Proctor and Gamble 2000 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company and Subsidiaries

32

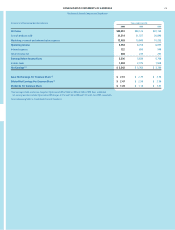

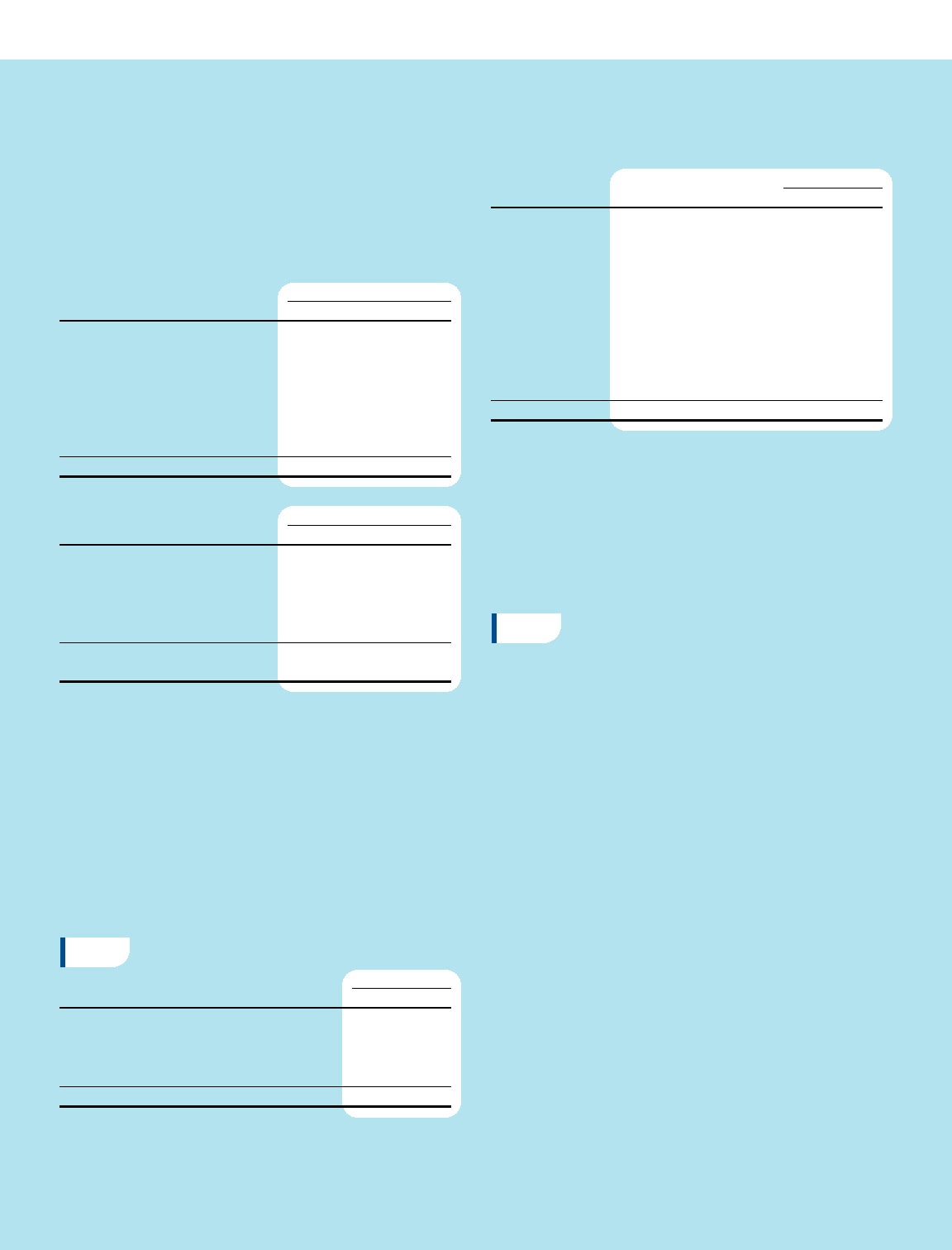

Millions of dollars except per share amounts

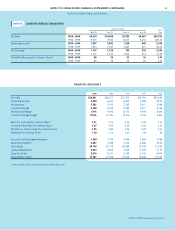

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Net Earnings Per Common Share

Net earnings less preferred dividends (net of related tax benefits)

are divided by the weighted average number of common shares

outstanding during the year to calculate basic net earnings per

common share. Diluted net earnings per common share are calcu-

lated to give effect to stock options and convertible preferred stock.

