Pfizer 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

20

2013 Financial Report

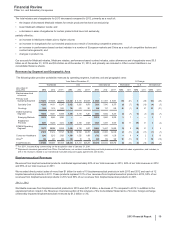

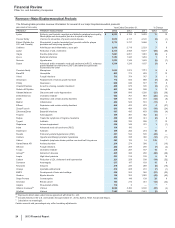

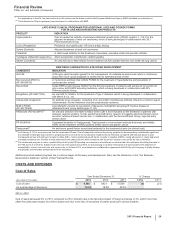

Geographically,

• in the U.S., revenues from biopharmaceutical products decreased 6% in 2013, compared to 2012, reflecting, among other things:

lower revenues from Lipitor, Revatio and Geodon, all due to loss of exclusivity (down approximately $875 million in 2013);

lower Alliance revenues from Spiriva, reflecting the final-year terms of our Spiriva co-promotion agreement in the U.S. (down

approximately $320 million in 2013), and Enbrel, reflecting the expiration of the co-promotion agreement in the U.S. and Canada in

October 2013 (down approximately $82 million);

lower revenues from generic atorvastatin (down approximately $145 million in 2013);

lower revenues from Prevnar, due to decreased government purchases (down approximately $84 million in 2013); and

lower revenues from Zosyn (down approximately $45 million in 2013),

partially offset by:

the strong performance of certain other biopharmaceutical products, including Lyrica, Celebrex, Xeljanz, Inlyta and Xalkori (up

approximately $715 million in 2013).

• in our international markets, revenues from biopharmaceutical products decreased 7% in 2013, compared to 2012. Operationally,

revenues decreased 3% in 2013, compared to 2012, reflecting, among other things:

lower revenues for Lipitor and Xalatan/Xalacom (down approximately $1.4 billion in 2013) due to the loss of exclusivity of Lipitor in

developed Europe, Japan and Australia, and Xalatan/Xalacom in the majority of European markets and in Australia; lower revenues for

Viagra (down approximately $108 million in 2013) primarily due to loss of exclusivity in most major markets in Europe; and lower

revenues for Aricept (direct sales) (down approximately $88 million in 2013) due to the loss of exclusivity in certain markets; and

lower Alliance revenues (down approximately $493 million in 2013), primarily due to the loss of exclusivity of Aricept in many major

European markets, the return of our rights to Aricept in Japan to Eisai Co., Ltd., and lower revenues for Spiriva in certain European

countries, Canada and Australia (where the Spiriva collaboration has terminated),

partially offset by:

higher revenues for Lyrica, and new product growth from Inlyta and Xalkori, (collectively, approximately $506 million in 2013).

The unfavorable impact of foreign exchange on international biopharmaceutical revenues of 4% in 2013 also contributed to the decrease in

revenues from biopharmaceutical products in our international markets.

During 2013, international revenues from biopharmaceutical products represented 61% of total revenues from biopharmaceutical products,

compared to 62% in 2012.

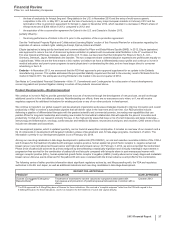

Primary Care Operating Segment

Primary Care unit revenues decreased 15% in 2013, compared to 2012, reflecting lower operational revenues of 13% in 2013, primarily due

to:

• the loss of exclusivity of Lipitor and the resulting shift in the reporting of Lipitor revenues in developed Europe and Australia to the

Established Products unit beginning January 1, 2013, as well as the loss of exclusivity of certain other products in various markets,

including Viagra in most major European markets in June 2013 and Lyrica in Canada in February 2013;

• the termination of the co-promotion agreement for Aricept in Japan in December 2012; and

• in the U.S. and certain European countries, the co-promotion collaboration for Spiriva is in its final year, which per the terms of the

collaboration agreement, has resulted in a decline in Pfizer's share of Spiriva revenues; and in Australia, Canada and certain other

European countries, the Spiriva collaboration has terminated,

partially offset by:

• the strong operational performance of Celebrex, Chantix and Pristiq in the U.S., as well as Lyrica in developed markets and the launch in

February 2013 of Eliquis.

The unfavorable impact of foreign exchange of 2% in 2013, also contributed to the decrease in Primary Care unit revenues.

Collectively, the decline in revenues in developed markets for Lipitor and for certain other Primary Care unit products that lost exclusivity in

various markets in 2013, as well as the resulting shift in the reporting of certain product revenues to the Established Products unit, and the

termination and final-year terms of certain co-promotion agreements, reduced Primary Care unit revenues by approximately $2.9 billion, or

19%, in comparison with 2012.

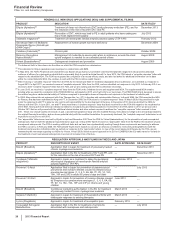

Specialty Care and Oncology Operating Segment

• Specialty Care unit revenues decreased 6% in 2013, compared to 2012, reflecting a decrease in operational revenues of 4% in 2013,

primarily due to:

the loss of exclusivity and the resulting shift in the reporting of Geodon and Revatio revenues in the U.S. and Xalabrands revenues in

developed Europe and Australia to the Established Products unit beginning January 1, 2013; and

the expiration of the co-promotion agreement for Enbrel in the U.S. and Canada on October 31, 2013, as a result of which for a 36-

month period thereafter, we are entitled to royalty payments that are expected to be significantly less than the share of Enbrel profits