Pfizer 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2013 Financial Report

67

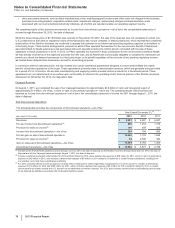

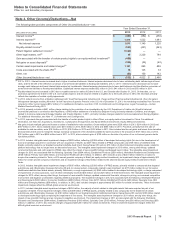

hydrochloride), the first once-daily liquid medication approved in the U.S. for the treatment of attention deficit hyperactivity disorder. Quillivant

XR received approval from the U.S. Food and Drug Administration (FDA) on September 27, 2012, and was launched in the U.S. on January

14, 2013. The total consideration for the acquisition was approximately $442 million, which consisted of upfront payments to NextWave's

shareholders of approximately $278 million and contingent consideration with an estimated acquisition-date fair value of approximately $164

million. The contingent consideration consisted of up to $425 million in additional payments that are contingent upon attainment of certain

revenue milestones. In 2013, we finalized the allocation of the consideration transferred to the assets acquired and the liabilities assumed in

this acquisition. We recorded $519 million in Identifiable intangible assets, consisting of $474 million in Developed technology rights and $45

million in In-process research and development; $166 million in net deferred tax liabilities; and $89 million in Goodwill. In 2013, as a result of

lowered commercial forecasts, the fair value of the contingent consideration decreased and we recognized a pre-tax gain of approximately

$114 million in Other (income)/deductions––net.

Nexium Over-The-Counter Rights

In August 2012, we entered into an agreement with AstraZeneca for the exclusive, global, over-the-counter (OTC) rights for Nexium, a leading

prescription drug currently approved to treat the symptoms of gastroesophageal reflux disease. We made an upfront payment of $250 million

to AstraZeneca, and AstraZeneca is eligible to receive milestone payments of up to $550 million based on product launches and level of sales,

as well as royalty payments based on sales. The upfront payment for this Consumer Healthcare asset acquisition was expensed and included

in Research and development expenses in our consolidated statement of income for the year ended December 31, 2012.

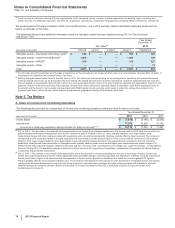

Alacer Corp.

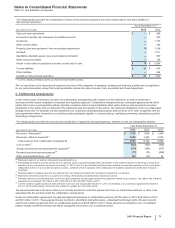

On February 26, 2012, we completed our acquisition of Alacer Corp., a company that manufactured, marketed and distributed Emergen-C, a

line of effervescent, powdered drink mix vitamin supplements. In connection with this Consumer Healthcare acquisition, we recorded $181

million in Identifiable intangible assets, consisting primarily of the Emergen-C indefinite-lived brand; $69 million in net deferred tax liabilities;

and $192 million in Goodwill.

Ferrosan Holding A/S

On December 1, 2011, we completed our acquisition of the consumer healthcare business of Ferrosan Holding A/S (Ferrosan), a Danish

company engaged in the sale of science-based consumer healthcare products, including dietary supplements and lifestyle products, primarily

in the Nordic region and the emerging markets of Russia and Central and Eastern Europe. This acquisition is reflected in our consolidated

financial statements beginning in the first fiscal quarter of 2012. Our acquisition of Ferrosan’s consumer healthcare business increases our

presence in dietary supplements with a new set of brands and pipeline products. Also, we believed that the acquisition would allow us to

expand the marketing of Ferrosan's brands through Pfizer's global footprint and provide greater distribution and scale for certain Pfizer brands,

such as Centrum and Caltrate, in Ferrosan's key markets. In connection with this Consumer Healthcare acquisition, we recorded $362 million

in Identifiable intangible assets, consisting of indefinite-lived and finite-lived brands; $94 million in net deferred tax liabilities; and $322 million

in Goodwill.

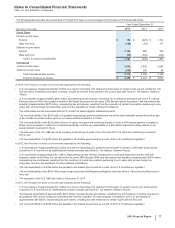

Excaliard Pharmaceuticals, Inc.

On November 30, 2011, we completed our acquisition of Excaliard Pharmaceuticals, Inc. (Excaliard), a privately owned biopharmaceutical

company. Excaliard's lead compound, EXC-001, a Phase 2 compound, is an antisense oligonucleotide designed to interrupt the process of

skin fibrosis by inhibiting expression of connective tissue growth factor (CTGF). The total consideration for the acquisition was approximately

$174 million, which consisted of an upfront payment to Excaliard's shareholders of approximately $86 million and contingent consideration

with an estimated acquisition-date fair value of approximately $88 million. The contingent consideration consists of up to $230 million in

additional payments that are contingent upon the attainment of certain regulatory and revenue milestones. Payments under the contingent

consideration arrangement were $30 million in 2012 as a regulatory milestone was reached. In connection with this Worldwide Research and

Development acquisition, we recorded $257 million in Identifiable intangible assets––In-process research and development; $87 million in net

deferred tax liabilities; and $8 million in Goodwill.

Icagen, Inc.

On September 20, 2011, we completed our cash tender offer for the outstanding shares of Icagen, Inc. (Icagen), resulting in an approximate

70% ownership of the outstanding shares of Icagen, a biopharmaceutical company focused on discovery, development and commercialization

of novel orally-administered small molecule drugs that modulate ion channel targets. On October 27, 2011, we acquired all of the remaining

shares of Icagen. In connection with this Worldwide Research and Development acquisition, we recorded $19 million in Identifiable intangible

assets.

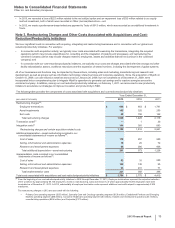

King Pharmaceuticals, Inc.

Description of the Transaction

On January 31, 2011 (the acquisition date), we completed a tender offer for the outstanding shares of common stock of King Pharmaceuticals,

Inc. (King), at a purchase price of $14.25 per share in cash and acquired approximately 92.5% of the outstanding shares. On February 28,

2011, we acquired all of the remaining shares of King for $14.25 per share in cash. As a result, the total fair value of consideration transferred

for King was approximately $3.6 billion in cash ($3.2 billion, net of cash acquired).