Proctor and Gamble 2000 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company and Subsidiaries

31

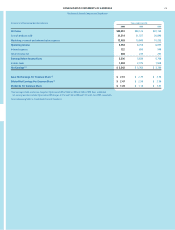

Millions of dollars except per share amounts

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Charges for the program were $814 ($688 after tax) and $481

($385 after tax) in 2000 and1999, respectively. Estimated costs for

fiscal 2001 are $750 ($550 after tax). The balance of the charges are

not expected to materially affect any single year, and savings

are expected to offset the charges. All charges for the program are

reflected in the Corporate segment for management and external

reporting.

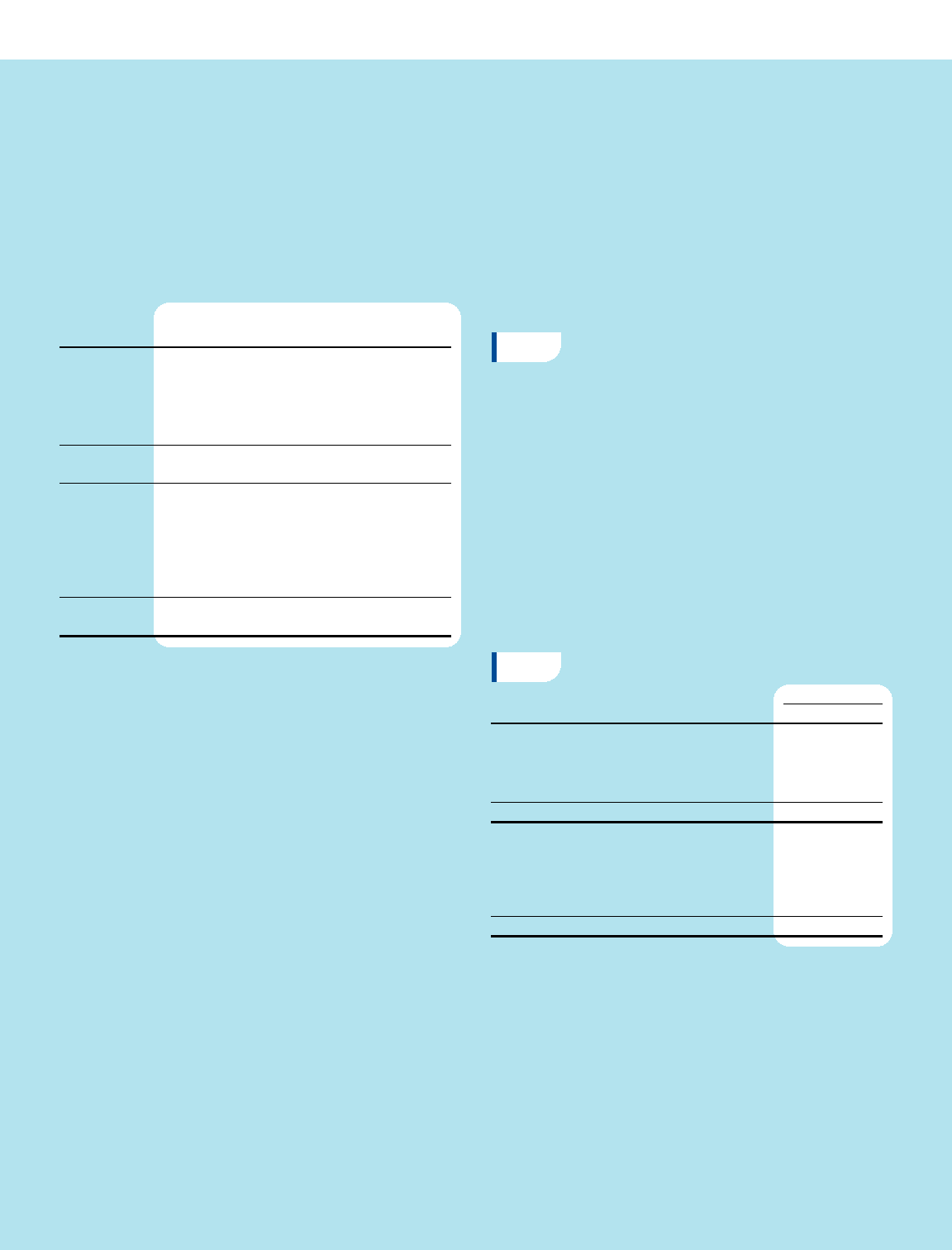

The before-tax amounts consisted of the following:

