Pfizer 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2013 Financial Report

25

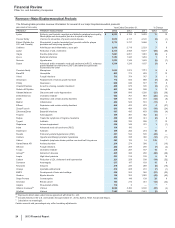

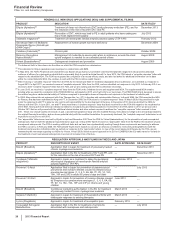

Biopharmaceutical—Selected Product Descriptions

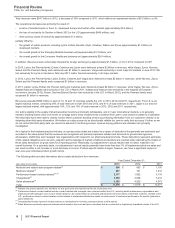

• Lyrica is indicated in the U.S. for three neuropathic pain conditions, fibromyalgia and adjunctive therapy for adult patients with partial

onset seizures. In certain countries outside the U.S., indications include neuropathic pain (peripheral and central), fibromyalgia, adjunctive

treatment of epilepsy and generalized anxiety disorder. Worldwide revenues for Lyrica increased 11% in 2013 compared to 2012.

In the U.S., revenues increased 17% in 2013 compared to 2012 driven by price and volume growth, despite continued competition from

generic versions of competitive medicines, as well as managed care pricing and formulary pressures.

Internationally, Lyrica revenues increased 6% in 2013 compared to 2012, with the growth due to a focus on enhancing diagnosis and

treatment rates of neuropathic back pain and expediting the identification and appropriate treatment of generalized anxiety disorder in the

EU, and physician education regarding neuropathic pain and fibromyalgia in Japan. Foreign exchange had an unfavorable impact on

international revenues of 4% in 2013, compared to 2012.

• Prevnar family of products consists of Prevnar 13/Prevenar 13 and Prevnar/Prevenar (7-valent), our pneumococcal conjugate vaccines for

the prevention of various syndromes of pneumococcal disease. Overall, worldwide revenues for the Prevnar family of products decreased

3% in 2013, compared to 2012.

In the U.S., revenues for the Prevnar family of products decreased 4% in 2013, compared to 2012, mainly due to inventory sell-through in

the public and private markets and lower demand related to lower birth rates, lower rates of children receiving the final dose of the

approved dosing schedule, and stronger U.S. Centers for Disease Control and Prevention (CDC) inventory management procedures.

Internationally, revenues for the Prevnar family of products decreased 3% in 2013, compared to 2012, primarily due to much lower

purchases in Turkey, the end of the catch-up program in Australia and the unfavorable impact of foreign exchange.

On February 24, 2014, we announced the top-line results of the Community-Acquired Pneumonia Immunization Trial in Adults (CAPiTA),

which was conducted in order to fulfill requirements in connection with the FDA’s approval of the Prevnar 13 adult indication under its

accelerated approval program. This study of approximately 85,000 subjects evaluated the efficacy of Prevnar 13 in adults age 65 and

older. CAPiTA met its primary clinical objective, which was efficacy against a first episode of vaccine-type, community-acquired pneumonia

(CAP). It also met both of its secondary clinical objectives, which were efficacy against (i) a first episode of non-bacteremic/non-invasive,

vaccine-type CAP and (ii) a first episode of vaccine-type, invasive pneumococcal disease. We plan to share the CAPiTA data with U.S. and

worldwide regulatory authorities and vaccine technical committees to help inform any decisions regarding potential Prevnar 13 label and

recommendation updates. We expect that the CAPiTA data will be an important component in any consideration of potential updated or

new recommendations for adults and that other key factors, such as the current burden of pneumococcal disease in adults, also will be

taken into consideration.

At its regular meeting held on February 22, 2012, the CDC's Advisory Committee on Immunization Practices (ACIP) indicated that it will

defer voting on a recommendation for the routine use of Prevnar 13 in adults 50 years of age and older until the results of CAPiTA, as well

as data on the impact of pediatric use of Prevnar 13 on the disease burden and serotype distribution among adults, are available. The rate

of uptake for the use of Prevnar 13 in adults 50 years of age and older has been impacted by ACIP’s decision to defer voting on a

recommendation for the routine use of Prevnar 13 in that population. At its regular meeting held on June 20, 2012, ACIP voted to

recommend the use of Prevnar 13 for adults 19 years of age and older with immuno-compromising conditions such as HIV infections,

cancer, advanced kidney disease and other immuno-compromising conditions. This recommendation is based on the disproportionate

burden of invasive pneumococcal disease in this patient population.

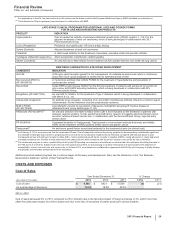

• Enbrel, for the treatment of moderate-to-severe rheumatoid arthritis, polyarticular juvenile rheumatoid arthritis, psoriatic arthritis, plaque

psoriasis and ankylosing spondylitis, a type of arthritis affecting the spine, recorded an increase in worldwide revenues, excluding the U.S.

and Canada, of 1% in 2013, compared to 2012. Results were favorably impacted by the overall growth in the anti-tumor necrosis factor

(TNF) biologic market and strong performance in European markets. Results were unfavorably impacted 3% by foreign exchange and by

decreased government purchases in Brazil.

Our co-promotion agreement with Amgen Inc. (Amgen), under which we co-promoted Enbrel in the U.S. and Canada and shared in the

profits from Enbrel sales in those countries, and which we included in Alliance revenues through October 31, 2013, expired on that date

and, subject to the terms of the agreement, we are entitled to a royalty stream for 36 months thereafter, which we expect will be

significantly less than our share of Enbrel profits from U.S. and Canadian sales prior to the expiration. The royalties paid to us during the

36-month period are and will be included in Other (income)/deductions––net rather than in Revenues in our consolidated statements of

income from November 1, 2013. Following the end of the royalty period, we will not be entitled to any further revenues from Enbrel sales in

the U.S. and Canada. Our exclusive rights to Enbrel outside the U.S. and Canada will not be affected by the expiration of the co-promotion

agreement with Amgen.

• Celebrex, indicated for the treatment of the signs and symptoms of osteoarthritis and rheumatoid arthritis worldwide and for the

management of acute pain in adults in the U.S., Japan and certain other markets, recorded an increase in worldwide revenues of 7% in

2013, compared to 2012, primarily due to strong performance in the U.S.

In the U.S., revenues increased 11% in 2013, compared to 2012, primarily driven by price increases and overall market growth, partially

offset by volume erosion due to ongoing generic pressure, as well as higher rebates and sales allowances.

Internationally, Celebrex revenues increased 1% in 2013, compared to 2012. Strong operational performance in international markets was

driven by growth in Japan (strong performance in the low back pain and osteoarthritis indications), South Korea (maximizing expanded

reimbursement to osteoarthritis patients age greater than 60 years rather than age greater than 65 years), and in emerging markets,

primarily driven by Latin America and China, partially offset by lower revenues in the developed markets in Europe in 2013, compared to

2012. Foreign exchange had an unfavorable impact on international revenues of 6% in 2013, compared to 2012.

• Lipitor is for the treatment of elevated LDL-cholesterol levels in the blood. Lipitor has lost exclusivity and faces generic competition in all

major markets. Branded Lipitor recorded worldwide revenues of $2.3 billion, or a decrease of 41%, in 2013, compared to 2012, due to: