Pfizer 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

94

2013 Financial Report

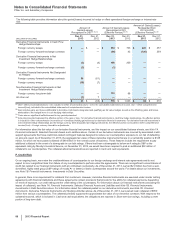

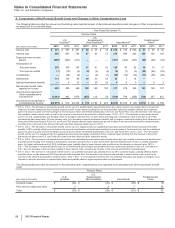

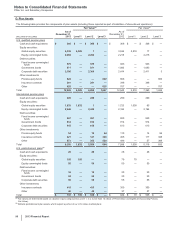

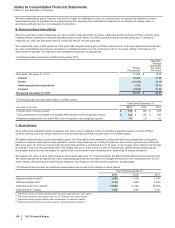

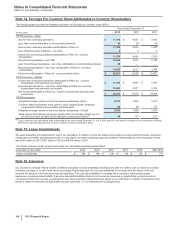

The following table provides the effects as of December 31, 2013 of a one-percentage-point increase or decrease in the healthcare cost trend

rate assumed for postretirement benefits:

(MILLIONS OF DOLLARS) Increase Decrease

Effect on total service and interest cost components $15$

(14)

Effect on postretirement benefit obligation 248 (222)

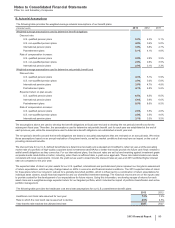

Actuarial and other assumptions for pension and postretirement plans can result from a complex series of judgments about future events and

uncertainties and can rely heavily on estimates and assumptions. For a description of the risks associated with estimates and assumptions,

see Note 1C. Basis of Presentation and Significant Accounting Policies: Estimates and Assumptions.

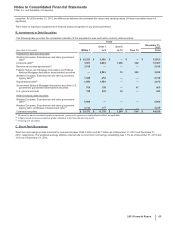

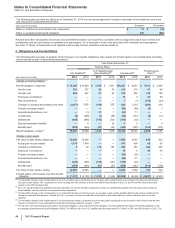

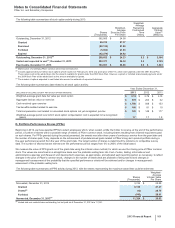

C. Obligations and Funded Status

The following table provides an analysis of the changes in our benefit obligations, plan assets and funded status of our benefit plans (including

those reported as part of discontinued operations):

Year Ended December 31,

Pension Plans

U.S. Qualified(a) U.S. Supplemental

(Non-Qualified)(b) International(c) Postretirement

Plans(d)

(MILLIONS OF DOLLARS) 2013 2012 2013 2012 2013 2012 2013 2012

Change in benefit obligation (e)

Benefit obligation, beginning $ 16,268 $14,835 $ 1,549 $1,431 $10,227 $ 8,891 $ 4,165 $ 3,900

Service cost 301 357 26 35 216 215 61 68

Interest cost 666 697 67 62 378 406 166 182

Employee contributions ————10 969 58

Plan amendments ————1(1) (152) (24)

Changes in actuarial assumptions and other (2,257) 1,926 (165) 252 229 1,232 (540) 259

Foreign exchange impact ————(66) (80) (9) 1

Acquisitions/divestitures, net —(1)37 1(63) 71 ——

Curtailments (8)(605)(1) (80)(64) (101) (8) (11)

Settlements (444)(485)(105) (121)(156) (33) ——

Special termination benefits —8—30 45—6

Benefits paid (550)(464)(67) (61)(400) (387) (314) (274)

Benefit obligation, ending(e) 13,976 16,268 1,341 1,549 10,316 10,227 3,438 4,165

Change in plan assets

Fair value of plan assets, beginning 12,540 12,005 ——7,589 6,953 644 422

Actual gain on plan assets 1,318 1,464 ——976 668 98 85

Company contributions 520 172 182 380 383 244 353

Employee contributions ————10 969 58

Foreign exchange impact ————(95) (35) ——

Acquisitions/divestitures, net ————(54) 31 ——

Settlements (444)(485)(105) (121)(156) (33) ——

Benefits paid (550)(464)(67) (61)(400) (387) (314) (274)

Fair value of plan assets, ending 12,869 12,540 ——8,250 7,589 741 644

Funded status—Plan assets less than benefit

obligation $ (1,107) $ (3,728) $ (1,341) $ (1,549) $(2,066) $ (2,638) $ (2,697) $ (3,521)

(a) The favorable change in the funded status of our U.S. qualified plans is primarily due to the plan gains resulting from the increase in the discount rate and an

increase in plan assets. The curtailments in 2012 resulting from the decision to freeze the defined benefit plans in the U.S. and Puerto Rico had a favorable

impact on the 2012 funded status.

(b) Our U.S. supplemental (non-qualified) plans are generally not funded and these obligations, which are substantially greater than the annual cash outlay for

these liabilities, will be paid from cash generated from operations.

(c) The favorable change in the funded status of our international plans is primarily due to an increase in plan assets partially offset by plan losses resulting from

changes in actuarial assumptions. Outside the U.S., in general, we fund our defined benefit plans to the extent that tax or other incentives exist or the law

requires.

(d) The favorable change in the funded status of our postretirement plans is primarily due to the plan gains resulting from the increase in the discount rate and the

impact of a decision to move participants to Medicare Advantage effective January 1, 2015.

(e) For the U.S. and international pension plans, the benefit obligation is the projected benefit obligation. For the postretirement plans, the benefit obligation is the

accumulated postretirement benefit obligation (ABO). The ABO for all of our U.S. qualified pension plans was $13.7 billion in 2013 and $15.9 billion in 2012. The