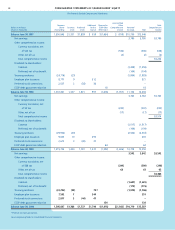

Asset

Write- Accelerated

Separations Downs Depreciation Other Total

1999:

Charges $ 45 $ 217 $ 208 $ 11 $ 481

Cash spent (10) – – (2) (12)

Charged against

assets – (217) (208) – (425)

Reserve balance

June 30, 1999 35 – – 9 44

2000:

Charges 153 64 386 211 814

Cash spent (100) – – (220) (320)

Charged against

assets – (64) (386) – (450)

Reserve balance

June 30, 2000 88 – – – 88

Employee separation charges related to severance packages for

approximately 2,800 people in 2000 and 400 people in 1999. The

packages are predominantly voluntary and are formula driven

based on salary levels and past service. Severance costs related to

voluntary separations are charged to earnings when the employee

accepts the offer.

Asset write-downs in 2000 related to assets held for sale or disposal

and represented excess capacity that is in the process of being

removed from service or disposed. These assets were written down

to the lower of their current carrying basis or amounts expected to

be realized upon disposal, less minor disposal costs. Asset write-

downs in 1999 related primarily to manufacturing assets that are

expected to operate at levels significantly below their capacity.

The projected cash flows from such assets over their remaining

useful lives are now estimated to be less than their current carrying

values; therefore, the assets were written down to estimated fair

value as determined using discounted cash flows. The asset write-

downs charged to earnings will not have a significant impact on

future depreciation charges.

Charges for accelerated depreciation related to long-lived assets

that will be taken out of service prior to the end of their normal

service period due to manufacturing consolidations, technology

standardization and plant closures. The Company has shortened

the estimated useful lives of such assets, resulting in accelerated

depreciation.

Other costs included primarily relocation, training costs and legal

entity restructuring costs directly related to the Organization 2005

initiative.

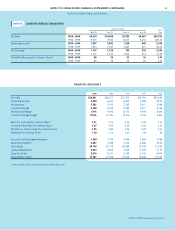

NOTE 3 ACQUISITIONS

In 2000, the Company acquired The Iams Company and Affiliates

for approximately $2,222 in cash. Other acquisitions in 2000

totaled $745 and consisted primarily of Recovery Engineering,

Inc. and a joint venture ownership increase in China. The 2000

acquisitions were accounted for using the purchase method, and

resulted in goodwill of $2,508. Purchase acquisitions in 1999

totaled $137. In 1998, the Company acquired Tambrands, Inc.,

and its leading brand, Tampax, for approximately $1,844 in cash.

Other acquisitions in 1998 totaled $1,425 and included the acqui-

sition of paper businesses and increased ownership in various

ventures in Latin America and Asia. The 1998 acquisitions, all of

which were accounted for using the purchase method, resulted in

goodwill of $3,335.

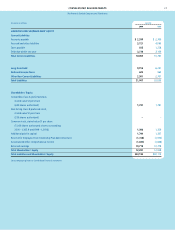

NOTE 4 SUPPLEMENTAL FINANCIAL INFORMATION

June 30

2000 1999

Accrued and Other Liabilities

Marketing expenses $1,142 $1,094

Compensation expenses 462 449

Other 2,117 2,540

3,721 4,083

Other Non-Current Liabilities

Other postretirement benefits $ 824 $1,081

Pension benefits 975 926

Other 502 694

2,301 2,701

Selected Operating Expenses

Research and development costs are charged to earnings as

incurred and were $1,899 in 2000, $1,726 in 1999 and $1,546 in

1998. Advertising costs are charged to earnings as incurred and

were $3,667 in 2000, $3,538 in 1999 and $3,704 in 1998.