Proctor and Gamble 2000 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL REVIEW (CONTINUED)

The Procter & Gamble Company and Subsidiaries

21

Based on the Company’s overall currency rate exposure as

of and during the year ended June 30, 2000, including

derivative and other instruments sensitive to foreign

currency movements, a near-term change in currency

rates, at a 95% confidence level based on historical

currency rate movements, would not materially affect the

Company’s financial statements.

COMMODITY PRICE EXPOSURE

Raw materials used by the Company are subject to price

volatility caused by weather, supply conditions, political

and economic variables and other unpredictable factors.

The Company uses futures and options contracts, pri-

marily in food and beverage products, to manage the

volatility related to certain of these exposures. Commodity

hedging activity is not material to the Company’s financial

statements.

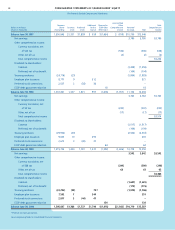

ORGANIZATION 2005

As also discussed in Note 2 to the consolidated finan-

cial statements, effective July 1, 1999, the Company

reorganized its operations, moving from a geographic

structure to product-based Global Business Units.

This Organization 2005 program is designed to realign the

organizational structure, work processes and culture to

commercialize innovations faster and drive growth. This

involves Global Business Units streamlining decision

making to quickly flow innovation across categories and

geographies, Market Development Organizations getting

initiatives to market faster and more efficiently, and

Global Business Services leveraging scale to deliver ser-

vices at significantly lower cost.

To achieve this, changes are required to administrative

and manufacturing operations. As announced in June

1999, the Company has undertaken a multi-year program

to consolidate and standardize manufacturing opera-

tions, reduce enrollment and effect other actions integral

to the Organization 2005 objectives.

The cost of this program is estimated to be $2.1 billion

after tax over a six year period. Based on the nature

and duration of the Organization 2005 program, costs

incurred in future years are subject to varying degrees of

estimation for key assumptions, such as normal

employee attrition levels, the actual timing of the execu-

tion of plans and other variables. The estimated cost

of the program has increased approximately $200 mil-

lion after tax since its announcement, primarily due to

refinement of estimates associated with the legal and

organizational restructuring of the Company and expan-

sion of certain manufacturing consolidation plans.

Significant savings are expected to begin accruing next

fiscal year, reaching going annual levels of approximately

$1.2 billion after tax by fiscal 2004. This annual savings

estimate has increased by approximately $300 million

since announcement of the program, primarily due to

the savings associated with the legal and organiza-

tional restructuring, which yields substantial tax and

other savings.