Basic and diluted net earnings per share are reconciled as follows:

Years ended June 30

2000 1999 1998

Net earnings available to

common shareholders $3,427 $3,654 $3,676

Effect of dilutive securities

Preferred dividends, net

of tax benefit 115 109 104

Preferred dividend impact on

funding of ESOP (18) (22) (25)

Diluted net earnings 3,524 3,741 3,755

Years ended June 30

Shares in thousands 2000 1999 1998

Basic weighted average common

shares outstanding 1,313.2 1,328.1 1,343.4

Effect of dilutive securities

Conversion of preferred shares 94.3 97.2 99.8

Exercise of stock options 19.7 21.5 22.3

Diluted weighted average common

shares outstanding 1,427.2 1,446.8 1,465.5

Equity Put Options

During 2000, the Company entered into a series of equity put

options on its common stock. These agreements will be settled on

a physical or net-share basis at the Company’s option and expire

in the October-December 2000 quarter. The premium received

from the sale of the instruments was credited to equity and

reduces the Company’s cash outlay for share repurchases.

As of June 30, 2000, put options equivalent to 12 million common

shares were outstanding at prices ranging from $60 to $71 per

share. The impact on diluted earnings per share is immaterial.

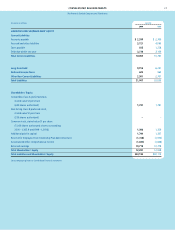

NOTE 5 SHORT-TERM AND LONG-TERM DEBT

June 30

2000 1999

Short-Term Debt

U.S. obligations $2,142 $2,308

Foreign obligations 785 375

Current portion of long-term debt 283 467

3,210 3,150

The weighted average short-term interest rates were 4.8% and

5.7% as of June 30, 2000 and 1999, respectively.

June 30

Average Rate Maturities 2000 1999

Long-Term Debt

U.S. notes and

debentures 5.73% 2000 – 2049 $7,664 $3,760

ESOP Series A 8.33% 2000 – 2004 392 472

ESOP Series B 9.36% 2007 – 2021 1,000 1,000

U.S. commercial

paper –1,019

Foreign obligations 143 447

Current portion of

long-term debt (283) (467)

8,916 6,231

Long-term weighted average interest rates in the preceding table

are as of June 30, 2000, and include the effects of related interest

rate swaps discussed in Note 6.

The fair value of the long-term debt was $8,929 and $6,517 at

June 30, 2000 and 1999, respectively. Long-term debt maturities

during the next five years are as follows: 2001– $283; 2002 – $472;

2003 – $534; 2004 – $1,139 and 2005 – $973.

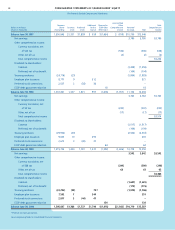

NOTE 6 RISK MANAGEMENT ACTIVITIES

The Company is exposed to market risks, such as changes in inter-

est rates and currency exchange rates. To manage the volatility

relating to these exposures, the Company nets the exposures on a

consolidated basis to take advantage of natural offsets. For the

residual portion, the Company enters into various derivative trans-

actions pursuant to the Company’s policies in areas such as

counterparty exposure and hedging practices. The financial

impacts of these hedging instruments are offset in part or in whole

by corresponding changes in the underlying exposures being

hedged. The Company does not hold or issue derivative financial

instruments for trading purposes.

Interest Rate Management

The Company’s policy is to manage interest cost using a mix of fixed

and variable rate debt. To manage this mix in a cost-efficient

manner, the Company enters into interest rate swaps in which the

Company agrees to exchange, at specified intervals, the difference

between fixed and variable interest amounts calculated by refer-

ence to an agreed-upon notional principal amount. These swaps are

designated to hedge underlying debt obligations. For qualifying

hedges, the interest rate differential is reflected as an adjustment to

interest expense over the life of the swaps.