Proctor and Gamble 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2000 ANNUAL REPORT

Table of contents

-

Page 1

2000 ANNUAL REPORT -

Page 2

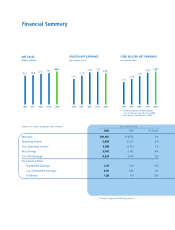

... 1999 2000 1996 1997 1998 1999 2000 * Excluding Organization 2005 program costs of $.48 per share after tax in 2000 and $.26 per share after tax in 1999. Amounts in millions except per share amounts Years ended June 30 2000 1999 % change Net Sales Operating Income Core Operating Net... -

Page 3

... history, but our biggest, most profitable brands didn't grow at acceptable rates. > We invested for the future - in new businesses and developing markets - but some costs grew faster than revenues. > We made important leadership changes, placing people into new jobs as part of our organizational... -

Page 4

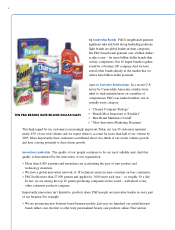

...significant sales and hold strong leadership positions. Eight brands are global leaders in their categories. Ten P&G brands each generate over a billion dollars in sales a year - far more billion-dollar brands than our key competitors. Our 10 largest brands, together, would be a Fortune 100 company... -

Page 5

...our market share on these brands. Second, we are making tougher choices about investing in new products and new businesses. We'll use fast-cycle learning techniques to get rapid consumer validation of our biggest ideas, and commercialize those ideas more quickly worldwide. Third, we are working hard... -

Page 6

... place as the preeminent consumer products company in the world. John E. Pepper Chairman of the Board August 1, 2000 A. G. Lafley President and Chief Executive August 1, 2000 MANAGEMENT CHANGE After 30 years of service, Durk I. Jager retired July 1 as chairman, president, chief executive and... -

Page 7

..., we will judiciously invest in new brands that we believe have global leadership potential. The key is striking the right balance. We did it in our fabric & home care business in North America this past year, where we delivered double-digit sales growth, with gains on big brands like Tide and Downy... -

Page 8

... have to be a global company that can operate like a small local business in every part of the world. Our new structure helps us to do that. Swiffer is a good example. This brand is built on a global marketing and technology platform - meaning the product and the marketing programs supporting it can... -

Page 9

... your acquisition plans? A: We look for acquisitions that will provide a good financial return for our shareholders, while considering key strategic issues: > We want brands that can help expand our leadership in existing categories. Tampax, for example, strengthened our feminine care business by... -

Page 10

...with customers; and managing costs and cash more rigorously. The following examples demonstrate how we are doing this: ACTION PLAN 01 BUILD BIG BRANDS CASE IN POINT > TIDE AND ARIEL Investing in our largest brands is providing an engine for growth. Continuous innovation in products and marketing... -

Page 11

...$25 billion commercially prepared pet food market. Iams sells its Eukanuba and Iams brands of dog and cat food in 77 countries. > In the six months following the acquisition, P&G expanded the Iams brand to 25,000 additional retail outlets in North America. (Its super-premium Eukanuba brand continues... -

Page 12

... line of hair care products based on our best science and a deep understanding of Physique's target consumer. This understanding enabled the brand to reach its audience in very different ways - where they live, where they work, where they play and where they shop. In-store consultants helped... -

Page 13

.... > Business activities which previously were dispersed across many business units - such as employee services, workplace services, purchasing, customer logistics, accounting and financial reporting, and information technology - are being consolidated in key service centers around the world. > GBS... -

Page 14

...the Financial Statements Independent Auditors' Report Consolidated Statements of Earnings Consolidated Balance Sheets Consolidated Statements of Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Financial Highlights Directors and Corporate Officers -

Page 15

.... Excluding a negative 2% exchange rate impact, net sales increased 7% on 4% unit volume growth. This growth reflects strong product initiative activity, the acquisition of the Iams pet health and nutrition business and progress on flagship brands, largely in fabric and home care. Worldwide gross... -

