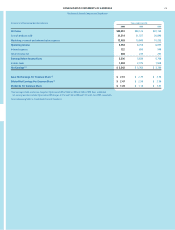

The Procter & Gamble Company and Subsidiaries

28 CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Accumulated

Common Additional Reserve for Other Total

Dollars in millions/ Shares Common Preferred Paid-in ESOP Debt Comprehensive Retained Comprehensive

Shares in thousands Outstanding Stock Stock Capital Retirement Income Earnings Total Income

Balance June 30, 1997 1,350,843 $1,351 $1,859 $ 559 $(1,634) $ (819) $10,730 $12,046

Net earnings 3,780 3,780 $3,780

Other comprehensive income:

Currency translation, net

of $25 tax (536) (536) (536)

Other, net of tax (2) (2) (2)

Total comprehensive income $3,242

Dividends to shareholders:

Common (1,358) (1,358)

Preferred, net of tax benefit (104) (104)

Treasury purchases (24,716) (25) (1,904) (1,929)

Employee plan issuances 8,777 9 312 321

Preferred stock conversions 2,557 2 (38) 36 –

ESOP debt guarantee reduction 18 18

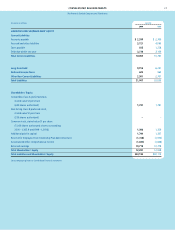

Balance June 30, 1998 1,337,461 1,337 1,821 907 (1,616) (1,357) 11,144 12,236

Net earnings 3,763 3,763 $3,763

Other comprehensive income:

Currency translation, net

of $4 tax (232) (232) (232)

Other, net of tax (17) (17) (17)

Total comprehensive income $3,514

Dividends to shareholders:

Common (1,517) (1,517)

Preferred, net of tax benefit (109) (109)

Treasury purchases (29,924) (30) (2,503) (2,533)

Employee plan issuances 9,605 10 393 403

Preferred stock conversions 2,612 3 (40) 37 –

ESOP debt guarantee reduction 64 64

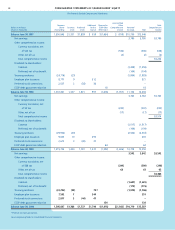

Balance June 30, 1999 1,319,754 1,320 1,781 1,337 (1,552) (1,606) 10,778 12,058

Net earnings 3,542 3,542 $3,542

Other comprehensive income:

Currency translation, net

of $88 tax (299) (299) (299)

Other, net of tax 63 63 63

Total comprehensive income $3,306

Dividends to shareholders:

Common (1,681) (1,681)

Preferred, net of tax benefit (115) (115)

Treasury purchases (24,296) (24) 72(1) (1,814) (1,766)

Employee plan issuances 7,592 7 344 351

Preferred stock conversions 2,817 3 (44) 41 –

ESOP debt guarantee reduction 134 134

Balance June 30, 2000 1,305,867 $1,306 $1,737 $1,794 $(1,418) $(1,842) $10,710 $12,287

(1)Premium on equity put options.

See accompanying Notes to Consolidated Financial Statements.