Proctor and Gamble 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company and Subsidiaries

38

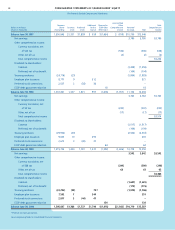

Millions of dollars except per share amounts

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

The Company had net sales in the United States of $20,038,

$18,314 and $17,848 for the years ended June 30, 2000, 1999 and

1998, respectively. Assets in the United States totaled $17,227

and $15,142 as of June 30, 2000 and 1999, respectively.

The Company’s largest customer, Wal-Mart Stores, Inc. and its

affiliates, accounted for 14%, 12% and 11% of consolidated net

sales in 2000, 1999 and 1998, respectively. These sales occurred

primarily in the United States.

Fabric and Beauty Health Food and

Home Care Paper Care Care Beverage Corporate Total

Net Sales 2000 $12,157 $12,044 $7,389 $3,909 $4,634 $(182) $39,951

1999 11,415 12,190 7,376 2,876 4,655 (387) 38,125

1998 11,019 11,685 7,469 2,889 4,620 (528) 37,154

Net Earnings 2000 1,450 1,069 894 335 364 (570) 3,542

1999 1,497 1,278 917 242 328 (499) 3,763

1998 1,406 990 845 232 294 13 3,780

Before-Tax Earnings 2000 2,318 1,817 1,393 540 566 (1,098) 5,536

1999 2,417 2,195 1,457 372 528 (1,131) 5,838

1998 2,240 1,772 1,379 381 477 (541) 5,708

Depreciation and Amortization 2000 354 664 194 159 153 667 2,191

1999 293 638 198 107 149 763 2,148

1998 295 611 198 105 135 254 1,598

Total Assets 2000 5,477 8,415 3,497 2,229 2,611 11,965 34,194

1999 5,047 8,184 3,754 1,556 2,598 10,974 32,113

Capital Expenditures 2000 807 1,282 310 195 235 189 3,018

1999 638 1,327 285 143 237 198 2,828

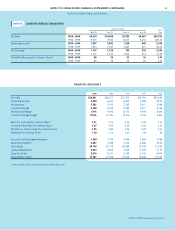

NOTE 12 SEGMENT INFORMATION

On July 1, 1999, as part of the Organization 2005 initiative, the

Company changed its internal management structure to product-

based global business units. Previously, the Company had been

organized on a geographic basis. The segments manufacture and

market products as follows:

• Fabric and home care includes laundry care, dish care, fabric

conditioners and hard surface cleaners.

• Paper aggregates tissues and towel, feminine care and baby

care, which contains diapers and wipes.

• Beauty care includes cosmetics, hair care, deodorants, fragrances

and other beauty products.

• Health care includes personal health care, oral care, prescription

drugs and pet health and nutrition.

• Food and beverage includes coffee, snacks, commercial services,

juice, peanut butter and shortening and oil.

The Corporate segment includes both operating and non-operating

elements such as financing and investing activities, goodwill amorti-

zation, employee benefit costs, charges related to restructuring

(including the Organization 2005 program), segment eliminations

and other general corporate items. The segment eliminations adjust

management reporting principles to accounting principles generally

accepted in the United States of America and primarily affect the

treatment of unconsolidated investees and income taxes, which are

reflected in the business segments using applicable local statutory tax

rates. Corporate assets primarily include cash, investment securities

and goodwill.