Page 16

... to increased research spending, primarily in the paper and health care businesses, and increased spending for new initiatives. Organization 2005 charges increased marketing, research and administrative expense by $38 million, related primarily to employee separation expenses. Operating income grew... -

Page 17

..., behind the Organization 2005 program, including increased capacity. In 1999, capital spending was driven by standardization projects in paper and capacity expansions in the paper and food and beverage businesses. Net cash used for acquisitions completed during 2000 totaled $2.97 billion, primarily... -

Page 18

... Corporate segment to reconcile to accounting principles generally accepted in the United States of America. FABRIC AND HOME CARE Strong sales growth was spurred by the introduction of new brands and solid base business performance in North America and Northeast Asia, as well as continued expansion... -

Page 19

...the Attends adult incontinence brand, unit volume increased 2%. Net earnings were $1.07 billion, down 16%, reflecting tissues and towel expansion in Western Europe, investments in new product initiatives on Charmin, a tough competitive environment in baby care and feminine care businesses, increased... -

Page 20

18 FINANCIAL REVIEW (CONTINUED) The Procter & Gamble Company and Subsidiaries BEAUTY CARE North America increased volume behind premium product introductions. Physique, positioned as a salon-quality brand, was launched in the last half of the year and achieved solid share results. The ... -

Page 21

... investing activities, goodwill amortization, employee benefit costs, charges related to restructuring (including the Organization 2005 program), segment eliminations and other general corporate items. Corporate sales reflected adjustments to reconcile management reporting conventions to accounting... -

Page 22

20 FINANCIAL REVIEW (CONTINUED) The Procter & Gamble Company and Subsidiaries HEDGING AND DERIVATIVE FINANCIAL INSTRUMENTS INTEREST RATE EXPOSURE The Company is exposed to market risks, such as changes in interest rates, currency exchange rates and commodity prices. To manage the volatility ... -

Page 23

... 2 to the consolidated financial statements, effective July 1, 1999, the Company reorganized its operations, moving from a geographic structure to product-based Global Business Units. This Organization 2005 program is designed to realign the organizational structure, work processes and culture to... -

Page 24

... The Procter & Gamble Company and Subsidiaries The Company recorded Organization 2005 charges of $814 million ($688 million after tax) and $481 million ($385 million after tax) in 2000 and 1999, respectively. These charges were recorded in the Corporate segment for management and external reporting... -

Page 25

... statements in the Annual Report and in other contexts relating to volume growth, increases in market shares, Organization 2005, financial goals and cost reduction, among others. These forward-looking statements are based on assumptions and estimates regarding competitive activity, pricing, product... -

Page 26

...Financial Officer INDEPENDENT AUDITORS' REPORT 250 East Fifth Street Cincinnati, Ohio 45202 To the Board of Directors and Shareholders of The Procter & Gamble Company: We have audited the accompanying consolidated balance sheets of The Procter & Gamble Company and subsidiaries as of June 30, 2000... -

Page 27

CONSOLIDATED STATEMENTS OF EARNINGS The Procter & Gamble Company and Subsidiaries 25 Amounts in millions except per share amounts 2000 Years ended June 30 1999 1998 Net Sales $39,951 21,514 12,483 5,954 722 304 5,536 1,994 $ 3,542 $38,125 21,027 10,845 6,253 650 235 5,838 2,075 $ 3,763 $37,... -

Page 28

...SHEETS The Procter & Gamble Company and Subsidiaries Amounts in millions 2000 June 30 1999 ASSETS Current Assets Cash and cash equivalents Investment securities Accounts receivable Inventories... Total Assets See accompanying Notes to Consolidated Financial Statements. 9,080 1,305 10,385 (1,599)... -

Page 29

...per share (5,000 shares authorized; shares outstanding: 2000 -1,305.9 and 1999 -1,319.8) Additional paid-in capital Reserve for Employee Stock Ownership Plan debt retirement Accumulated other comprehensive income Retained earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity... -

Page 30

28 CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY The Procter & Gamble Company and Subsidiaries Dollars in millions/ Shares in thousands Common Shares Outstanding Common Stock Preferred Stock Additional Paid-in Capital Reserve for ESOP Debt Retirement Accumulated Other Comprehensive Income... -

Page 31

... Acquisitions Change in investment securities Total Investing Activities Financing Activities Dividends to shareholders Change in short-term debt Additions to long-term debt Reductions of long-term debt Proceeds from stock options Treasury purchases Total Financing Activities Effect of Exchange... -

Page 32

... the financial and operating decisions, are accounted for using the equity method. These investments are managed as integral parts of the Company's business units, and segment reporting reflects such investments as consolidated subsidiaries. Use of Estimates: Preparation of financial statements in... -

Page 33

... acquisition of paper businesses and increased ownership in various ventures in Latin America and Asia. The 1998 acquisitions, all of which were accounted for using the purchase method, resulted in goodwill of $3,335. NOTE 4 SUPPLEMENTAL FINANCIAL INFORMATION June 30 2000 1999 Employee separation... -

Page 34

... 2005 - $973. NOTE 6 RISK MANAGEMENT ACTIVITIES Years ended June 30 Shares in thousands 2000 1999 1998 Basic weighted average common shares outstanding Effect of dilutive securities Conversion of preferred shares Exercise of stock options Diluted weighted average common shares outstanding Equity... -

Page 35

... options Currency swaps Fair value Forward contracts Purchased options Currency swaps $1,822 1,147 0 4 18 0 $1,988 1,358 33 (6) 19 5 The Company manufactures and sells its products in a number of countries throughout the world and, as a result, is exposed to movements in foreign currency exchange... -

Page 36

... 1999 1998 The Company has stock-based compensation plans under which stock options are granted annually to key managers and directors at the market price on the date of grant. The 2000 and 1999 grants are fully exercisable after three years and have a fifteen year life, while prior years' grants... -

Page 37

... FINANCIAL STATEMENTS (CONTINUED) The Procter & Gamble Company and Subsidiaries 35 The following table summarizes information about stock options outstanding at June 30, 2000: Options Outstanding Number Outstanding (Thousands) Weighted Avg. Exercise Price Weighted Avg. Remaining Contractual Life... -

Page 38

... FINANCIAL STATEMENTS (CONTINUED) The Procter & Gamble Company and Subsidiaries The elements of the net amount recognized for the Company's postretirement plans are summarized below: Years ended June 30 Pension Benefits 2000 1999 Other Retiree Benefits 2000 1999 The Company's stock comprised... -

Page 39

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED) The Procter & Gamble Company and Subsidiaries 37 The projected benefit obligation, accumulated benefit obligation and fair value of plan assets for the pension plans with accumulated benefit obligations in excess of plan assets were $1,368, ... -

Page 40

... TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED) The Procter & Gamble Company and Subsidiaries NOTE 12 SEGMENT INFORMATION On July 1, 1999, as part of the Organization 2005 initiative, the Company changed its internal management structure to productbased global business units. Previously, the... -

Page 41

... Net Earnings Per Common Share* Diluted Core Net Earnings Per Common Share Dividends Per Common Share Research and Development Expense Advertising Expense Total Assets Capital Expenditures Long-Term Debt Shareholders' Equity *2000 and 1999 amounts include Organization 2005 program costs. $39,951... -

Page 42

... Health Affairs, Executive Dean, School of Medicine at Duke University, and President/CEO of Duke University Health Systems Robert D. Storey Partner in the law firm of Thompson, Hine & Flory, L.L.P. Marina v.N. Whitman Professor of Business Administration and Public Policy, University of Michigan... -

Page 43

...,965 Common Stock shareholders of record, including participants in the Shareholder Investment Program, as of July 21, 2000. FORM 10-K Shareholders may obtain a copy of the Company's 2000 report to the Securities and Exchange Commission on Form10-K by going to P&G's investor Web site at www.pg.com... -

Page 44